by Richard Mills

GoldSeek

The weaker labor market and rising unemployment rate, which hit 4.1% in June, is fodder for the US Federal Reserve to slash interest rates, possibly once in September and a second time in December.

The weaker labor market and rising unemployment rate, which hit 4.1% in June, is fodder for the US Federal Reserve to slash interest rates, possibly once in September and a second time in December.

In remarks to Congress, Fed Chair Jerome Powell said the US is “no longer an overheated economy” with a job market that has “cooled considerably” and is back where it was before the pandemic, suggesting the potential for rate cuts is becoming stronger. (Reuters, July 9, 2024)

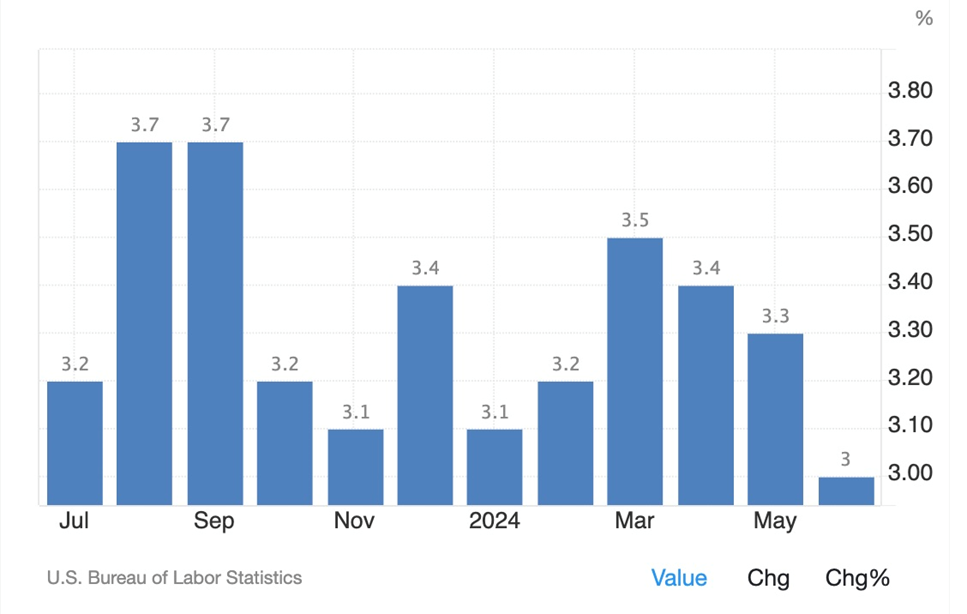

Powell told senators that inflation has been improving in recent months. The chart below shows the annual inflation rate slowed to 3.0% in June, compared to 3.3% in May and 3.4% in April.