from Zero Hedge

By Dhaval Joshi, chief strategist at BCA Research

Executive Summary

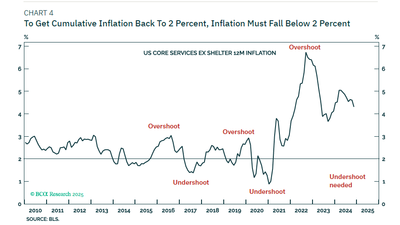

- In the developed economies excluding Japan, rising inflation expectations will lift them further above the 2 percent target. This will limit the scope for further interest rate cuts.

- But in Japan, rising inflation expectations will lift them up to the BoJ’s 2 percent target. This will remove the BoJ’s justification for its decades-long zero interest rate policy (ZIRP).

- The normalisation of Japan’s monetary policy poses a big risk to stocks because Japan has been the main source of financial market liquidity, and thereby, of rising stock market valuations.

- Hence, the biggest risk to US tech valuations comes from a rise in the Japanese real bond yield.

- On a structural (1-2 year) time horizon though, it is highly likely that Japanese real yields will rise, causing a meaningful setback in stocks versus bonds, and especially the US superstar stocks.

- But from a timing perspective, wait until the complexities of the price trends in USD/JPY and/or Nasdaq versus 30-year T-bond have reached the point of collapse that signalled previous reversals at the end of 2023 and the summer of 2024. You can monitor these indicators on our website.

- Go tactically long copper.

2024’s political Zeitgeist was encapsulated in what I have called the ‘3 I’s’: Incumbents punished for Inflation and Immigration.