by Alex Tanzi

Insurance Journal

Price pressures have eased substantially over the past two years, but a disconnect remains between what US inflation data show and what millions of Americans experience with their finances.

Price pressures have eased substantially over the past two years, but a disconnect remains between what US inflation data show and what millions of Americans experience with their finances.

That’s in part because price levels are still higher than they were before the pandemic. Another explanation: the government’s key inflation measure excludes a number of major everyday costs that have surged in recent years.

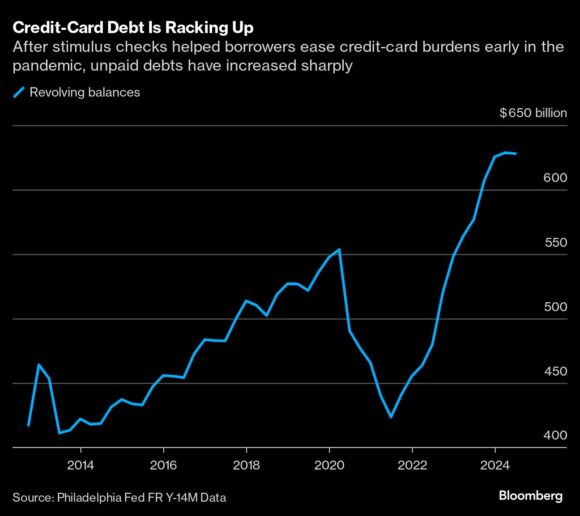

Property taxes, tips and interest charges from credit cards to auto loans aren’t factored into the Bureau of Labor Statistics’ consumer price index. The CPI also leaves out a key aspect of home insurance, as well as brokerage fees and under-the-table payments to babysitters and dog walkers — costs that can add up.