from Sky News Australia

What Americans Can Learn From Venezuela’s Crackdown On ‘Price Gougers’

by Michael Munger

The American Institute for Economic Research

Things are rarely so bad that decisive action by government officials can’t make things worse.

Things are rarely so bad that decisive action by government officials can’t make things worse.

In the current election, the Republicans are trying to outdo each other by proposing larger and more restrictive tariffs. The Democrats have just come out with a remarkably bad plan to outlaw “price gouging,” particularly for groceries.

Such proposals get more attention from politicians at election time, because to get votes you have to show you did something. The fact that the right thing is to do nothing is hard for politicians to accept, because no one can claim credit for the market.

I’m not trying to make a partisan point, because as I noted above there are ill-advised proposals on both sides of the party divide. And I’m not claiming markets are perfect. The problem is that asking voters what they want prices to be is a recipe for becoming…. well, Venezuela.

No ‘Joy’ On Labor Day: Inflation Sends Cost of Cookouts Soaring

by Hannah Knudsen

Breitbart.com

Americans are feeling less “joy” when firing up their grills and getting their marinades ready this Labor Day weekend, realizing that some of the classic barbecue staples are costing them a lot more.

Americans are feeling less “joy” when firing up their grills and getting their marinades ready this Labor Day weekend, realizing that some of the classic barbecue staples are costing them a lot more.

It all begins with firing up the grill, which will cost more than it did three and a half years ago. According to data from the Bureau of Labor statistics, the price of propane, kerosene, and firewood has risen 16 percent from January 2021 to July 2024.

Staples of the basic all-American cookout are up too, meaning hamburgers and hotdogs are going to cost you. According to Consumer Price Index (CPI) data, the price of ground beef has risen 26 percent since January 2021, when former President Donald Trump left the White House.

Fed Favored Annual Core PCE Price Index Slightly Up, at 2.6%: Core Services Inflation 3.7%, Durable Goods Deflation -2.5%

by Wolf Richter

Wolf Street

Month-to-month, core services inflation jumped while durable goods deflation deepened, and so core PCE price index hits Fed’s target.

Month-to-month, core services inflation jumped while durable goods deflation deepened, and so core PCE price index hits Fed’s target.

The “Core” PCE price index, the Fed’s primary yardstick for its 2% inflation target, rose by 2.62% from a year ago in July, a hair up from the June reading of 2.58% (red in the chart below). This “core” index attempts to show underlying inflation by excluding the components of food and energy as they can be very volatile, spiking and plunging with commodity prices (red in the chart below).

The overall PCE price index, which includes the food and energy components, rose by 2.50% year-over-year in July, also a hair up from June’s 2.47% (blue). Within it, energy prices edged up year-over-year by 0.2%, and food prices rose 1.4%.

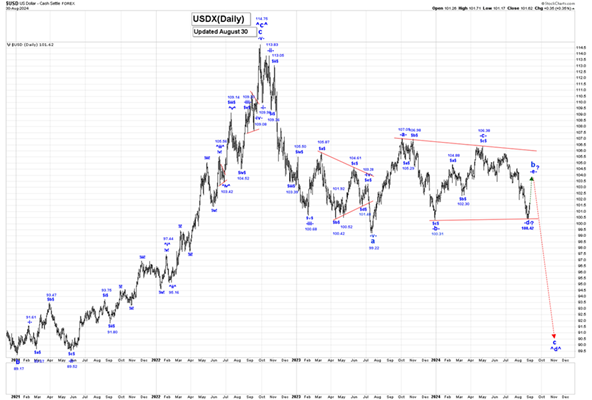

U.S. Dollar: Wave Counts of Horror

by Captain Ewave

GoldSeek

Analysis:

Analysis:

Within our bearish wave b triangle, we completed wave -a- at 107.05, wave -b- at 100.31, wave -c- at 106.38, and it looks like wave -d- may still be underway, although it cannot fall much further.

After wave -d- ends we still expect to move higher again in wave -e-, which cannot exceed the wave -c- high of 106.38, for the current triangle formation to still be valid.

After wave -e- and our bearish wave b triangle ends, we expect a sharp drop lower in wave c. We will update our projected endpoint for wave c, after wave b ends.

Inflation Slightly Below Target in July

by William J. Luther

The American Institute for Economic Research

The Federal Reserve’s efforts to bring down inflation appear to have worked. Indeed, the latest data from the Bureau of Economic Analysis (BEA) suggests the Fed may have reduced inflation even more than it intended. The Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 1.9 percent in July 2024. It has averaged just 0.9 percent over the last three months.

The Federal Reserve’s efforts to bring down inflation appear to have worked. Indeed, the latest data from the Bureau of Economic Analysis (BEA) suggests the Fed may have reduced inflation even more than it intended. The Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 1.9 percent in July 2024. It has averaged just 0.9 percent over the last three months.

Core inflation, which excludes volatile food and energy prices, also came in low. Core PCEPI grew at a continuously compounding annual rate of 1.9 percent in July 2024, and 1.7 percent over the last three months.

Kamala Harris’ Affordability Agenda is a Good Idea Backed by Terrible Policies

Americans need a politician dedicated to unwinding decades of government interventions that have driven up the cost of middle-class living.

by Peter Suderman

Reason.com

If there’s one thing the last 50 years of American politics have proven, it’s that voters hate inflation. If there’s another, it’s that politicians seeking to capitalize on that hatred will propose unproductive, unworkable, and unaffordable policies to counter rising prices.

If there’s one thing the last 50 years of American politics have proven, it’s that voters hate inflation. If there’s another, it’s that politicians seeking to capitalize on that hatred will propose unproductive, unworkable, and unaffordable policies to counter rising prices.

So it is with Vice President Kamala Harris.

In the weeks since she ascended to the top of the Democratic presidential ticket, Harris has come forward with a suite of policies she has cast as tools for bringing down the cost of living for middle-class Americans. Among those policies are a vague but potentially sweeping federal ban on price gouging for food and groceries, and a subsidy of up to $25,000 for qualified first-time home buyers.

Food First NL: Grocery Costs Up 8% as Inflation Hits Families Hard

from VOCM

Food First NL has released its annual Nutritious Food Basket numbers which, not surprisingly, reflect the growing cost of groceries.

Food First NL has released its annual Nutritious Food Basket numbers which, not surprisingly, reflect the growing cost of groceries.

The latest numbers for 2023 show that a family of four pays and average of $333 a week for groceries that meet the recommendations of the Canada Food Guide. That’s up a whopping 8 per cent from the previous year.

Those figures differ depending on where you live. For those on the north coast of Labrador, the cost is greater, at $509 a week, while in eastern Newfoundland where transportation is not as great a factor and competition is higher, the cost is $317 a week.

Gas Prices Up 50 Percent Since Kamala Harris Took Office

by Hannah Knudsen

Breitbart.com

Americans are largely unable to find the “joy” Democrats have touted, especially when they hit the gas pumps, as prices have risen 50 percent since Vice President Kamala Harris has been in the White House.

Americans are largely unable to find the “joy” Democrats have touted, especially when they hit the gas pumps, as prices have risen 50 percent since Vice President Kamala Harris has been in the White House.

According to data from the U.S. Bureau of Labor Statistics, not seasonally adjusted, the cost of gasoline has risen 50 percent since January 2021.

[…] This is a stark reality Americans are all too familiar with. During the second year of the Biden-Harris administration, gas prices actually broke record highs several times.

As it stands, the highest recorded average price for regular unleaded gasoline is $5.016, recorded on June 14, 2022. Diesel reached an all-time high five days later, reaching $5.816 on June 19, 2022, according to data from AAA.

Are Shoppers’ Concerns Around Food Inflation Starting to Ease?

While consumers feel they have “more or less control” over their grocery finances, they are still worried about rising food costs, new FMI research found.

by Peyton Bigora

Grocery Dive

Dive Insight:

Dive Insight:

Shoppers’ perception of inflation has shifted throughout 2024. In response, grocers continue to employ value-focused strategies to win over their customers — and the strategy is paying off.

More than 40% of surveyed shoppers stated their “primary food store” is on their side as an entity supporting their financial health, while 30% said the same for “food stores in general,” FMI found. Only 17% said the same for manufacturers and food processors, with 31% feeling they are “working against me.”

Food Profit Margins Shrink, but Harris Blames Them for Rising Grocery Bills

by Joel Griffith

The American Institute for Economic Research

Rising grocery costs continue to put the squeeze on families. Overall, the cost of a trip to fill the pantry rose nearly 22 percent since the beginning of 2021. Many specific staples rose far more — eggs are up 110 percent, flour up 29 percent, orange juice up 82 percent. A family of four spending $1000 per month just three and a half years is spending an additional $2,640 annually for this same shopping list.

Rising grocery costs continue to put the squeeze on families. Overall, the cost of a trip to fill the pantry rose nearly 22 percent since the beginning of 2021. Many specific staples rose far more — eggs are up 110 percent, flour up 29 percent, orange juice up 82 percent. A family of four spending $1000 per month just three and a half years is spending an additional $2,640 annually for this same shopping list.

Unfortunately, Vice President Harris misdiagnosed the source of the problem as “bad actors” seeing their “highest profits in two decades.” She blames the initial surge in food prices on supply chain issues during the pandemic — certainly a major contribution to the shortages and price increases on many items early in the pandemic.