from Kitco NEWS

Inflation Slightly Below Target in July

by William J. Luther

The American Institute for Economic Research

The Federal Reserve’s efforts to bring down inflation appear to have worked. Indeed, the latest data from the Bureau of Economic Analysis (BEA) suggests the Fed may have reduced inflation even more than it intended. The Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 1.9 percent in July 2024. It has averaged just 0.9 percent over the last three months.

The Federal Reserve’s efforts to bring down inflation appear to have worked. Indeed, the latest data from the Bureau of Economic Analysis (BEA) suggests the Fed may have reduced inflation even more than it intended. The Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 1.9 percent in July 2024. It has averaged just 0.9 percent over the last three months.

Core inflation, which excludes volatile food and energy prices, also came in low. Core PCEPI grew at a continuously compounding annual rate of 1.9 percent in July 2024, and 1.7 percent over the last three months.

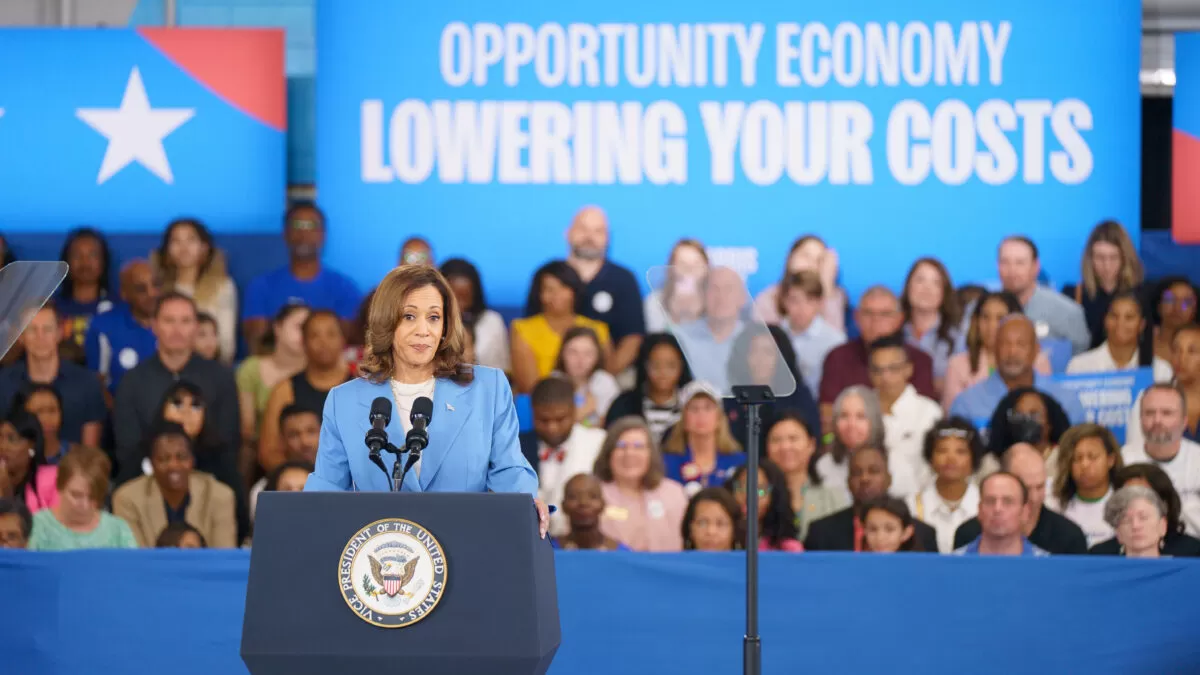

Kamala Harris’ Affordability Agenda is a Good Idea Backed by Terrible Policies

Americans need a politician dedicated to unwinding decades of government interventions that have driven up the cost of middle-class living.

by Peter Suderman

Reason.com

If there’s one thing the last 50 years of American politics have proven, it’s that voters hate inflation. If there’s another, it’s that politicians seeking to capitalize on that hatred will propose unproductive, unworkable, and unaffordable policies to counter rising prices.

If there’s one thing the last 50 years of American politics have proven, it’s that voters hate inflation. If there’s another, it’s that politicians seeking to capitalize on that hatred will propose unproductive, unworkable, and unaffordable policies to counter rising prices.

So it is with Vice President Kamala Harris.

In the weeks since she ascended to the top of the Democratic presidential ticket, Harris has come forward with a suite of policies she has cast as tools for bringing down the cost of living for middle-class Americans. Among those policies are a vague but potentially sweeping federal ban on price gouging for food and groceries, and a subsidy of up to $25,000 for qualified first-time home buyers.

Food First NL: Grocery Costs Up 8% as Inflation Hits Families Hard

from VOCM

Food First NL has released its annual Nutritious Food Basket numbers which, not surprisingly, reflect the growing cost of groceries.

Food First NL has released its annual Nutritious Food Basket numbers which, not surprisingly, reflect the growing cost of groceries.

The latest numbers for 2023 show that a family of four pays and average of $333 a week for groceries that meet the recommendations of the Canada Food Guide. That’s up a whopping 8 per cent from the previous year.

Those figures differ depending on where you live. For those on the north coast of Labrador, the cost is greater, at $509 a week, while in eastern Newfoundland where transportation is not as great a factor and competition is higher, the cost is $317 a week.

Gas Prices Up 50 Percent Since Kamala Harris Took Office

by Hannah Knudsen

Breitbart.com

Americans are largely unable to find the “joy” Democrats have touted, especially when they hit the gas pumps, as prices have risen 50 percent since Vice President Kamala Harris has been in the White House.

Americans are largely unable to find the “joy” Democrats have touted, especially when they hit the gas pumps, as prices have risen 50 percent since Vice President Kamala Harris has been in the White House.

According to data from the U.S. Bureau of Labor Statistics, not seasonally adjusted, the cost of gasoline has risen 50 percent since January 2021.

[…] This is a stark reality Americans are all too familiar with. During the second year of the Biden-Harris administration, gas prices actually broke record highs several times.

As it stands, the highest recorded average price for regular unleaded gasoline is $5.016, recorded on June 14, 2022. Diesel reached an all-time high five days later, reaching $5.816 on June 19, 2022, according to data from AAA.

Are Shoppers’ Concerns Around Food Inflation Starting to Ease?

While consumers feel they have “more or less control” over their grocery finances, they are still worried about rising food costs, new FMI research found.

by Peyton Bigora

Grocery Dive

Dive Insight:

Dive Insight:

Shoppers’ perception of inflation has shifted throughout 2024. In response, grocers continue to employ value-focused strategies to win over their customers — and the strategy is paying off.

More than 40% of surveyed shoppers stated their “primary food store” is on their side as an entity supporting their financial health, while 30% said the same for “food stores in general,” FMI found. Only 17% said the same for manufacturers and food processors, with 31% feeling they are “working against me.”

Food Profit Margins Shrink, but Harris Blames Them for Rising Grocery Bills

by Joel Griffith

The American Institute for Economic Research

Rising grocery costs continue to put the squeeze on families. Overall, the cost of a trip to fill the pantry rose nearly 22 percent since the beginning of 2021. Many specific staples rose far more — eggs are up 110 percent, flour up 29 percent, orange juice up 82 percent. A family of four spending $1000 per month just three and a half years is spending an additional $2,640 annually for this same shopping list.

Rising grocery costs continue to put the squeeze on families. Overall, the cost of a trip to fill the pantry rose nearly 22 percent since the beginning of 2021. Many specific staples rose far more — eggs are up 110 percent, flour up 29 percent, orange juice up 82 percent. A family of four spending $1000 per month just three and a half years is spending an additional $2,640 annually for this same shopping list.

Unfortunately, Vice President Harris misdiagnosed the source of the problem as “bad actors” seeing their “highest profits in two decades.” She blames the initial surge in food prices on supply chain issues during the pandemic — certainly a major contribution to the shortages and price increases on many items early in the pandemic.

Slow Cooking in a Microwave World: Understanding Inflation and Economic Trends

by Money Metals

GoldSeek

In the latest episode of the Money Metals Midweek Memo, host Mike Maharrey dives deep into the recurring economic themes that dominate the news cycle. Maharrey begins by acknowledging a feeling many listeners may share: a sense of repetition in the content.

In the latest episode of the Money Metals Midweek Memo, host Mike Maharrey dives deep into the recurring economic themes that dominate the news cycle. Maharrey begins by acknowledging a feeling many listeners may share: a sense of repetition in the content.

However, he stresses the importance of understanding that while news headlines change daily, the underlying economic fundamentals remain consistent, often playing out in slow motion over time.

Fudging the Figures

by Alasdair MacLeod

Gold Money

Of all the dangers that threaten the global financial system, the one most likely to topple it is the US Government’s debt trap. This article explains how and why it is becoming inevitable.

Of all the dangers that threaten the global financial system, the one most likely to topple it is the US Government’s debt trap. This article explains how and why it is becoming inevitable.

According to the US Government, its debt stands at $35.210 trillion having grown 57% in the last five years. As the chart below shows, there was a big step up in early 2020 due to Covid. But subsequent attempts to control the deficit and therefore indebtedness have been absent.

[…] This article looks at the dollar’s debt trap, which despite being the greatest threat to the entire fiat currency based monetary system has attracted little notice from the financial media and investment commentators. Furthermore, the mechanics of a debt trap are poorly understood. It is timely, because with signs of America’s economy slowing down and formally reliable recession indicators such as the Sahm rule being triggered, the Keynesian response is for the government to increase spending to support the economy.

Trump’s Inflation Fantasies

by Rick Newman

Yahoo! Finance

If Donald Trump becomes president, he’s going to wave a magic wand on his first day in office and poof! The cost of food, energy, insurance, and many other things will suddenly plunge.

This is the gist of Trump’s riff on inflation, which he used to blame on President Joe Biden and now blames on Vice President Kamala Harris. When Biden was the Democratic presidential candidate, the inflation that peaked at 9% during his second year in office was a major electoral liability. Now that Harris has replaced Biden, Trump obviously hopes voters will transfer their anger over inflation onto her.

If the president had the power to single-handedly slay inflation, you might think Biden would have done it.

‘Don’t Be Scared of Beans’: How Readers Are Handling U.S. Grocery Inflation

by Aliya Uteuova

The Guardian

Back in 2019, $100 worth of groceries may have lasted a week for a household of two. Today, that same $100 will probably only buy enough groceries to stretch for a couple of days.

Back in 2019, $100 worth of groceries may have lasted a week for a household of two. Today, that same $100 will probably only buy enough groceries to stretch for a couple of days.

In the last four years, food prices have increased a whopping 22%, and consumers are feeling the pinch.

Even though inflation has recently fallen below 3% for the first time since 2021, food prices remain stubbornly high, and are still predicted to increase. Some food companies such as General Mills are continuing to raise prices of their products 4% this year, with profits jumping to $670.1m. Kellogg’s raised the price of cereal by 12%.