from WION

Turkish Tourists Flock to Greece as Inflation Drives Hotel Prices Through the Roof

by Emre Basaran

EuroNews

Hotel prices and ticket costs are soaring in Türkiye as inflation hits tourism.

Hotel prices and ticket costs are soaring in Türkiye as inflation hits tourism.

Turkish tourists are flocking to Greece as inflation makes it too expensive to travel within Turkey.

Inflation has surged in Türkiye in recent months, rocketing to 75.4 per cent in May, driven mainly by increases in hotel, cafe and restaurant prices.

“Actually, this problem started last year when the Turkish government took steps to suppress foreign currency,” Kivanç Meriç, Chairman of the Izmir Regional Representative Board of the Association of Turkish Travel Agencies (TÜRSAB), tells Euronews Travel.

Analyst Says the “Forces Underway for Inflation to Fall Like a Rock Are in Place”

Says its urgent that the Fed cut rates

by Eamonn Sheridan

Forex Live

Tom Lee is Fundstrat Global Advisors co-founder and head of research. Spoke with CNBC on Monday.

He is expecting inflation data from the US due on Friday (PCE) to be cooler.

- “One print can be uncertain, but I think the forces underway for inflation to fall like a rock are in place”

- there do not seem to be any new drivers of inflation

- so it can surprise to the downside

- expects inflation to fall sharply due to a recession in durable goods

- said there is “urgency” for the Federal Reserve to begin cutting interest rates

The data is due on Friday 25 July at 0830 US Eastern time / 1230 GMT

Fed’s Fake Victory Over Inflation

by David Stockman

LewRockwell.com

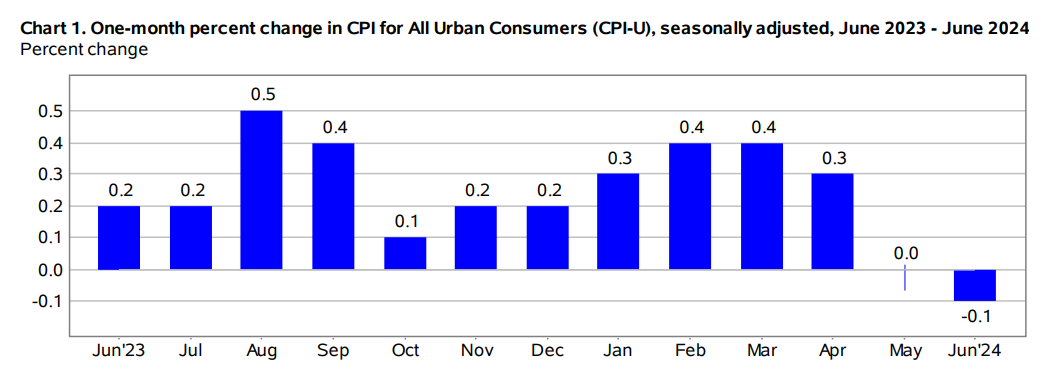

If you don’t think the Fed has become an abject handmaid of the Wall Street gamblers, take a gander at the chart below. Owing to the slight down-tick in this week’s monthly CPI report, the outcry for rate cuts is reaching a deafening roar down in the trading pits. And judging by Powell’s presser on Wednesday, the Fed is fixing to bend over soon, bar of soap in outstretched hand.

If you don’t think the Fed has become an abject handmaid of the Wall Street gamblers, take a gander at the chart below. Owing to the slight down-tick in this week’s monthly CPI report, the outcry for rate cuts is reaching a deafening roar down in the trading pits. And judging by Powell’s presser on Wednesday, the Fed is fixing to bend over soon, bar of soap in outstretched hand.

And yet and yet. On everything that makes a difference to the main street cost of living, prices are up by 32% to 36% during the period of UniParty rule since January 2017.

That’s right. Among the five biggies—services, food, energy, transportation and shelter—that comprise an overwhelming share of main street family budgets, the rate of price increase during the last seven-and-one-half years is close to 4.0% per annum! And for want of doubt, that rate of gain means that prices would double every 18 years.

Why Consumers and Economists Don’t See Eye-to-Eye On Inflation

Official data shows that inflation has declined over the past year, but nearly two out of every three respondents to a recent survey believe it has risen.

by Terry Lane

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1961227840-62b23241ef6742b6a51dc56ede70089f.jpg) While the Federal Reserve is starting to feel pretty good about inflation, consumers remain frustrated about price pressures.

While the Federal Reserve is starting to feel pretty good about inflation, consumers remain frustrated about price pressures.

A recent survey by Morning Consult showed that nearly two out of every three respondents believed that annual inflation was either much or somewhat higher than a year ago, even though inflation has slowed from last year no matter how you measure it.1

“I think that consumers think about it differently than economists do,” said Sofia Baig, economist at Morning Consult.

So, why are consumers’ views of inflation different from the members of the Federal Reserve? One answer is consumers perceive price changes over time differently, Baig said.

Three Ways Inflation Could Be Impacted Now That Biden Has Dropped Out of the 2024 Election

by Nicole Spector

NASDAQ

In a post on X, formerly known as Twitter, President Joe Biden announced on July 21, that he has dropped out of the 2024 Presidential race.

In a post on X, formerly known as Twitter, President Joe Biden announced on July 21, that he has dropped out of the 2024 Presidential race.

“While it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term,” Biden wrote. “I will speak to the Nation later this week in more detail about my decision.”

[…] Democrats have been rallying for Biden to drop out since his disastrous performance in his first 2024 debate with former President and 2024 Republican nominee Donald Trump. Now that it’s actually happened, you may be wondering how the change could impact your wallet.

Waiting For the Coast to Clear On Inflation

by Ben Carlson

A Wealth of Common Sense

The Fed will likely begin cutting interest rates in the months ahead, for good reason.

The Fed will likely begin cutting interest rates in the months ahead, for good reason.

Last week felt like a victory against high inflation:

[…] We’ve now had no price increases on the overall inflation rate for two months.

Some pundits still aren’t so sure it’s time to take a victory lap just yet.

What about the 1970s?

There was a spike in inflation at the outset of the decade, it fell, then re-accelerated:

Business Cost Inflation: Labor Expenses Will Drive 2024-2025 Budgets

by Bill Conerly

Forbes

![]() Consumer inflation is declining, but business costs are a different story, challenging many companies. A little relief is in the cards, but not enough to compensate for smaller increases in product prices. Most businesses will need productivity growth to protect their profit.

Consumer inflation is declining, but business costs are a different story, challenging many companies. A little relief is in the cards, but not enough to compensate for smaller increases in product prices. Most businesses will need productivity growth to protect their profit.

Labor Costs

Labor is the largest cost for many organizations. Average hourly earnings over the last 12 months rose four percent, down from a peak of seven percent recorded early in 2022. That four percent inflation rate has been stable in recent months. Benefits cost data are only available through the first quarter and show 3.5 percent rate of increase. That was down from a year earlier.

Joe Biden Dropout Fallout, Inflation Data, and the Start of Tech Earnings: What to Know This Week

by Josh Schafer

Yahoo! Finance

Stocks pulled back from record highs amid pressure across the technology sector after a global tech outage sent shockwaves throughout the market on Friday.

The S&P 500 (^GSPC) ended the week down nearly 2% while the Nasdaq Composite (^IXIC) dropped more than 3.5% on the week. Both indexes had their worst weekly performance since April. Meanwhile, the Dow Jones Industrial Average (^DJI) rose about 0.7%.

This week, critical readings on economic growth and inflation, as well as the start of Big Tech earnings, will determine if the malaise continues.

Inflation and the Fed’s Monetary Policy

by Alasdair MacLeod

Gold Money

Jay Powell has signalled that inflation is moving sustainably towards the Fed’s 2% target and that the jobs market has cooled down. Hopes for an interest rate cut are rising, but the Fed is being misled badly…

Jay Powell has signalled that inflation is moving sustainably towards the Fed’s 2% target and that the jobs market has cooled down. Hopes for an interest rate cut are rising, but the Fed is being misled badly…

The dynamics behind rate policy

Undoubtedly, market values everywhere are predicated on the Fed cutting rates. To a limited extent, this could become a self-fulfilling prophecy. So far, the effect on the 10-year US Treasury Note, which sets the valuation tone for all financial assets, has been to reduce its yield in recent months from 4.7% to under 4.2% currently. I have pencilled in a potential support line at 4.08% (the pecked line).

Prepare For Liftoff, Bulls vs Bears, Plus Get Ready For More Inflation

from King World News

Prepare for liftoff, plus a look at bulls vs bears and more inflation.

Prepare for liftoff, plus a look at bulls vs bears and more inflation.

The Great Rotation

July 18 (King World News) – Graddhy out of Sweden: This very big picture ratio chart now shows silver breaking out plus backtesting vs SPX.

Silver Coiling To Blastoff vs S&P 500