from FOX 32 Chicago

Frustration Over Bills, Inflation Could Shape 2024 Presidential Election

by Susan Tompor

Detroit Free Press

More often than not, I’m asking economists about things like the Federal Reserve, the jobless rate and the outlook for auto sales. Typically, I’m not bringing up second-hand conversations with hairdressers.

More often than not, I’m asking economists about things like the Federal Reserve, the jobless rate and the outlook for auto sales. Typically, I’m not bringing up second-hand conversations with hairdressers.

But lately, such conversations can matter when you consider whether, somehow, Vice President Kamala Harris might be able to put 10,000 miles between her and the shocking 40-year high for inflation that hit in June 2022.

It turns out, everyday conversations can tell you a great deal about economic angst and why some people think the U.S. economy stinks. The economy is lousy, you say, even when the U.S. unemployment rate was a mere 4.1% in June?

African Nations Turn to Gold to Protect Against Currency Losses

by Ray Ndlovu and Okech Francis

BNN Bloomberg

(Bloomberg) — African nations are rushing to build their gold reserves to hedge against geopolitical tensions that have battered their currencies and fanned inflation.

(Bloomberg) — African nations are rushing to build their gold reserves to hedge against geopolitical tensions that have battered their currencies and fanned inflation.

Nations from South Sudan, Zimbabwe and Nigeria have either taken steps to shore up their holdings or are considering doing so. The move follows that of central banks in places such as China and India that have accumulated gold to diversify reserves and reduce dependency on the US dollar. About 20 central banks are expected to stock up in the coming year, according to a World Gold Council survey.

“As a diversification strategy, that makes some sense,” said Charlie Robertson, head of macro strategy at FIM Partners. “While gold does not pay interest, unlike reserves held in US treasuries, this hasn’t mattered because the gold price has risen so much. It’s been a profitable trade.” The price of bullion has rallied 16% this year to $2,396.59 an ounce on Monday.

Inflation Drove Prices Higher at Coca-Cola, Consumers Still On the Hunt for Value: CEO

by Brooke DiPalma

Yahoo! Finance

Coca-Cola (KO) held on to its momentum to deliver another bubbly quarter on Tuesday.

The soda giant beat Wall Street’s estimates in Q2, led by global demand for its beverages, despite higher prices. Revenue grew 3% to $12.4 billion, compared to the expected $11.76 billion. Earnings per share came in 7% higher year over year at $0.84, compared to estimates of $0.81.

On a call with Yahoo Finance, CEO James Quincey attributed the results to “a strong execution of the strategy.” Consequently, the company is raising its 2024 guidance.

Biden is Out, but It’s Still the Inflation Election

by Rick Newman

Yahoo! Finance

Democrats seem thrilled now that Vice President Kamala Harris has replaced Joe Biden as their likely presidential nominee. Donations are pouring in, endorsements are piling up, and it’s now Republicans, not Democrats, who have to grapple with an elderly presidential nominee.

This fresh start for Democrats, however, doesn’t alleviate a problem Harris inherits from Biden: Voters associate the Biden administration and Democrats in general with the high inflation of the last two years.

And there’s no easy way for Harris to wash her hands of it.

Different Household – Different Inflation Rate

by Regina Kiss and Georg Strasser

European Central Bank

Households differ considerably in terms of the inflation they experience at any point in time. The main reasons for this are that prices (and thus price changes) differ from place to place and that households do not all buy the same products. Households adjust their purchases over time, but not enough to offset these differences.

Households differ considerably in terms of the inflation they experience at any point in time. The main reasons for this are that prices (and thus price changes) differ from place to place and that households do not all buy the same products. Households adjust their purchases over time, but not enough to offset these differences.

Sources of inflation rate dispersion across households

The differences between households in terms of their exposure to inflation have gained a lot of attention, especially since the recent jump in the cost of living. Their different inflation experiences feed into different inflation perceptions and expectations (D’Acunto et al. 2021; Weber et al. 2022). In turn, this can mean that households seemingly react differently to aggregate inflation. Moreover, systematic inflation differences among households can have distributional effects. For example, because poorer households spend a larger share of their income on food, an increase in food prices reduces their purchasing power relatively more.

Erdogan’s Economy: Turkish Inflation Hits 91%, Tanking Tourism Industry

by John Hayward

Breitbart.com

Persistently high inflation under the policies of President Recep Tayyip Erdogan is decimating the Turkish tourism industry, as both foreign visitors and locals decide to save money by nipping over to Greece for holiday getaways.

Persistently high inflation under the policies of President Recep Tayyip Erdogan is decimating the Turkish tourism industry, as both foreign visitors and locals decide to save money by nipping over to Greece for holiday getaways.

“Angry citizens have taken to social media to share their bills, including the equivalent of $640 for food and drinks for five people in Bodrum and $30 for five scoops of ice cream in Cesme,” Fortune reported Monday.

Grumpy Turks said the quality of service at hotels and restaurants is declining even as the prices skyrocket. Some accused Turkish businesses of using notoriously high inflation as an excuse to push their prices even higher.

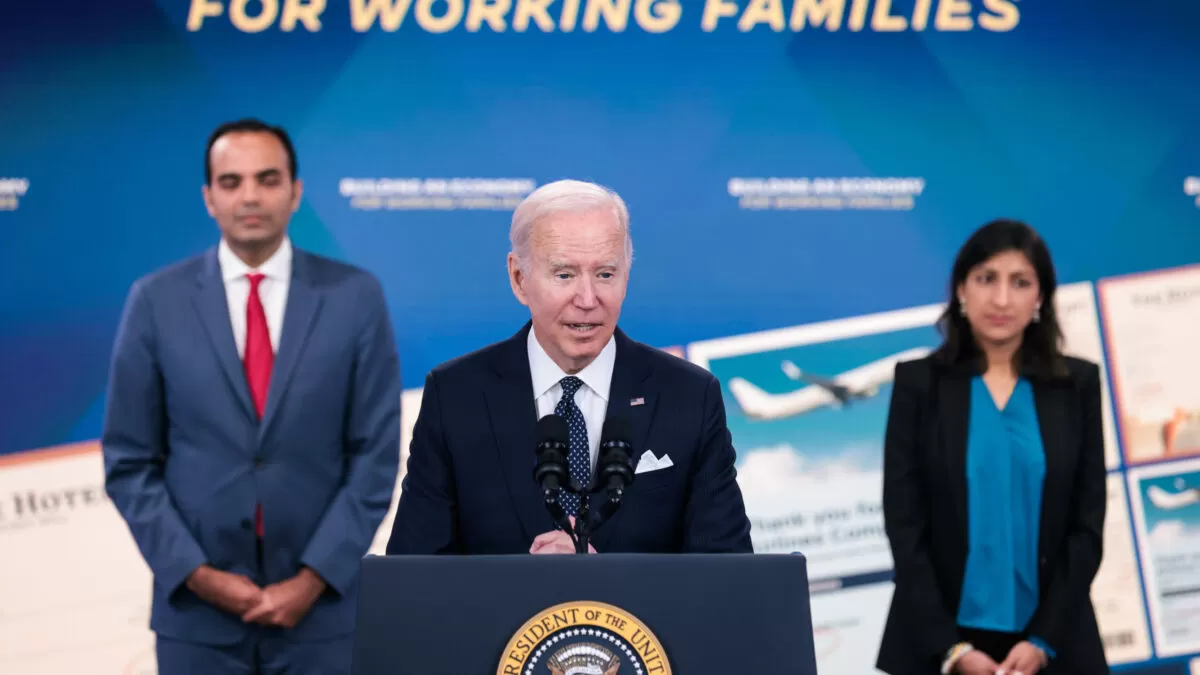

Biden’s Big Government Solutions Dismiss Customer Welfare

Sen. Rand Paul writes that repealing the Robinson-Patman Act would help bust inflation.

by Rand Paul

Reason.com

The ostensible purpose of antitrust policy is to promote healthy competition in the marketplace, but antitrust enforcement has largely protected inefficient firms from the threat of competition and deprived consumers of the lower prices they would otherwise enjoy. Thanks to legal scholars like Robert Bork, antitrust enforcement over the past four decades has primarily focused on the most logical place—maximizing benefits for consumers. But Democrats are taking a radical turn from Bork’s philosophy by reviving a nearly 90-year-old price discrimination law known as the Robinson-Patman Act, making discounts to lower prices illegal. To strengthen your family’s purchasing power, the Robinson-Patman Act should be repealed.

The ostensible purpose of antitrust policy is to promote healthy competition in the marketplace, but antitrust enforcement has largely protected inefficient firms from the threat of competition and deprived consumers of the lower prices they would otherwise enjoy. Thanks to legal scholars like Robert Bork, antitrust enforcement over the past four decades has primarily focused on the most logical place—maximizing benefits for consumers. But Democrats are taking a radical turn from Bork’s philosophy by reviving a nearly 90-year-old price discrimination law known as the Robinson-Patman Act, making discounts to lower prices illegal. To strengthen your family’s purchasing power, the Robinson-Patman Act should be repealed.

At a press conference in 2021, President Joe Biden called for “full and aggressive enforcement” of archaic antitrust laws against private industry. “Forty years ago, we chose the wrong path, in my view,” said Biden, “following the misguided philosophy of people like Robert Bork.” Now, instead of protecting consumers, the Federal Trade Commission (FTC) is determined to scapegoat well-run businesses to divert blame away from Biden for his own inflationary policies.

Venezuela Inflation Has Cooled, but Voters Say They Still Can’t Make Ends Meet

With the Venezuelan presidential election looming, workers say their salaries have not caught up with prices, despite lowest inflation rates in years.

by Reuters

NBC News

The government of Venezuelan President Nicolás Maduro, who is seeking reelection on Sunday, has had some success in curbing formerly sky-high inflation, but workers say their salaries have not caught up with high prices for food and other goods.

The government of Venezuelan President Nicolás Maduro, who is seeking reelection on Sunday, has had some success in curbing formerly sky-high inflation, but workers say their salaries have not caught up with high prices for food and other goods.

That, combined with general frustration after years of economic malaise, could chill support for Maduro and help bring out the vote for opposition coalition candidate Edmundo González, said voters and analysts.

Venezuela had suffered six-digit hyperinflation for about four years, with the indicator reaching a heady 130,000%, eroding savings and making basic supplies scarce.

Republican Platform Ignores Real Causes of Inflation

by Dr. Ron Paul

Ron Paul Institute

The 2024 Republican platform promises that, if Donald Trump returns to the White House and Republicans gain complete control of Congress, they will reduce inflation. The platform contains some proposals, such as reducing regulations and extending the 2017 tax reductions, that may help lower prices in some sectors and spur economic growth. However, the GOP platform does not address how the Federal Reserve’s enabling of spendaholic politicians contributes to price inflation.

The 2024 Republican platform promises that, if Donald Trump returns to the White House and Republicans gain complete control of Congress, they will reduce inflation. The platform contains some proposals, such as reducing regulations and extending the 2017 tax reductions, that may help lower prices in some sectors and spur economic growth. However, the GOP platform does not address how the Federal Reserve’s enabling of spendaholic politicians contributes to price inflation.

Other than an obligatory promise to cut “wasteful” spending, and a pledge to eliminate the Department of Education, the Republican platform is largely silent on proposals to reduce federal spending.

Cell Phones, Clothes … Rent? Inflation Pushes Teens Into the Workforce

by Bailey Schulz and Jessica Guynn

USA Today

At 18, Michelle Chen covers her cellphone bills as well as school expenses. She squirrels away money for college. And, with her earnings from a summer job with the Boston’s SuccessLink Youth Employment Program, she helps her parents by stocking the fridge with groceries when the shelves are bare and makes sure her two younger brothers have pocket money.

At 18, Michelle Chen covers her cellphone bills as well as school expenses. She squirrels away money for college. And, with her earnings from a summer job with the Boston’s SuccessLink Youth Employment Program, she helps her parents by stocking the fridge with groceries when the shelves are bare and makes sure her two younger brothers have pocket money.

Chen, a nursing major at Simmons University in Boston this fall, said she began working in fourth grade when her family ran a Chinese takeout restaurant. Since then, she has worked in social media marketing for a hair care company and as a coding instructor, learning soft skills that aren’t typically taught in school such as teamwork and time management.

Those skills, she said, helped her thrive in her classes. And the extra pocket money means she can pitch in with family expenses.

Trump Would Send Inflation Higher. That’s Not Good for Crypto, Says Analyst

Tax cuts, tariffs, and a weaker dollar lead to inflation, said Noelle Acheson.

by Ben Weiss

DL News

Former President Donald Trump is pro-crypto.

Former President Donald Trump is pro-crypto.

He’s met with prominent Bitcoin miners and will speak at an industry conference, while crypto boosterism is even part of the Republican party’s election platform.

Many in the industry swoon over Trump and think he’ll “pump their bags.”

But could Trump’s economic policies end up hurting, not helping, the crypto markets?

If we assume that the former president’s economic platform leads to higher inflation, then yes, said Noelle Acheson, a crypto and macroeconomic analyst, in a recent newsletter.