from NewsNation

Coming Soon: Silver’s Mania Phase

by Adam Sharp

Daily Reckoning

Every so often, silver goes through a mania phase.

Every so often, silver goes through a mania phase.

I experienced my first and only silver mania from 2009-2011. There’s nothing quite like it in the investment world. Simultaneously thrilling, nauseating, and lucrative.

Silver is tiny compared to gold and other commodities, so bull markets tend to be almost violent in nature. Once generalist investors get involved, things can quickly get out of hand, in the best kind of way.

Here’s a chart showing the relative performance of silver vs gold from 2009 through 2011:

Inflation Heats Up for Third Consecutive Month, Casting Shadow On Fed’s Earlier Cuts

by John Carney

Breitbart.com

Inflation continued its steady rise in February, the latest indication that the Federal Reserve’s efforts to restore price stability have faltered.

Inflation continued its steady rise in February, the latest indication that the Federal Reserve’s efforts to restore price stability have faltered.

The personal consumption expenditures (PCE) price index rose 0.3 percent for the month in February, matching the January pace. If prices rose at that pace over the next twelve months, inflation would rise to four percent. Compared with a year ago, the PCE price index is up 2.5 percent.

The Fed uses the PCE price index for its official target of two percent inflation. It also uses the index in the economic projections of Fed officials that are released at every other meeting of the Fed’s monetary policy committee.

The core PCE price index, which strips out volatile food and energy prices, rose 0.4 percent from the previous month.

Inflation Galore Now: Fed Started Rate Cuts at the Low Point Six Months Ago, Just as Inflation Began to Resurge

by Wolf Richter

Wolf Street

Core PCE price index jumps MoM by most in 13 months on Non-Housing Services. Recreational Services blow out. Durable Goods continue 6-month trip out of deflation.

Core PCE price index jumps MoM by most in 13 months on Non-Housing Services. Recreational Services blow out. Durable Goods continue 6-month trip out of deflation.

The inflation measure released today – the PCE price index favored by the Fed as yardstick for its inflation target – dished up another surprise.

While gasoline prices fell in February from January, and food prices were stable month-to-month after substantial increases in prior months, prices in core services jumped, driven by non-housing services, especially by the ongoing six-month-long red-hot spike in recreational services – the services that consumers want to buy.

Goldman Sachs Sees Trump Tariffs Spiking Inflation, Stunting Growth and Raising Recession Risks

Goldman Sachs expects aggressive duties from the White House to raise inflation and unemployment and drag economic growth to a near-standstill.

by Jeff Cox

CNBC.com

With decision day looming this week for President Donald Trump’s latest round of tariffs, Goldman Sachs expects aggressive duties from the White House to raise inflation and unemployment and drag economic growth to a near-standstill.

With decision day looming this week for President Donald Trump’s latest round of tariffs, Goldman Sachs expects aggressive duties from the White House to raise inflation and unemployment and drag economic growth to a near-standstill.

The investment bank now expects that tariff rates will jump 15 percentage points, its previous “risk-case” scenario that now appears more likely when Trump announces reciprocal tariffs on Wednesday. However, Goldman did note that product and country exclusions eventually will pull that increase down to 9 percentage points.

When the new trade moves are enacted, the Goldman economic team led by head of global investment research Jan Hatzius sees a broad, negative impact on the economy.

In a note published on Sunday, the firm said “we continue to believe the risk from April 2 tariffs is greater than many market participants have previously assumed.”

Paper Promises, Golden Truths

by Adam Sharp

Daily Reckoning

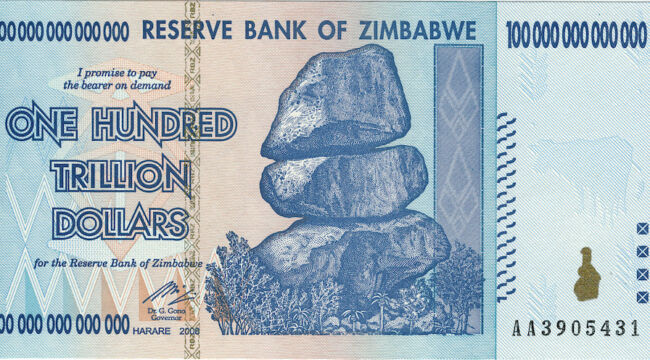

“Paper money eventually returns to its intrinsic value – zero.” – Voltaire, 18th century

In films and TV shows set in the future, money is usually a digital government currency.

Credits, cubits, and chits are a few names I recall. This is a globalist CBDC-based vision of the future. Bleak.

But in one of my favorite sci-fi movies, Looper, precious metals reign supreme as money. In that film, the inevitable breakdown in fiat currency has already occurred and hard money has made a comeback.

This latter scenario is far more likely. Time and time again, central banks and governments have proven they cannot be trusted with the power to create unlimited money. It doesn’t matter whether it’s paper or digital money, central bankers will print too much of it given the chance.

Gold Going Higher, Dollar Losing 75% Value | Rick Rule

by Craig Hemke

Sprott Money

In this Monthly Wrap-Up, host Craig Hemke is joined by legendary investor Rick Rule to break down the latest developments in the precious metals market. We discuss gold’s strong March gains, why the gold price is going much higher, the declining purchasing power of the U.S. dollar, mining stocks, and the future of commodities like copper. Rick shares deep insights backed by 50 years of experience, including his views on upcoming economic risks and how investors can protect their wealth with precious metals. Watch today!

Wall Street Tumbles as Fresh Data Fuels Inflation Fear

by Noel Randewich and Pranav Kashyap

Reuters.com

March 28 (Reuters) – Wall Street stocks ended sharply lower on Friday, with selloffs in Amazon, Microsoft and other technology heavyweights, after U.S. data stoked fears of weak economic growth and high inflation as the Trump administration ratchets up tariffs.

March 28 (Reuters) – Wall Street stocks ended sharply lower on Friday, with selloffs in Amazon, Microsoft and other technology heavyweights, after U.S. data stoked fears of weak economic growth and high inflation as the Trump administration ratchets up tariffs.

U.S. consumer spending rebounded less than expected in February while a measure of underlying prices increased the most in 13 months.

Adding to concerns, a University of Michigan survey showed consumers’ 12-month inflation expectations soared to the highest in nearly 2-1/2 years in March, and they expect inflation to remain elevated beyond the next year.

That data fueled fears that a rush of tariff announcements from U.S. President Donald Trump since taking office in January will boost prices of imported goods, drive inflation and deter the Federal Reserve from cutting interest rates.

Trump and the Fate of the Dollar

by James Rickards

Daily Reckoning

What is the Mar-a-Lago Accord? And what would a Mar-a-Lago Accord mean for the value of the U.S. dollar?

What is the Mar-a-Lago Accord? And what would a Mar-a-Lago Accord mean for the value of the U.S. dollar?

We begin our analysis with the name itself. Mar-a-Lago Accord is an echo of the three major international currency accords since the original Bretton Woods Agreements reached in 1944.

Accords Through The Years

The first was the Smithsonian Agreement in December 1971. This came in the aftermath of President Nixon’s decision on August 15, 1971, to end the convertibility of U.S. dollars into physical gold by U.S. trading partners at the fixed rate of $35.00 per ounce. The major countries in the global system (U.S., UK, France, Germany, Italy, Japan, Netherlands, Sweden, Switzerland, Canada, Belgium, and Netherlands) met at the Smithsonian Institution in Washington DC to decide how to reopen the gold window.

Is Inflation Necessary?

by Kelsey Williams

GoldSeek

IS INFLATION NECESSARY?

IS INFLATION NECESSARY?

The straight answer is “no”. The clarity of my emphasis is prompted by a friend’s reaction to my previous article “No Winners When The Inflation Balloon Pops”.

In the article, I said, “A certain amount of inflation is necessary to keep things from cascading downward.” My friend exclaimed quite vociferously that “INFLATION IS NEVER NECESSARY!” He’s right. Both he and I shared similar concerns a number of years ago when one of our monetary heroes, Milton Friedman, made similar comments about the necessity of inflation. To us, it seemed like a cop-out; and, it still does.

As far as my own comment is concerned, I asked my friend to consider the context in which my statement was made. Here is an excerpt from the article that should help clarify why I said what I did…

Fed’s Collins Says it is Clear Tariffs Will Drive Inflation Up Near Term

by Michael S. Derby

Yahoo! Finance

“It looks inevitable that tariffs are going to increase inflation in the near term” and it seems more likely than not right now the jump will be short-lived, she said in an appearance in Boston.

But “there are risks” the higher price pressures could prove more enduring, she noted, and the details and reactions of those targeted by the tariffs matter a lot in determining how much prices will be affected.

Collins also said she fully supported the Fed’s decision last week to hold rates steady.