from Yahoo Finance

It’s Not You. It’s Bidenflation.

by Sean Ring

Daily Reckoning

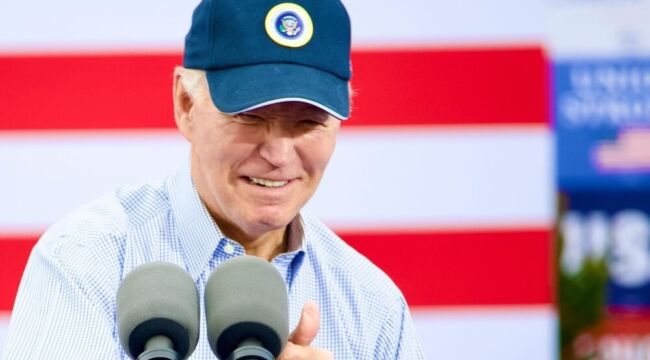

Joke Biden didn’t invent inflation. But he inadvertently attached his name to it, much like Jimmy Carter did in the 1970s.

Joke Biden didn’t invent inflation. But he inadvertently attached his name to it, much like Jimmy Carter did in the 1970s.

A few months ago, Greg Ip wrote the most condescendingly asinine article The Wall Street Journal ever had the misfortune to publish. In “What’s Wrong With the Economy? It’s You, Not the Data,” Ip alleged The Great Unwashed™ were too stupid to realize how good everything was under Dear Leader Potatohead Biden.

Ip wrote:

Yes, some individuals faced higher inflation (someone who bought a house, for instance) but, for the average person, inflation went down.

The Fed Doesn’t Fight Inflation

by J. Kennerly Davis

American Thinker

The most important thing to understand about the persistent inflation that has destroyed 20 percent of the dollar’s purchasing power since Joe Biden took office is that inflation is not the target of government policies designed to eliminate it. Inflation is the creation of government policies and government policies intentionally perpetuate inflation to enable the government to default unlawfully on its otherwise unsustainable debt.

The most important thing to understand about the persistent inflation that has destroyed 20 percent of the dollar’s purchasing power since Joe Biden took office is that inflation is not the target of government policies designed to eliminate it. Inflation is the creation of government policies and government policies intentionally perpetuate inflation to enable the government to default unlawfully on its otherwise unsustainable debt.

Inflation is always and everywhere the result of government policies that increase the supply of money circulating in the economy faster than the productive sectors of the economy can expand their capacity to produce goods and services for purchase.

From day one, the Biden administration has flooded the economy with borrowed money in the form of transfer payments, subsidies, and grants designed to secure the political support of favored constituencies such as those in the green tech sector.

Middle-Income Earners Turn to Spending Cuts, Second Jobs to Deal with Inflation

Households earning between $50,000 to $148,000 a year showing signs of strain

by Terry Lane

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-523282434-9634e83b86a84217ab113ef30ddbefee.jpg) Middle-income earners are taking second jobs, cutting back on spending and delaying large purchases to deal with inflation, a new survey shows.

Middle-income earners are taking second jobs, cutting back on spending and delaying large purchases to deal with inflation, a new survey shows.

Roughly 78% of respondents to a survey conducted by Santander US said inflation was a major concern with nearly three out of four reporting seeing higher prices in the second quarter.

“While current economic conditions remain challenging, American households are showing great resiliency by taking the necessary actions to navigate through inflationary pain points,” said Santander US CEO Tim Wennes. “For many households, this has meant scaling back on spending, including summer activities.”

Nobel Economists Bash Trump, Hail Biden in Pre-Debate Inflation Attack

by John Carney

Breitbart.com

Sixteen Nobel Prize-winning economists — all unabashed liberals — have unleashed a partisan attack against Donald Trump on the eve of the first presidential debate.

Sixteen Nobel Prize-winning economists — all unabashed liberals — have unleashed a partisan attack against Donald Trump on the eve of the first presidential debate.

In a letter released Wednesday, the economists claim that former President Donald Trump could stoke inflation if he wins the presidency in November and implements his economic plans. It’s highly likely that President Joe Biden or even the debate moderators will cite the letter during Thursday night’s debate.

“Many Americans are concerned about inflation, which has come down remarkably fast. There is rightly a worry that Donald Trump will reignite this inflation, with his fiscally irresponsible budgets,” the economists claim without evidence.

Inflation vs Wages: How Rising Prices Stack Up Against Growing Pay

On average, wages have risen faster than prices since the onset of the pandemic, and lower-paid workers have seen the steepest gains even while facing the highest cost burdens.

by Rob Wile

NBC News

It’s a key question on voters’ minds heading into Thursday night’s presidential debate: How far does my dollar go in 2024?

It’s a key question on voters’ minds heading into Thursday night’s presidential debate: How far does my dollar go in 2024?

The short answer: further than they might think.

Since February 2020, the Consumer Price Index has climbed a cumulative 20.8%, according to Bureau of Labor Statistics data. Over that same period, average hourly earnings rose 22.3%.

The chart below shows the result: Inflation-adjusted hourly earnings (the yellow line) have increased 1.5% since December 2019, indicating a net gain for workers’ average spending power.

Struggling Canadians Sound Alarm On Skyrocketing Grocery Prices

Canucks reveal they’re suffering the same inflation dilemma as Americans when it comes to rising grocery costs.

by Infowars.com

Info Wars

Similar to the United States, America’s neighbors to the north are seeing grocery prices at supermarkets shoot through the roof, prompting Canadians to document their grievances on social media.

Similar to the United States, America’s neighbors to the north are seeing grocery prices at supermarkets shoot through the roof, prompting Canadians to document their grievances on social media.

In one shocking video, a woman complains over the $220 cost of a few days worth of groceries purchased.

[…] Prices have gotten so out of control under Prime Minister Justin Trudeau’s regime that some Canadians have taken to crossing the border to purchase groceries in the US, arguing it’s a cheaper option.

Meanwhile in the US, as Americans also suffer exorbitant food costs, Biden Treasury Secretary and former Federal Reserve Chair Janet Yellen, a millionaire, claimed in a recent interview she hasn’t noticed “sticker shock” at the grocery store.

Inflation Keeps Coming in Waves, but Economist Can’t Even Get On Their Surfboards

by David Haggith

GoldSeek

Even with the Fed consistently warning that its inflation fight has quite a ways to go due to the prevailing forces pounding against it, many people in financial markets just don’t want to see it. Well, they can pound sand as the price waves keep knocking them down then.

Even with the Fed consistently warning that its inflation fight has quite a ways to go due to the prevailing forces pounding against it, many people in financial markets just don’t want to see it. Well, they can pound sand as the price waves keep knocking them down then.

Force Fed stays with the fight

Fed Governor Michelle Bowman said that an interest-rate hike will be on the table, as far as she is concerned, if inflation doesn’t start moving back downward again. The Fed is certainly nowhere near a point of lowering rates.

Trump Needs to Hammer This During the Debate

Inflation was at 1.4%

by Brian C. Joondeph

American Thinker

The first and perhaps only presidential debate between presumed nominees Donald Trump and Joe Biden takes place on June 27 in CNN’s Atlanta headquarters. Home court advantage goes to President Biden.

The first and perhaps only presidential debate between presumed nominees Donald Trump and Joe Biden takes place on June 27 in CNN’s Atlanta headquarters. Home court advantage goes to President Biden.

Is there anyone at CNN, aside from the janitors and cleaning crew, that support Trump? Doubtful. The debate will be moderated by the Trump hating undynamic duo of Jake Tapper and Dana Bash.

CNN will mute the microphones, to keep Trump from objecting to Biden’s fabrications, and likely to silence Biden’s gibberish, something occurring with increasing frequency.

No live audience will watch the debates, which will run 90 minutes, two commercial breaks, time for Biden to get a shot of vitamins, stimulants, or whatever keeps him awake and coherent for brief stretches of time.

Argentina Logs First Week with No Inflation in Food Prices in 30 Years

by Christian K. Caruzo

Breitbart.com

For the first time in 30 years, Argentina experienced a zero-percent increase in the inflation rates of food and drinks during the third week of June, President Javier Milei confirmed on Monday morning.

For the first time in 30 years, Argentina experienced a zero-percent increase in the inflation rates of food and drinks during the third week of June, President Javier Milei confirmed on Monday morning.

A study published on Sunday by Econométrica, a private Argentine consulting firm, first reported the no-inflation week. In its study, Econométrica analyzed 8,000 prices in local online supermarkets and found no change when compared to the preceding week — something that has not happened in Argentina in three decades. In addition to the lack of variation in prices in one week, the study found that the prices of food and drinks only experienced an increase of 0.1 percent in the past 15 days.

Is the Global Inflationary Depression Already Here?

from Zero Hedge

Authored by Peter St. Onge and Jeffrey A. Tucker via the Brownstone Institute,

There was an oblique message buried in a New York Times story on the growing crisis in commercial real estate in cities. Yes, this is exactly the kind of article that people pass over because it seems like it doesn’t have broad application. In fact, it does. It affects the core of issues like our city skylines, how we think about urbanism and progress, where we vacation and work, and whether the big cities are drivers or drains on national productivity.