from Schwab Network

Home Insurance Rates Continue to Surge, Media and Industry Blame ‘Climate Change’ Catastrophes

by Jack Hellner

American Thinker

Home insurance rates are continuing to skyrocket, to the point that many people no longer have good options on affordable coverage.

Home insurance rates are continuing to skyrocket, to the point that many people no longer have good options on affordable coverage.

And the cause? Well the media and the industry say it’s climate change. From NPR:

‘Everything is rising at a scary rate’: Why car and home insurance costs are surging

Last year, there were around two dozen severe storms in the U.S. with billion-dollar price tags, spreading lightning, hail and damaging winds through many parts of the country.

‘While a lot of these storms don’t make national headlines, they do tend to be very costly at the local level,’ says Tim Zawacki, principal research analyst for insurance at S&P Global Market Intelligence. ‘And the breadth of where these storms are occurring is something that I think the industry is quite concerned about.’

From Marketplace:

Is Hyper-Inflation That Destroys a Currency a “Solution”?

by Charles Hugh Smith

Of Two Minds

When predicting the future, we’re best served by following “what benefits the wealthy and powerful,” as that is the likeliest outcome.

When predicting the future, we’re best served by following “what benefits the wealthy and powerful,” as that is the likeliest outcome.

This contrarian sees a strong consensus around the notion that hyper-inflation is the inevitable end-game of nation-states / central banks issuing fiat currencies, i.e. currencies that are not restrained by being pegged to tangible assets such as gold reserves. The temptation to issue (via “printing” or borrowing new currency into existence by selling sovereign bonds) more currency becomes irresistible to politicians and central bankers alike. as the means to mollify every constituency, from elites to the military to commoners dependent on state-funded bread and circuses.

This unrestrained creation of new money far in excess of the expansion of goods and services (i.e. the real economy) devalues the currency, as “all the new money chases too few goods and services.” Gresham’s law kicks in–bad money drives good money out of circulation–as precious metals, fine art, gemstones, etc. are hoarded and the depreciating currency is spent as fast as possible before its purchasing power declines even further.

Gold Rises On Softer Dollar as Focus Shifts to U.S. Inflation Data

by Brijesh Patel

Yahoo! Finance

Spot gold was up 0.3% at $2,357.44 per ounce by 1:55 p.m. ET (1755 GMT). U.S. gold futures settled 0.9% higher at $2,356.5.

“The dollar index is down and we are seeing the yield curve rates drop a little bit. Gold is coming off a correction and is hovering around resistance levels and now it’s bouncing again,” said Bart Melek, head of commodity strategies at TD Securities.

U.S. Consumer Confidence Recovers; Inflation Worries Persist

by Lucia Mutikani

Reuters.com

WASHINGTON, May 28 (Reuters) – U.S. consumer confidence unexpectedly improved in May after deteriorating for three straight months amid optimism about the labor market, but worries about inflation persisted and many households expected higher interest rates over the next year.

WASHINGTON, May 28 (Reuters) – U.S. consumer confidence unexpectedly improved in May after deteriorating for three straight months amid optimism about the labor market, but worries about inflation persisted and many households expected higher interest rates over the next year.

The mixed survey from the Conference Board on Tuesday also showed more consumers believed that the economy could slip into recession in the next 12 months. Nonetheless, consumers were very upbeat about the stock market and more planned to buy major household appliances over the next six months.

While the economy is expected to slow this year as a result of the cumulative impact of 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022 to tame inflation, economists and most business executives are not forecasting a downturn.

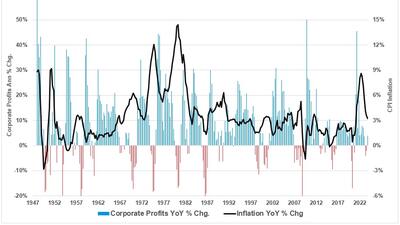

No, Corporate Greed is Not the Cause of Inflation

from Zero Hedge

Authored by Lance Roberts via RealInvestmentAdvice.com,

Corporate greed is not causing inflation, despite the claims of many on the political left who failed to understand the very basics of economic supply and demand.

“If you take a look at what people have, they have the money to spend. It angers them and angers me that you have to spend more. It’s like 20% less for the same price. That’s corporate greed. That’s corporate greed. And we have got to deal with it. And that’s what I’m working on.” – President Biden via CNN

Dem Rep. Jonathan Jackson: Can’t Cut Food Stamps Because Inflation’s So Bad, But That’s Supply, Not Biden

by Ian Hanchett

Breitbart.com

On Friday’s edition of Bloomberg’s “Balance of Power,” Rep. Jonathan Jackson (D-IL) argued against cuts to SNAP benefits because “people are aching” due to inflation, but argued that’s not Joe Biden’s fault and there were supply chain issues.

On Friday’s edition of Bloomberg’s “Balance of Power,” Rep. Jonathan Jackson (D-IL) argued against cuts to SNAP benefits because “people are aching” due to inflation, but argued that’s not Joe Biden’s fault and there were supply chain issues.

After discussing crop insurance, Jackson said, [relevant remarks begin around 1:05:50] “I’ve come to look at SNAP as food insurance and family insurance that the government uses. So, when people cannot do for themselves, I think the government should help them. When the people can do for themselves, the government needs to step back. Right now, people are aching. There’s been auto inflation, there’s been housing inflation, there’s education — if you will — the cost of education inflation. But this farm bill doesn’t even address the deal with food inflation. And so, to think that we could talk about taking $30 billion out of the budget to attack women and children, we’re going to take a stand and we’re not going to concede an inch.”

Services Inflation for Japanese Businesses Spikes by Most Since 1991, Bank of Japan Gets Lots of Rate-Hike Ammo

by Wolf Richter

Wolf Street

Huge month-to-month jumps for second month in a row as businesses jack up their prices for new fiscal year.

Huge month-to-month jumps for second month in a row as businesses jack up their prices for new fiscal year.

The producer price index for services that Japanese businesses buy jumped by 0.82% in April from March, after a similar jump in March from April, according to data from the Bank of Japan. On an annualized basis, both those jumps amounted to just over 10%.

In the data that exclude the consumption tax hikes in the past, the April spike boosted the year-over-year increase to 2.9%, the worst jump going back to 1991.

$15 Big Macs: As Inflation Drives Up Fast Food Prices, Map Shows How They Differ Nationwide

You’re probably paying about twice what you paid in 2014 for a standard fast-food combo meal. These maps and charts show how it looks at popular chains across the nation.

by James Powel and Sara Chernikoff

USA Today

Across the nation families looking for a quick option to feed the family have seen prices rise as inflation has taken a bite out of the fast-food experience.

Across the nation families looking for a quick option to feed the family have seen prices rise as inflation has taken a bite out of the fast-food experience.

The Bureau of Labor Statistics’ latest reading from the so-called fast-food index saw annual inflation for the sector come in at 4.8%.

The BLS also found that prices in “limited-service restaurants” increased by 47% since 2014.

Fast food has become a staple of the American diet meaning that price increases at the drive-thru can make a major impact.

Inflation to the Nines

by Peter C. Earle

The American Institute for Economic Research

Twice in the past few weeks President Joe Biden has claimed that when he took office in January 2021 inflation was “over nine percent.” First on CNN’s OutFront with Erin Burnett on May 8 and again on May 14 in a Yahoo! Finance interview, the bizarre comment was made. And as has become a routine with the gaffe-prone chief executive, White House staffers added shamelessness to what could have been limited to embarrassment by issuing a statement: “The President was making the point that the factors that caused inflation were in place when he took office. The pandemic caused inflation around the world by disrupting our economy and breaking our supply chains.”

Americans will have to decide for themselves if the claim made by Biden was a lie intended to mislead anyone not familiar with the trajectory of prices over the past several years, or an innocent error. It is a choice US citizens have been confronted with frequently, in particular where assertions regarding the health of the economy have been made.

Inflation is Already Soaking the Rich 1%, New Research Shows

by Simon Constable

Forbes

![]() The recent inflationary surge is squeezing households, but not likely in the way you think. It’s hitting the wealthy disproportionately, new research shows.

The recent inflationary surge is squeezing households, but not likely in the way you think. It’s hitting the wealthy disproportionately, new research shows.

Inflation peaked at 9.1% in June 2022, and has recently dropped to 3.4% in April, according to data collated by TradingEconomics. However, the inflation rate is still way higher than it was in the five years through 2020 when the Consumer Price index grew at a rate that hovered around 2% and sometimes went negative.

In many ways that stability was good for the economy. But the jump in inflation after the pandemic has hit everyone in the wallet, experts say. However, it’s also true some groups got hit harder than others.