from Fox Business

Inflation and Insolvency Causing Interest Rates to Rise

by Michael Pento

FX Street

US corporations’ hiring plans last year totaled 769,953 workers, the fewest since 2015, according to the labor research firm Challenger, Grey, and Christmas. Private sector data shows that the need to hire new employees for all of last year was the lowest in nearly a decade. The ADP report showed that there were just 122k jobs created in December. We also have the private data from the Institute of Supply Management. The ISM manufacturing survey showed the employment subcomponent was 45.3, which means employment is in contraction and contracting faster. Also, the ISM service sector survey showed that job growth was barely in expansion territory at 51.4.

US corporations’ hiring plans last year totaled 769,953 workers, the fewest since 2015, according to the labor research firm Challenger, Grey, and Christmas. Private sector data shows that the need to hire new employees for all of last year was the lowest in nearly a decade. The ADP report showed that there were just 122k jobs created in December. We also have the private data from the Institute of Supply Management. The ISM manufacturing survey showed the employment subcomponent was 45.3, which means employment is in contraction and contracting faster. Also, the ISM service sector survey showed that job growth was barely in expansion territory at 51.4.

But then we have the official government information coming from the Labor Department. Initial jobless claims and the monthly Non-farm Payroll report have been remarkable pieces of misdirection and fiction. The benign initial claims figures could result from fewer people being hired, so fewer people are eligible to file unemployment insurance claims. However, what is the excuse behind the constant need to adjust the initial NFP report number lower, which will surely be the case once again for the December figure?

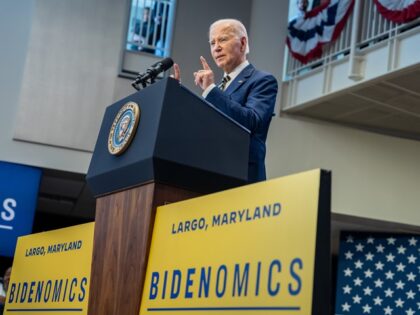

Biden: I Ignored Summers’ Inflation Warnings ‘to Instill Some Confidence’ in People, Deal with COVID

by Ian Hanchett

Breitbart.com

During an interview with MSNBC aired on Thursday’s broadcast of “The Last Word,” President Joe Biden stated that he decided to proceed with massive stimulus spending despite warnings that it would create inflation by people like Harvard Professor Larry Summers because “I looked at the practical need for us to instill some confidence in the American people that we can grow this economy.” And argued that it made sense to spend to take care of the coronavirus pandemic.

During an interview with MSNBC aired on Thursday’s broadcast of “The Last Word,” President Joe Biden stated that he decided to proceed with massive stimulus spending despite warnings that it would create inflation by people like Harvard Professor Larry Summers because “I looked at the practical need for us to instill some confidence in the American people that we can grow this economy.” And argued that it made sense to spend to take care of the coronavirus pandemic.

Host Lawrence O’Donnell asked, [relevant exchange begins around 26:55] “I want to bring this down to something about your presidential decision-making in that entire range of domestic policy decisions, of which there were so many. And I’m particularly interested in Joe Biden versus Larry Summers.

ECB Faces a Problem: Euro Area Services Inflation Stuck at 4.0% for 13th Month. CPI Accelerates Further, as Energy & Durable Goods Stopped Plunging

by Wolf Richter

Wolf Street

Inflation far from over. ECB risks throwing fuel on top of it.

Inflation far from over. ECB risks throwing fuel on top of it.

Services inflation in the 20 countries that use the euro accelerated to +4.0% in December, according to Eurostat today. This marks the 13th month in a row that the services CPI has been in the 4.0% range, roughly two to four times what prevailed before the pandemic (between +1% and +2%), and two full percentage points above the peaks before the pandemic and not making any progress at all (red in the chart below).

On Joe Biden’s Last Day, the U.S. is Dangerously Close to the Point of No Return [Podcast]

by James Hickman

Schiff Sovereign

It’s hilarious how Joe Biden spent his entire four year administration using tech companies to suppress dissent and censor critics. He now claims those same tech companies are a threat to democracy.

It’s hilarious how Joe Biden spent his entire four year administration using tech companies to suppress dissent and censor critics. He now claims those same tech companies are a threat to democracy.

He just awarded the Presidential Medal of Freedom to billionaire George Soros, who notoriously uses his money to meddle in elections and fund ultra-woke leftist politicians. But billionaires who fund causes on the right are… a threat to democracy.

Biden further believes that he is not responsible for any of the inflation of his tenure, and he expresses no concern about his massive deficit spending and debt accumulation.

Javier Milei Slashes Argentina’s Inflation in Just One Year

Austerity measures and bold economic reforms led to the country’s lowest inflation rate in over four years.

by Katarina Hall

Reason.com

Argentina’s annual inflation rate fell to 117.8 percent in 2024, marking a significant drop of 93.6 points compared to the record 211.4 percent inflation rate of 2023. The sharp decline signals a significant turnaround for Argentina’s economy under President Javier Milei.

Argentina’s annual inflation rate fell to 117.8 percent in 2024, marking a significant drop of 93.6 points compared to the record 211.4 percent inflation rate of 2023. The sharp decline signals a significant turnaround for Argentina’s economy under President Javier Milei.

In December 2024, inflation stood at 2.7 percent, Argentina’s National Institute of Statistics and Census (INDEC) claimed in a new report. While slightly higher than the record low of 2.4 percent in November, Economy Minister Luis Caputo attributed the uptick to “seasonal factors” tied to the holiday season and the start of summer vacations.

Despite the minor increase, December marked the third consecutive month in which prices rose by less than 3 percent. The data “confirms the disinflation process is continuing,” Caputo posted on X following the report’s release.

Inflation: What’s Your Number?

Chris and Paul discuss inflation as a government policy issue, and its impact on purchasing power and retirement.

by Dr. Chris Martenson

Chris Martenson’s Peak Prosperity

For the past 17 years, I’ve been running all over the place educating and warning everyone I could about inflation. Inflation is 100% the product of official policy. Heck, the Fed even has a minimum target for inflation, although they’ve never explained to anyone why they have any target at all let alone the specific rate of 2%.

For the past 17 years, I’ve been running all over the place educating and warning everyone I could about inflation. Inflation is 100% the product of official policy. Heck, the Fed even has a minimum target for inflation, although they’ve never explained to anyone why they have any target at all let alone the specific rate of 2%.

Over the past 5 years, cumulative inflation is an eye-watering (because we’re all crying) 26.4%, which means if you were earning $100k in 2020 and are still earning $100k, you’ve experienced a $26,400 pay cut. Looked at another way, your taxes went by $26,400 because inflation is, indeed a tax. It operates exactly and precisely the same way as a tax.

In a proper tax regime, the government tells you how much it’s going to take, it takes it, and then spends it. In the illegitimate, and thoroughly immoral inflation-as-a-tacx regime, the government spends the money first, and then you pay for it with your money losing value.

White House: We Didn’t Get Inflation Spike with First Trump Tariffs, But ’25 Different from ’17

by Ian Hanchett

Breitbart.com

During an interview with Bloomberg aired on Thursday’s “Balance of Power,” White House Council of Economic Advisers Chair Jared Bernstein acknowledged that there wasn’t an inflation spike caused by tariffs in the first Trump administration, but argued that things in 2025 are much different from where they were in 2017.

During an interview with Bloomberg aired on Thursday’s “Balance of Power,” White House Council of Economic Advisers Chair Jared Bernstein acknowledged that there wasn’t an inflation spike caused by tariffs in the first Trump administration, but argued that things in 2025 are much different from where they were in 2017.

Bernstein said, “I want to give this incoming team the benefit of the doubt. I know some of these folks, they’re good economists, they don’t want to generate higher inflation or higher interest rates, but if you do look at the impact of, say, sweeping tariffs or deportations or fiscal stimulus through unnecessary high-end tax cuts, really also hurting the economy’s fiscal outlook, all of those, of course, are inflationary, and then, if you add in compromising Fed independence, you’ve got a real problem on your hands. I don’t think they want to go there.”

Surprise! Inflation is Not Getting Better

by Jay Davidson

American Thinker

Directors of the Federal Reserve board are admitting that inflation is not coming down, in spite of the massive increase in Fed Fund interest rates two years ago. That rate increase was touted as the solution to Jerome Powell’s “transitory” inflation. I said it wouldn’t work then, and it hasn’t.

Directors of the Federal Reserve board are admitting that inflation is not coming down, in spite of the massive increase in Fed Fund interest rates two years ago. That rate increase was touted as the solution to Jerome Powell’s “transitory” inflation. I said it wouldn’t work then, and it hasn’t.

Lisa D. Cook, a member of the Fed’s board of governors, said during a recent speech that the labor market has been “somewhat more resilient” since September while inflation has remained “stickier” than expected. “I think we can afford to proceed more cautiously with further cuts.”

Of course inflation is “sticky” — the Fed is not addressing inflation. The Fed caused it.

The solution to persistent inflation centers on the reason for inflation in the first place: excessive money supply. This bout of inflation started in 2008, when the Federal Reserve started printing money, thinking it would stimulate the economy.

Why Banks in the U.S. Are Quietly Panicking

by James Hickman

Schiff Sovereign

Bank of America released its quarterly earnings report this morning, bright and early at 6:45am. And according to their newest financial statements, the bank is currently sitting on a whopping $112 BILLION in net unrealized bond losses.

Bank of America released its quarterly earnings report this morning, bright and early at 6:45am. And according to their newest financial statements, the bank is currently sitting on a whopping $112 BILLION in net unrealized bond losses.

To say this is atrocious would be a massive understatement. Yet Bank of America had the audacity to say that their “balance sheet remained strong” throughout 2024.

What a hilarious fiction. Do they seriously think that no one will notice $112 billion in bond losses— nearly FIFTY SEVEN PERCENT of the bank’s tangible common equity? How stupid do they think people are?

The Fed Needs to Watch Out: Amid Strong Demand From Our Drunken Sailors, Retail Sales Surged in Late 2024 and Inflation Caught Its Second Wind

by Wolf Richter

Wolf Street

More consumers, more workers, more jobs, more money. GDPNow jumps upon these retail sales.

More consumers, more workers, more jobs, more money. GDPNow jumps upon these retail sales.

Retail sales rose by 0.45% in December from November (+5.5% annualized), and November and October were revised higher – October from +0.46% to +0.56%, and November from +0.69% to +0.77% – and it’s on top of these upwardly revised sales that December sales grew by another 0.45%, all seasonally adjusted.

The slow first half was followed by a blistering acceleration in the second half, particularly over the past four months.