from talkdigitalnetwork

Most Fed Officials Were Worried About Higher Inflation, but Not Enough to Put Rate Hikes On the Table, Minutes of December Meeting Show

Almost all officials saw chance that inflation would stay higher than desired, in part due to Trump policy plans

by Greg Robb

Market Watch

“Almost all” Fed officials judged that the upside risks to inflation had increased, the minutes said.

This was due, in part, to potential changes in trade and immigration policy under consideration by the incoming Trump administration.

All of this led to a careful and cautious approach — but not hikes.

If inflation remained elevated, many Fed officials said the central bank could hold the policy rate steady or ease more slowly. There was no mention of rate hikes.

Inflation Expectations Will Keep Rising in 2025, and it Matters Most in Japan

from Zero Hedge

By Dhaval Joshi, chief strategist at BCA Research

Executive Summary

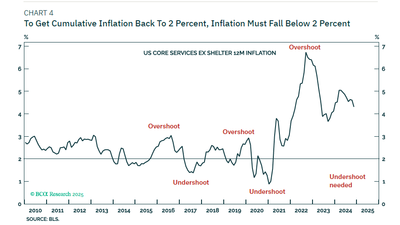

- In the developed economies excluding Japan, rising inflation expectations will lift them further above the 2 percent target. This will limit the scope for further interest rate cuts.

- But in Japan, rising inflation expectations will lift them up to the BoJ’s 2 percent target. This will remove the BoJ’s justification for its decades-long zero interest rate policy (ZIRP).

- The normalisation of Japan’s monetary policy poses a big risk to stocks because Japan has been the main source of financial market liquidity, and thereby, of rising stock market valuations.

- Hence, the biggest risk to US tech valuations comes from a rise in the Japanese real bond yield.

- On a structural (1-2 year) time horizon though, it is highly likely that Japanese real yields will rise, causing a meaningful setback in stocks versus bonds, and especially the US superstar stocks.

- But from a timing perspective, wait until the complexities of the price trends in USD/JPY and/or Nasdaq versus 30-year T-bond have reached the point of collapse that signalled previous reversals at the end of 2023 and the summer of 2024. You can monitor these indicators on our website.

- Go tactically long copper.

2024’s political Zeitgeist was encapsulated in what I have called the ‘3 I’s’: Incumbents punished for Inflation and Immigration.

Gold Gains as Traders Seek Haven Amid Tariff, Inflation Worries

by Yvonne Yue Li

BNN Bloomberg

(Bloomberg) — Gold advanced as traders sought safety in the precious metal amid concerns over tariffs and inflation, even as a strong US jobs report supported the case for a pause in Federal Reserve interest-rate cuts.

(Bloomberg) — Gold advanced as traders sought safety in the precious metal amid concerns over tariffs and inflation, even as a strong US jobs report supported the case for a pause in Federal Reserve interest-rate cuts.

US hiring accelerated in December and the unemployment rate unexpectedly fell, capping another year of resilience in the jobs market, a Bureau of Labor Statistics report showed Friday. The print reaffirmed policymakers’ view that the US central bank will adopt a more cautious approach to lower borrowing costs amid a still-healthy labor market and sticky inflation.

Swap traders have now shifted their expectations for the Fed’s next rate cut to the second half of the year, and 30-year Treasury yield rose above 5% for the first time for the first time in more than a year.

Vast Devaluation of Dollar Coming in 2025 – Craig Hemke

by Greg Hunter

USA Watchdog

Financial writer, market analyst and precious metals expert Craig Hemke predicted at the beginning of 2024 that the US National Debt would tack on another $2 trillion to the $34 trillion that was already there. The federal debt now stands at $36.3 trillion. Hemke was correct, and now he’s back with his 2025 predictions. Let’s start with where interest rates, they have already gone up dramatically in the last year. Hemke says, “If the economy really is sliding into recession, and they can’t get the budget under control, because of the liquidity that is going to be needed to control interest rates, the fed will be talking openly about yield curve control.”

Financial writer, market analyst and precious metals expert Craig Hemke predicted at the beginning of 2024 that the US National Debt would tack on another $2 trillion to the $34 trillion that was already there. The federal debt now stands at $36.3 trillion. Hemke was correct, and now he’s back with his 2025 predictions. Let’s start with where interest rates, they have already gone up dramatically in the last year. Hemke says, “If the economy really is sliding into recession, and they can’t get the budget under control, because of the liquidity that is going to be needed to control interest rates, the fed will be talking openly about yield curve control.”

Isn’t “yield curve control” just another term for printing massive amounts of money to buy the debt? Hemke says, “Yes, exactly. The money has to come from somewhere, right? If they are buying government debt because that’s what they are doing. They are the buyer of last resort to keep those yields down. So, where’s the money coming from? They are the ones creating it. This is a vast devaluation of the currency (US dollar). This is money creation, dollar creation that gets flushed into the economy . . . . This is just like what happened after covid. It continues this inflation against the little guy, you and me and everybody else that has to take their dollars and go buy things. This is where it becomes an untenable situation.”

UMich Inflation Expectations Soar to Highest Since 2008 as Democrats Confidence Slumps

from Zero Hedge

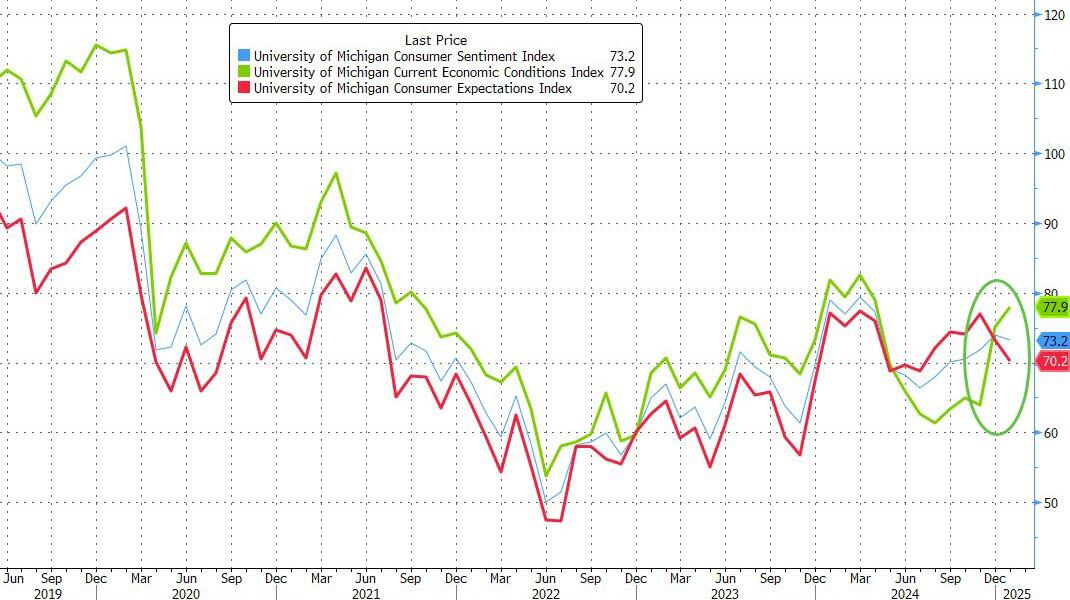

After ‘current conditions’ surged higher in December – on Trump optimism – analysts expected confidence to remain high in preliminary January sentiment data from UMich.

But the data was mixed with Current Conditions soaring further (highest since April) while expectations dropped (lowest since July), dragging the headline down modestly…

[…] Democrats continue to get more depressed as Republicans’ sentiment continues to rise…

[…] Most problematically, inflation expectations soared with the 5-10Y horizon surging to its highest since 2008…

Cracks Emerge in the Fed’s Rate Cut Consensus

by John Carney

Breitbart.com

The End of the Cutting Cycle?

The End of the Cutting Cycle?

It is not just the bond market that is having doubts about the stance of monetary policy. Federal Reserve officials are also seeing the light.

After lopping off a full percentage point from rates since September, at least some officials at the Fed appear to be questioning whether further easing is warranted. Judging by recent remarks and the latest minutes from their December Federal Open Market Committee (FOMC) meeting, the answer appears to be migrating toward a firm no.

Minutes from the December meeting, released Wednesday, reveal that at least some Fed officials are increasingly worried about inflation risks. “Almost all” officials noted that upside risks to inflation had grown—an acknowledgment that the Fed may have overdone it with rate cuts in an economy still posting respectable growth. Yet despite this newfound caution, the minutes show no appetite for reversing course toward rate hikes. Instead, the message was one of careful watchfulness and, perhaps, quiet regret.

U.S. Maintains Growth Momentum with Warning Signs of Inflation

by James Knightley

ING

Markets have been re-pricing the prospect of Federal Reserve rate cuts this year in the wake of more hawkish Fed commentary. Today’s data suggests that the economy is maintaining its strong momentum and that inflation continues to be sticky with concern over tariff implementation starting to impact corporate thinking and behaviour.

Markets have been re-pricing the prospect of Federal Reserve rate cuts this year in the wake of more hawkish Fed commentary. Today’s data suggests that the economy is maintaining its strong momentum and that inflation continues to be sticky with concern over tariff implementation starting to impact corporate thinking and behaviour.

Election clarity is helping to lift activity

We have been suggesting that that the clarity provided by the clean election outcome would lead companies that delayed investment and hiring on election/regulatory uncertainty to start putting money to work. That is seemingly the case based on the latest ISM purchasing managers’ indices. Last week’s manufacturing showed both output and news posting decent gains and today’s services ISM index has also come in stronger than expected with the headline reading rising to 54.1 from 52.1, above the 53.5 consensus.

Gold and Silver Firm On Futures’ Demand

by Alasdair MacLeod

Gold Money

In a shortened trading week, and against a global background of rising bond yields gold and silver have continued to edge higher. This is an important change in investment thinking.

In a shortened trading week, and against a global background of rising bond yields gold and silver have continued to edge higher. This is an important change in investment thinking.

Gold rose by $32 on the week to $2670, while silver rose by 21 cents to $30.12 on futures buying. Gold’s Open Interest rose by about 15,000 contracts while silver’s OI was marginally higher. Gold’s performance is remarkable in that it has been rising while global bond yields have also risen. Clearly, there is a shift in thinking taking place.

We are at an interesting juncture in credit markets, with a growing realisation that dollar interest rates are unlikely to fall much, if at all, and that they might even rise instead by the end of 2025. This logic comes with an appreciation that inflation under Trump’s avowed policies will continue to rise, or more accurately described, the purchasing power of the dollar will continue to decline.

The interest rate cat has been let out of the bag with dire consequences.

Will 2025 Be the Year of U.S. Fiscal Sanity?

With inflation risks persisting and entitlement spending surging, the situation cannot be ignored. But we never should have gotten to this point to begin with.

by Veronique de Rugy

Reason.com

The arrival of a new presidential administration invokes new beginnings and a break from the past. Still, realities from previous administrations remain, such as a fiscal challenge that demands immediate attention. It may weigh on the newcomers even more than they realize today. We can only hope they take it more seriously than their predecessors have done.

The arrival of a new presidential administration invokes new beginnings and a break from the past. Still, realities from previous administrations remain, such as a fiscal challenge that demands immediate attention. It may weigh on the newcomers even more than they realize today. We can only hope they take it more seriously than their predecessors have done.

The longstanding notion that debt accumulation is benign, based largely on interest rates that for a time fell below growth rates, has proven dangerously misleading. This flawed thinking ignored both human nature and economic reality: Politicians rarely limit borrowing to one-time emergencies (as the theory requires), and interest rates inevitably rise. Today, we face the consequences of these miscalculations.

Fed Favoring Slower Rate Cuts, Predicts Inflation to Run Higher

by Jennifer Schonberger

Yahoo! Finance

![]() The Federal Reserve’s December meeting minutes show officials believe inflation can take longer than anticipated to reach the 2% goal, citing risks from trade and immigration policies.

The Federal Reserve’s December meeting minutes show officials believe inflation can take longer than anticipated to reach the 2% goal, citing risks from trade and immigration policies.

Yahoo Finance senior Fed reporter Jennifer Schonberger joins Market Domination to discuss the central bank officials’ preference toward keeping interest rates higher for longer or possibly slowing down their pace of rate cuts if elevated inflation persists.

In the video above, Schonberger joins Josh Lipton and Julie Hyman to also uncover then tensions between President-elect Donald Trump and the Fed — namely chair Jerome Powell — over interest rates.