from Gregory Mannarino

Trump Claims Fed Chair Jerome Powell Was Too Busy with DEI and Climate Change to Tackle Inflation

The Federal Reserve left interest rates unchanged Wednesday, despite the new president’s demands for lower rates

by William Gavin

Quartz

President Donald Trump is renewing his old attacks on the Federal Reserve and its chair, Jerome Powell, after the independent body voted to hold interest rates steady in its first rate decision of the year.

President Donald Trump is renewing his old attacks on the Federal Reserve and its chair, Jerome Powell, after the independent body voted to hold interest rates steady in its first rate decision of the year.

“Because Jay Powell and the Fed failed to stop the problem they created with Inflation, I will do it,” Trump wrote on his Truth Social, by slashing regulations, pushing for more energy production, “rebalancing international trade,” and growing domestic manufacturing.

“If the Fed had spent less time on [diversity, equity, and inclusion], gender ideology, ‘green’ energy, and fake climate change, Inflation would never have been a problem,” Trump added. “Instead, we suffered from the worst Inflation in the History of our Country!”

Navigating the Challenges of Inflation in Urban Development Projects

Explore strategies for urban planners to manage and mitigate the impact of inflation on city development projects.

by Devin Partida

Planetizen

Rising costs in urban development are becoming a significant challenge due to inflation, global supply chain disruptions and increasing demand for raw materials. From skyrocketing fuel prices to rising labor expenses, these economic factors put immense pressure on budgets and timelines.

Rising costs in urban development are becoming a significant challenge due to inflation, global supply chain disruptions and increasing demand for raw materials. From skyrocketing fuel prices to rising labor expenses, these economic factors put immense pressure on budgets and timelines.

For urban planners, addressing these challenges safeguards the viability of projects that directly impact communities. Without proactive strategies, delays, budget overruns or cancellations can derail critical initiatives and leave cities struggling to meet growing demands. Understanding the root causes and taking strategic action keeps projects on track while ensuring long-term benefits.

The impact of rising costs on urban development

Inflation directly drives up material, labor and operational costs, creating significant challenges for development projects.

U.S. Inflation (PCE) Data Due Friday – Here Are the Critical Ranges to Watch

The ranges of estimates & how unexpected US data results can significantly impact markets

by Eamonn Sheridan

Forex Live

Due on Friday at 0830 US Eastern time (0130 GMT), the Core PCE data is the focus. The Personal Consumption Expenditures (PCE) data is a key measure of inflation that tracks changes in the prices of goods and services purchased by consumers. It is reported monthly by the Bureau of Economic Analysis (BEA) and is a critical tool used by the Federal Reserve to assess inflation and guide monetary policy.

Due on Friday at 0830 US Eastern time (0130 GMT), the Core PCE data is the focus. The Personal Consumption Expenditures (PCE) data is a key measure of inflation that tracks changes in the prices of goods and services purchased by consumers. It is reported monthly by the Bureau of Economic Analysis (BEA) and is a critical tool used by the Federal Reserve to assess inflation and guide monetary policy.

There are two main types of PCE data:

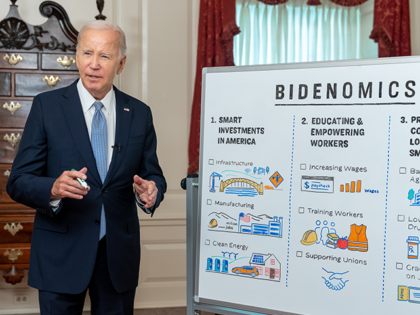

Wasserman Schultz: Trump Hasn’t Brought Down Prices From ‘Strongest Economy’ in the World Biden Gave Him

[Ed. Note: No comment on why this ‘strongest economy’ has a record number of people on food stamps.]

by Ian Hanchett

Breitbart.com

On Wednesday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Debbie Wasserman Schultz (D-FL) stated that President Donald Trump hasn’t brought down costs after “Joe Biden handed Donald Trump the strongest economy in the entire world.” And is undoing work “to make sure that the climate change that is crushing economies across the country is going to start to help improve.”

On Wednesday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Debbie Wasserman Schultz (D-FL) stated that President Donald Trump hasn’t brought down costs after “Joe Biden handed Donald Trump the strongest economy in the entire world.” And is undoing work “to make sure that the climate change that is crushing economies across the country is going to start to help improve.”

Wasserman Schultz said, “Joe Biden handed Donald Trump the strongest economy in the entire world. He is the only president in modern times that had positive job numbers in every single year he was president. We passed the CHIPS and Science Act and brought chip manufacturing back to this country. We passed the Infrastructure Investment and Jobs Act and made trillions of dollars of investment, that, right now, is what Donald Trump is planning to freeze, which is going devastate our economy, which is going to cancel people’s jobs.”

U.S. Core Inflation Edges Up Amid Volatile Food Prices

by Owen Fairclough

CGTN

The U.S. central bank hit the pause button on its interest rate cuts on Wednesday, Jan. 29, amid concerns inflation is rising again in parts of the economy.

The U.S. central bank hit the pause button on its interest rate cuts on Wednesday, Jan. 29, amid concerns inflation is rising again in parts of the economy.

The Federal Reserve had been cutting the benchmark rate it raised to drive down price surges driven by the COVID-19 pandemic. And if that pause is tough for consumers and businesses, it also puts the Fed on a collision course with President Donald Trump. Owen Fairclough reports.

Trump Slams Hawkish Fed for ‘Failing to Stop the Problem They Created’

from Zero Hedge

Update (1620ET): Quite frankly we are surprised it took this long for President Trump to respond to The Fed’s inaction today.

In a statement on his Truth Social account, Trump wrote:

“Because Jay Powell and the Fed failed to stop the problem they created with Inflation, I will do it by unleashing American Energy production, slashing Regulation, rebalancing International Trade, and reigniting American Manufacturing…

…but I will do much more than stopping Inflation, I will make our Country financially, and otherwise, powerful again!

Carney On Kudlow: Budget Cutting, Reducing Government Size ‘Profoundly Anti-Inflationary’

by Pam Key

Breitbart.com

Breitbart News economics editor John Carney said Tuesday on Fox Business Network’s “Kudlow” that the Trump administration’s plan to reduce the size of the federal government will be “profoundly anti-inflationary.”

Breitbart News economics editor John Carney said Tuesday on Fox Business Network’s “Kudlow” that the Trump administration’s plan to reduce the size of the federal government will be “profoundly anti-inflationary.”

Host Larry Kudlow said, “I mean, over 50,000 federal jobs, John, and I want to add to that the impoundment issue. I know that official Washington swampland doesn’t like impoundment. The fact is, American presidents had it for over 200 years until a far-left Congress took it away from Richard Nixon, you know, during his worst moments in 1974. But budget-cutting, employment rifts, and impoundment- now that is going to be tough stuff.

Carney said, “It is a profoundly anti-inflationary.”

Kudlow said, “There you go.”

Expect Another Round of High Inflation to Be Unleashed in 2025

from King World News

As we come to the end of trading in the first month of 2025, expect another round of high inflation to be unleashed this year.

As we come to the end of trading in the first month of 2025, expect another round of high inflation to be unleashed this year.

January 29 (King World News) – Gregory Mannarino, writing for the Trends Journal: The backbone of the entire world financial and economic system is being manipulated in a highly destructive and deceptive way. I am referring to central bank issued notes, and over 90 percent of the world population has no idea that it is happening.

My number one call for 2025 was currency devaluation, and devaluation via two specific mechanisms.

Powell: In “No Hurry” to Cut, Need to See “Further Progress” On Inflation, No Timeline to End QT (Not Even Close)

by Wolf Richter

Wolf Street

“Companies figured out they do like to raise prices. But we also hear a lot from companies these days that consumers have really had it with price increases.”

“Companies figured out they do like to raise prices. But we also hear a lot from companies these days that consumers have really had it with price increases.”

At the press conference following the meeting when the Fed pivoted to wait-and-see, Powell was asked multiple times from various angles about future rate cuts. In responding, and even on his own when not responding, Powell mentioned five times some version of “we do not need to be in a hurry” to cut, and eight times a version of “we need to see further progress” on inflation before cutting further.

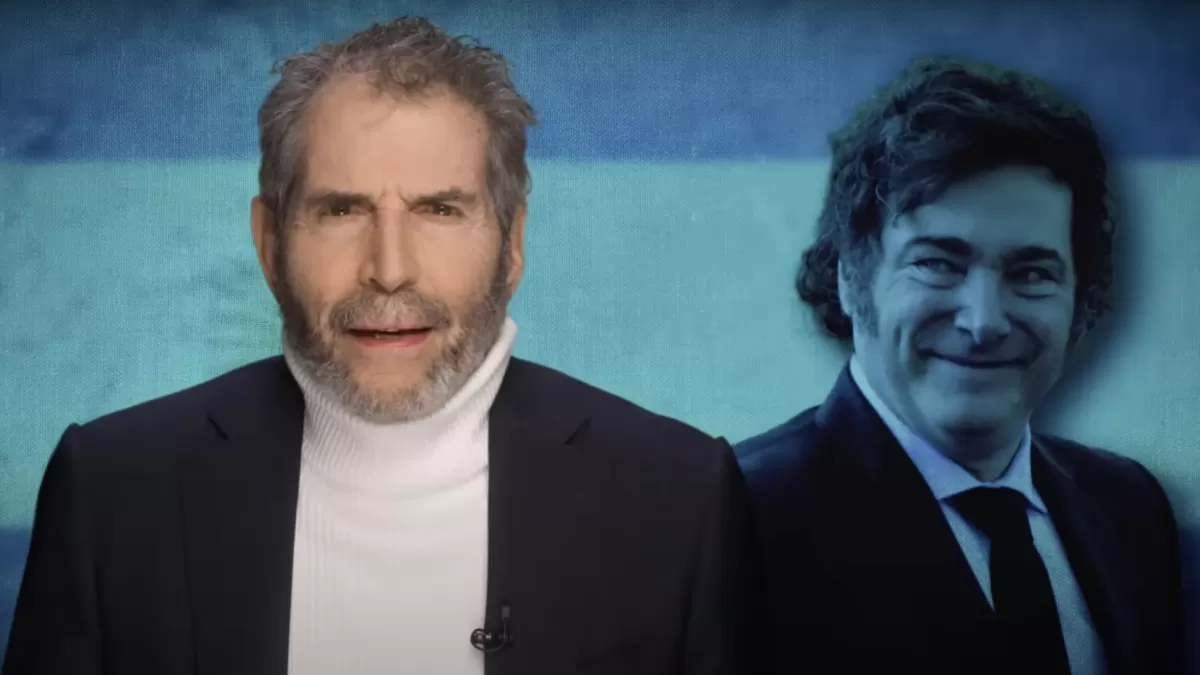

Javier Milei Promised to Take a ‘Chainsaw’ to Argentina’s Government. It’s Working.

Inflation and rent prices are down, and the country has a budget surplus.

by John Stossel

Reason.com

Finally, a real libertarian is president.

Finally, a real libertarian is president.

That’s in Argentina, where last year, Javier Milei surprised pundits by winning the election by a landslide. Now that he’s had a chance to govern, my new video covers the results and explains why Milei is now even more popular.

Argentina was once one of the richest countries in the world. Then, years of big government brought high inflation and poverty. By last year, Argentina was one of the poorest and least free countries in the world.

Then Milei, an economist, ran for office, saying things like, “The state is not the solution. The state is the problem!”

The media called him “radical” and “far-right.”