from Palisades Gold Radio

Like Biden, Trump Does Not Control the Price of Eggs

Though he promised to lower costs on Day 1, Trump remains just as beholden to the laws of supply and demand as his predecessor.

by Joe Lancaster

Reason.com

When President Donald Trump won a second term in November, the economy topped most voters’ concerns. Many felt the pain of higher prices, and they voted with their wallets.

When President Donald Trump won a second term in November, the economy topped most voters’ concerns. Many felt the pain of higher prices, and they voted with their wallets.

Trump talked repeatedly about runaway grocery prices during the campaign, pledging that if elected, paying over $4 for a carton of eggs would be a thing of the past. “When I win, I will immediately bring prices down, starting on Day 1,” he pledged.

But after winning reelection, Trump shrugged that it would be “hard” to bring grocery prices down “once they’re up.” Now, just days into his new administration, egg prices remain high and are likely to go higher. As it turns out, anyone who cast their vote thinking the president could unilaterally change grocery prices was buying into a fantasy.

JD Vance Finally Admits What Trump’s Big Plan to Lower Food Prices Is

The plan is no plan.

by Ellie Quinlan Houghtaling

The New Republic

Vice President JD Vance wants you to believe that Donald Trump will bring down grocery prices, even if he can’t spell out the nitty gritty of how it’s going to be accomplished.

Vice President JD Vance wants you to believe that Donald Trump will bring down grocery prices, even if he can’t spell out the nitty gritty of how it’s going to be accomplished.

Speaking with CBS’s Margaret Brennan on Sunday, the vice president insisted that the price of food would come down—but couldn’t muster up any details on exactly how or when that would happen.

“You campaigned on lowering prices for consumers. We’ve seen all these executive orders. Which one lowers prices?” asked Brennan.

What to Expect From Friday’s Report On Inflation

Inflation likely accelerated in December, putting pressure on the Federal Reserve to keep interest rates relatively high.

by Diccon Hyatt

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2195557704-b7b040b4cfd842579bb93e12e1921618.jpg) The Federal Reserve’s preferred measure of inflation likely accelerated in December, keeping the possibility of lower interest rates off the table for the time being.

The Federal Reserve’s preferred measure of inflation likely accelerated in December, keeping the possibility of lower interest rates off the table for the time being.

A Bureau of Economic Analysis report due Wednesday is expected to show consumer prices rose 2.6% over the past year in December, as measured by Personal Consumption Expenditures, according to a survey of forecasters by Dow Jones Newswires and The Wall Street Journal. That would be the third increase in as many months, up from 2.4% in November to the fastest annual pace since May.

Down the Rabbit Hole; The Age of Inflation On Demand

by Gary Tanashian

Kitco

[…] Let’s take a look at the 30yr Treasury yield Continuum from another angle by way of a chart I just found in my list that we used back in those critical days of early 2020 in gauging the coming inflationary recovery (and future inflation problem). I’ve marked it up further today in an effort to tell a story.

[…] Let’s take a look at the 30yr Treasury yield Continuum from another angle by way of a chart I just found in my list that we used back in those critical days of early 2020 in gauging the coming inflationary recovery (and future inflation problem). I’ve marked it up further today in an effort to tell a story.

My general view of this story is that what people call the “Everything bubble” is actually a long-term bubble in monetary policymaking (you can always count on government from either side of the aisle to auto-stimulate through fiscal policies) that has been periodically interrupted by bubble bursts, liquidity events and inflationary recoveries as our policy heroes swing into action. This continuum of invasive policy is ongoing, but in 2022, after the latest and most extreme policy kick-save ever, the bond market rebelled, and today the trend is gone. Poof!

GBP/USD Lower, Food Inflation Jumps

by Kenny Fisher

Market Pulse

The British pound has reversed directions on Tuesday and is considerably lower. In the North American session, GBP/USD is trading at 1.2436, down 0.48% on the day.

The British pound has reversed directions on Tuesday and is considerably lower. In the North American session, GBP/USD is trading at 1.2436, down 0.48% on the day.

UK food inflation hits 9-month high

The Bank of England has waged a tough war with inflation and managed to push inflation below its 2% target last September, when CPI eased to 1.7%. Since then, inflation has pushed higher and is currently running at 2.5%. The British Retail Consortium price index indicated that food prices jumped 0.5% m/m in January and 1.6% higher than a year earlier.

Democrats Finally Acknowledge Inflation, and Already Blame Trump

by John Carney

Breitbart.com

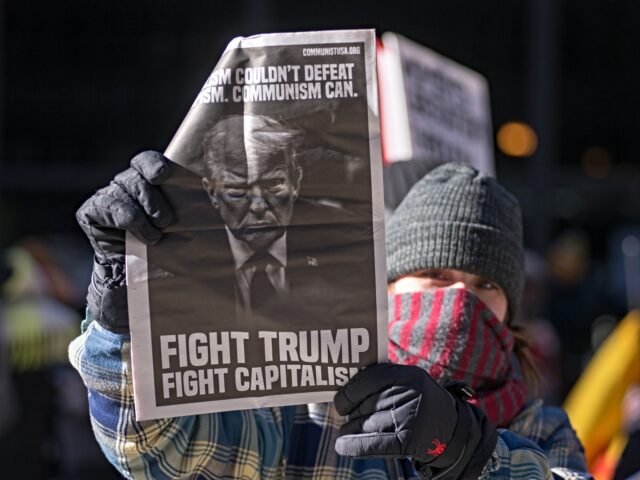

After four years of gaslighting the American people that inflation was transitory or non-existent, and just days after assuming office, the Democrat Party is blaming inflation on President Donald Trump.

After four years of gaslighting the American people that inflation was transitory or non-existent, and just days after assuming office, the Democrat Party is blaming inflation on President Donald Trump.

“Democrats slam Trump for not making good on promise to ‘immediately’ lower food prices,” reads the headline from far-left NBC News.

Some 20 Democrats, including Sen. Elizabeth Warren (D-Not Cherokee), sent Trump a letter on his sixth day in office attacking him over inflation:

Trump made inflation and the cost of food a hallmark of his run for a second presidential term, displaying everything from a teeny box of Tic Tacs at a rally in North Carolina to entire tables full of groceries outside his Bedminster, New Jersey, golf club to express his commitment to lowering voters’ grocery bills.

Trump Says Inflation Isn’t His No. 1 Issue. So What Will Happen to Consumer Prices?

Inflation was a driving force behind Donald Trump’s election victory, but he’s put the issue on the back burner during his first week in office

by Chris Megerian and Josh Boak

ABC News

WASHINGTON — Two months ago, in his first network television interview after the election, Donald Trump said he owed his victory to Americans’ anger over immigration and inflation, specifically the rising cost of groceries.

WASHINGTON — Two months ago, in his first network television interview after the election, Donald Trump said he owed his victory to Americans’ anger over immigration and inflation, specifically the rising cost of groceries.

“When you buy apples, when you buy bacon, when you buy eggs, they would double and triple the price over a short period of time,” he told NBC’s “Meet the Press. “And I won an election based on that. We’re going to bring those prices way down.”

But in Trump’s first week back in the White House, there was little in his initial blitz of executive orders that directly tackled those prices, besides directing federal agencies to start “pursuing appropriate actions.” He is taking steps to lower energy costs, something that Trump hopes will have ripple effects throughout the economy. Otherwise, his focus has been clamping down on immigration, which he described as his “No. 1 issue” shortly after taking the oath of office.

Here’s What To Expect From January’s CPI Inflation Figures

by Simon Moore

Forbes

![]() The Consumer Price Index report for January is expected to show broadly unchanged annual inflation compared to December according to nowcasts. The CPI release is scheduled for February 12. If nowcasts for relatively flat annual inflation hold, then that may reassure the Federal Open Market Committee that inflation is subdued. Nonetheless, further interest rate cuts are not viewed as imminent. Broadly flat inflation would be relatively welcome because headline CPI inflation has accelerated a little since September. Steady inflation would be a positive for policymakers in that context.

The Consumer Price Index report for January is expected to show broadly unchanged annual inflation compared to December according to nowcasts. The CPI release is scheduled for February 12. If nowcasts for relatively flat annual inflation hold, then that may reassure the Federal Open Market Committee that inflation is subdued. Nonetheless, further interest rate cuts are not viewed as imminent. Broadly flat inflation would be relatively welcome because headline CPI inflation has accelerated a little since September. Steady inflation would be a positive for policymakers in that context.

The Importance Of Housing

The most important series within CPI inflation is often shelter costs. Shelter carries a significant weight within the index and was increasing at a 4.4% annual rate as of the December CPI report. As such, shelter costs contributed 1.6% to the headline inflation rate of 2.9% on an annual basis to December 2024 given shelter’s 36% weight in the CPI series.

Ocasio-Cortez: ‘Trump is All About Making Inflation Worse’

by Tara Suter

The Hill

Rep. Alexandria Ocasio-Cortez (D-N.Y.) said amid fears of a trade war with Colombia on Sunday that President Trump is making inflation worse in the U.S.

Rep. Alexandria Ocasio-Cortez (D-N.Y.) said amid fears of a trade war with Colombia on Sunday that President Trump is making inflation worse in the U.S.

“To ‘punish’ Colombia, Trump is about to make every American pay even more for coffee,” the New York Democrat said on the social platform X.

“Remember: *WE* pay the tariffs, not Colombia,” she added. “Trump is all about making inflation WORSE for working class Americans, not better. He’s lining the pockets of himself and the billionaire class.”

Prior to Ocasio-Cortez’s remarks, Trump said in a post on Truth Social that “two repatriation flights from the United States, with a large number of Illegal Criminals, were not allowed to land in Colombia.”

Should Inflation Be Defined Only as Price Increases?

by Frank Shostak

Mises.org

If inflation is a general increase in prices, as most experts hold, then why is it regarded as bad news? What kind of damage does it do? Most experts are of the view that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of low-income earners and causes a misallocation of resources. Inflation weakens real economic growth.

If inflation is a general increase in prices, as most experts hold, then why is it regarded as bad news? What kind of damage does it do? Most experts are of the view that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of low-income earners and causes a misallocation of resources. Inflation weakens real economic growth.

Why should a general rise in prices hurt some groups of people and not others? Why should a general rise in prices weaken real economic growth? Or how does inflation lead to the misallocation of resources? The popular definition of inflation as a general increase in prices is questionable. In order to ascertain what inflation is all about, we must go back in time when this phenomenon emerged.

Historically, inflation occurred when a country’s ruler, such as a king, would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one.