from Bloomberg Television

Bidenflation’s Last Gasp? December Data Shows a Jump in PCE Inflation

by John Carney

Breitbart.com

The pace of inflation picked up in the final full month of Joe Biden’s presidency, capping off the worst burst of soaring consumer prices in forty years.

The pace of inflation picked up in the final full month of Joe Biden’s presidency, capping off the worst burst of soaring consumer prices in forty years.

The personal consumption expenditures price index rose by 0.3 percent in December, an acceleration from the 0.1 percent increase in November. Over the course of 2024, the index—which is the Fed’s favored measure of inflation—rose 2.6 percent, still well-above the Fed’s two percent target.

After excluding volatile food and energy prices, “core” inflation rose 2.8 percent last year, including a 0.2 percent rise in December. In November, core inflation rose 0.1 percent.

The Federal Reserve indicated this month that wants to see more evidence that inflation is easing before cutting interest rate cuts again. Officials have said they want to see how Donald Trump’s economic policies—including tax cuts, deportations and border control, tariffs, and deregualtion—will effect the economy before they make further policy moves. Investors currently expect the Fed to cut one or two times this year.

With Trump Imposing Tariffs, Suddenly the Media is Concerned About Inflation

by Jack Hellner

American Thinker

President Trump is imposing tariffs on Canada, Mexico, and China to force them to help the U.S on illegal immigration and drug trafficking.

President Trump is imposing tariffs on Canada, Mexico, and China to force them to help the U.S on illegal immigration and drug trafficking.

The media and other Democrats are complaining that it will cost Americans more than $800 even though Trump’s tariffs in his first term caused little if any inflation — tariffs don’t cause inflation, government money-printing does.

During the election they predicted the cost would be $4,000. Historical results mean little to Democrats.

Somehow the media campaigned to reelect Democrats even though their monetary policies, printing cash like there was no tomorrow, caused more than 20% inflation in four years. That means a family spending $70,000 in 2020 would have had to spend $14,000 more per year just to keep up but somehow they are now worried about $800 more?

Inflation Festers in Core Services, No Progress in Twelve Months. PCE Price Index Accelerates for Third Month: Justifies Fed’s Pivot to Wait-and-See

by Wolf Richter

Wolf Street

In a broader sense, there has been no progress at all on inflation in eight months.

In a broader sense, there has been no progress at all on inflation in eight months.

The sharply falling prices since mid-2022 of energy such as gasoline, and durable goods, such as motor vehicles, had contributed a lot to the cooling of inflation measures. But prices cannot fall forever – they can rise forever, but they cannot fall forever, and they stopped falling. And on top of it, services inflation has gotten stuck in mid-2024 at too high levels.

As a result, overall inflation indices, including the PCE price index released by the Bureau of Economic Analysis today, have started accelerating again on a year-over-year basis. The driver of inflation has been and still is in “core” services, which, at 3.8% year-over-year for the core services PCE price index, remains substantially higher than before the pandemic (yellow in the chart below).

The Government Lost 36% of Your Money Last Year

by James Hickman

Schiff Sovereign

In a 2022 interview, then-Transportation Secretary Pete Buttigieg discussed how we was going to spend $1.2 trillion of taxpayer money from the recently passed infrastructure bill.

In a 2022 interview, then-Transportation Secretary Pete Buttigieg discussed how we was going to spend $1.2 trillion of taxpayer money from the recently passed infrastructure bill.

“The main thing I’m thinking about,” he said, “is how do we make sure we take all this money— you know it’s $1.2 trillion— and actually deliver $1.2 trillion dollars worth of value. . .”

That whole way of thinking is just astonishing.

If you invest $1 million in a business, you’re obviously going to expect that the CEO will deliver a lot more than $1 million in value from that investment. In fact a good executive will be able to turn a $1 million investment into tens or hundreds of millions of dollars in value.

But a couple years ago, when he was still Transportation Secretary, Pete encapsulated the government’s approach to investing. They’re not looking to get a 100x, 10x, or even 2x return.

Inflation Stayed at 2.8% in December, Per Fed’s Preferred Metric – ‘Further Progress’ Needed for Rate Cuts

Inflation has stalled above policymakers’ 2% target, according to data released Friday morning, bolstering the case for the Federal Reserve’s decision earlier this week to pump the brakes on its interest rate cutting campaign.

by Derek Saul

Forbes

![]() Key Facts

Key Facts

– The personal consumption expenditures (PCE) index was up 2.6% last month compared to November and 0.3% compared to December 2023, according to the Commerce Department.

– Median economist forecasts called for 2.6% annual PCE increase and a 0.3% month-over-month increase for the measure which tracks Americans’ monthly spending on consumer goods and services, according to Dow Jones data.

– Core PCE, which excludes the index’s more volatile food and energy categories, was 0.2% higher last month than it was in November, meeting economist estimates of 0.2%.

Shop Like It’s 2020: How to Roll Back Five Years of Inflation at the Mall

by Daniel de Visé

USA Today

Prices at the mall are about one-fifth higher now than before the pandemic, thanks to cumulative inflation.

Want to spend like it’s February 2020? Try switching stores.

ALDI, the discount supermarket chain, released a report in January that makes a bold claim: Shoppers can save as much as 36% on groceries by taking their business to ALDI. The analysis compared supermarket prices in five large metro areas.

The report might be self-serving, but it captures the zeitgeist for many shoppers in 2025: Consumers are looking for ways to roll back half a decade of inflation.

Trump Claims Fed Chair Jerome Powell Was Too Busy with DEI and Climate Change to Tackle Inflation

The Federal Reserve left interest rates unchanged Wednesday, despite the new president’s demands for lower rates

by William Gavin

Quartz

President Donald Trump is renewing his old attacks on the Federal Reserve and its chair, Jerome Powell, after the independent body voted to hold interest rates steady in its first rate decision of the year.

President Donald Trump is renewing his old attacks on the Federal Reserve and its chair, Jerome Powell, after the independent body voted to hold interest rates steady in its first rate decision of the year.

“Because Jay Powell and the Fed failed to stop the problem they created with Inflation, I will do it,” Trump wrote on his Truth Social, by slashing regulations, pushing for more energy production, “rebalancing international trade,” and growing domestic manufacturing.

“If the Fed had spent less time on [diversity, equity, and inclusion], gender ideology, ‘green’ energy, and fake climate change, Inflation would never have been a problem,” Trump added. “Instead, we suffered from the worst Inflation in the History of our Country!”

Navigating the Challenges of Inflation in Urban Development Projects

Explore strategies for urban planners to manage and mitigate the impact of inflation on city development projects.

by Devin Partida

Planetizen

Rising costs in urban development are becoming a significant challenge due to inflation, global supply chain disruptions and increasing demand for raw materials. From skyrocketing fuel prices to rising labor expenses, these economic factors put immense pressure on budgets and timelines.

Rising costs in urban development are becoming a significant challenge due to inflation, global supply chain disruptions and increasing demand for raw materials. From skyrocketing fuel prices to rising labor expenses, these economic factors put immense pressure on budgets and timelines.

For urban planners, addressing these challenges safeguards the viability of projects that directly impact communities. Without proactive strategies, delays, budget overruns or cancellations can derail critical initiatives and leave cities struggling to meet growing demands. Understanding the root causes and taking strategic action keeps projects on track while ensuring long-term benefits.

The impact of rising costs on urban development

Inflation directly drives up material, labor and operational costs, creating significant challenges for development projects.

U.S. Inflation (PCE) Data Due Friday – Here Are the Critical Ranges to Watch

The ranges of estimates & how unexpected US data results can significantly impact markets

by Eamonn Sheridan

Forex Live

Due on Friday at 0830 US Eastern time (0130 GMT), the Core PCE data is the focus. The Personal Consumption Expenditures (PCE) data is a key measure of inflation that tracks changes in the prices of goods and services purchased by consumers. It is reported monthly by the Bureau of Economic Analysis (BEA) and is a critical tool used by the Federal Reserve to assess inflation and guide monetary policy.

Due on Friday at 0830 US Eastern time (0130 GMT), the Core PCE data is the focus. The Personal Consumption Expenditures (PCE) data is a key measure of inflation that tracks changes in the prices of goods and services purchased by consumers. It is reported monthly by the Bureau of Economic Analysis (BEA) and is a critical tool used by the Federal Reserve to assess inflation and guide monetary policy.

There are two main types of PCE data:

Wasserman Schultz: Trump Hasn’t Brought Down Prices From ‘Strongest Economy’ in the World Biden Gave Him

[Ed. Note: No comment on why this ‘strongest economy’ has a record number of people on food stamps.]

by Ian Hanchett

Breitbart.com

On Wednesday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Debbie Wasserman Schultz (D-FL) stated that President Donald Trump hasn’t brought down costs after “Joe Biden handed Donald Trump the strongest economy in the entire world.” And is undoing work “to make sure that the climate change that is crushing economies across the country is going to start to help improve.”

On Wednesday’s broadcast of Bloomberg’s “Balance of Power,” Rep. Debbie Wasserman Schultz (D-FL) stated that President Donald Trump hasn’t brought down costs after “Joe Biden handed Donald Trump the strongest economy in the entire world.” And is undoing work “to make sure that the climate change that is crushing economies across the country is going to start to help improve.”

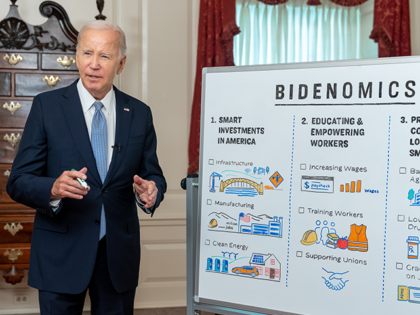

Wasserman Schultz said, “Joe Biden handed Donald Trump the strongest economy in the entire world. He is the only president in modern times that had positive job numbers in every single year he was president. We passed the CHIPS and Science Act and brought chip manufacturing back to this country. We passed the Infrastructure Investment and Jobs Act and made trillions of dollars of investment, that, right now, is what Donald Trump is planning to freeze, which is going devastate our economy, which is going to cancel people’s jobs.”