from Bloomberg Podcasts

U.S. Core Inflation Edges Up Amid Volatile Food Prices

by Owen Fairclough

CGTN

The U.S. central bank hit the pause button on its interest rate cuts on Wednesday, Jan. 29, amid concerns inflation is rising again in parts of the economy.

The U.S. central bank hit the pause button on its interest rate cuts on Wednesday, Jan. 29, amid concerns inflation is rising again in parts of the economy.

The Federal Reserve had been cutting the benchmark rate it raised to drive down price surges driven by the COVID-19 pandemic. And if that pause is tough for consumers and businesses, it also puts the Fed on a collision course with President Donald Trump. Owen Fairclough reports.

Trump Slams Hawkish Fed for ‘Failing to Stop the Problem They Created’

from Zero Hedge

Update (1620ET): Quite frankly we are surprised it took this long for President Trump to respond to The Fed’s inaction today.

In a statement on his Truth Social account, Trump wrote:

“Because Jay Powell and the Fed failed to stop the problem they created with Inflation, I will do it by unleashing American Energy production, slashing Regulation, rebalancing International Trade, and reigniting American Manufacturing…

…but I will do much more than stopping Inflation, I will make our Country financially, and otherwise, powerful again!

Carney On Kudlow: Budget Cutting, Reducing Government Size ‘Profoundly Anti-Inflationary’

by Pam Key

Breitbart.com

Breitbart News economics editor John Carney said Tuesday on Fox Business Network’s “Kudlow” that the Trump administration’s plan to reduce the size of the federal government will be “profoundly anti-inflationary.”

Breitbart News economics editor John Carney said Tuesday on Fox Business Network’s “Kudlow” that the Trump administration’s plan to reduce the size of the federal government will be “profoundly anti-inflationary.”

Host Larry Kudlow said, “I mean, over 50,000 federal jobs, John, and I want to add to that the impoundment issue. I know that official Washington swampland doesn’t like impoundment. The fact is, American presidents had it for over 200 years until a far-left Congress took it away from Richard Nixon, you know, during his worst moments in 1974. But budget-cutting, employment rifts, and impoundment- now that is going to be tough stuff.

Carney said, “It is a profoundly anti-inflationary.”

Kudlow said, “There you go.”

Expect Another Round of High Inflation to Be Unleashed in 2025

from King World News

As we come to the end of trading in the first month of 2025, expect another round of high inflation to be unleashed this year.

As we come to the end of trading in the first month of 2025, expect another round of high inflation to be unleashed this year.

January 29 (King World News) – Gregory Mannarino, writing for the Trends Journal: The backbone of the entire world financial and economic system is being manipulated in a highly destructive and deceptive way. I am referring to central bank issued notes, and over 90 percent of the world population has no idea that it is happening.

My number one call for 2025 was currency devaluation, and devaluation via two specific mechanisms.

Powell: In “No Hurry” to Cut, Need to See “Further Progress” On Inflation, No Timeline to End QT (Not Even Close)

by Wolf Richter

Wolf Street

“Companies figured out they do like to raise prices. But we also hear a lot from companies these days that consumers have really had it with price increases.”

“Companies figured out they do like to raise prices. But we also hear a lot from companies these days that consumers have really had it with price increases.”

At the press conference following the meeting when the Fed pivoted to wait-and-see, Powell was asked multiple times from various angles about future rate cuts. In responding, and even on his own when not responding, Powell mentioned five times some version of “we do not need to be in a hurry” to cut, and eight times a version of “we need to see further progress” on inflation before cutting further.

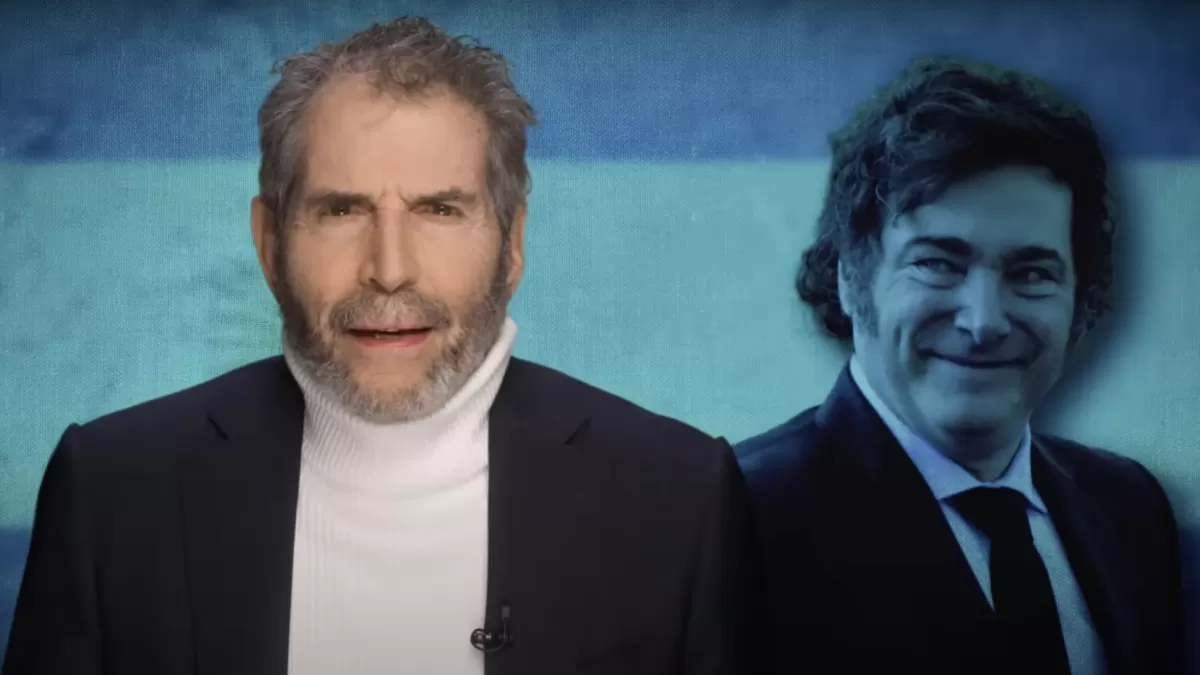

Javier Milei Promised to Take a ‘Chainsaw’ to Argentina’s Government. It’s Working.

Inflation and rent prices are down, and the country has a budget surplus.

by John Stossel

Reason.com

Finally, a real libertarian is president.

Finally, a real libertarian is president.

That’s in Argentina, where last year, Javier Milei surprised pundits by winning the election by a landslide. Now that he’s had a chance to govern, my new video covers the results and explains why Milei is now even more popular.

Argentina was once one of the richest countries in the world. Then, years of big government brought high inflation and poverty. By last year, Argentina was one of the poorest and least free countries in the world.

Then Milei, an economist, ran for office, saying things like, “The state is not the solution. The state is the problem!”

The media called him “radical” and “far-right.”

Like Biden, Trump Does Not Control the Price of Eggs

Though he promised to lower costs on Day 1, Trump remains just as beholden to the laws of supply and demand as his predecessor.

by Joe Lancaster

Reason.com

When President Donald Trump won a second term in November, the economy topped most voters’ concerns. Many felt the pain of higher prices, and they voted with their wallets.

When President Donald Trump won a second term in November, the economy topped most voters’ concerns. Many felt the pain of higher prices, and they voted with their wallets.

Trump talked repeatedly about runaway grocery prices during the campaign, pledging that if elected, paying over $4 for a carton of eggs would be a thing of the past. “When I win, I will immediately bring prices down, starting on Day 1,” he pledged.

But after winning reelection, Trump shrugged that it would be “hard” to bring grocery prices down “once they’re up.” Now, just days into his new administration, egg prices remain high and are likely to go higher. As it turns out, anyone who cast their vote thinking the president could unilaterally change grocery prices was buying into a fantasy.

JD Vance Finally Admits What Trump’s Big Plan to Lower Food Prices Is

The plan is no plan.

by Ellie Quinlan Houghtaling

The New Republic

Vice President JD Vance wants you to believe that Donald Trump will bring down grocery prices, even if he can’t spell out the nitty gritty of how it’s going to be accomplished.

Vice President JD Vance wants you to believe that Donald Trump will bring down grocery prices, even if he can’t spell out the nitty gritty of how it’s going to be accomplished.

Speaking with CBS’s Margaret Brennan on Sunday, the vice president insisted that the price of food would come down—but couldn’t muster up any details on exactly how or when that would happen.

“You campaigned on lowering prices for consumers. We’ve seen all these executive orders. Which one lowers prices?” asked Brennan.

What to Expect From Friday’s Report On Inflation

Inflation likely accelerated in December, putting pressure on the Federal Reserve to keep interest rates relatively high.

by Diccon Hyatt

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2195557704-b7b040b4cfd842579bb93e12e1921618.jpg) The Federal Reserve’s preferred measure of inflation likely accelerated in December, keeping the possibility of lower interest rates off the table for the time being.

The Federal Reserve’s preferred measure of inflation likely accelerated in December, keeping the possibility of lower interest rates off the table for the time being.

A Bureau of Economic Analysis report due Wednesday is expected to show consumer prices rose 2.6% over the past year in December, as measured by Personal Consumption Expenditures, according to a survey of forecasters by Dow Jones Newswires and The Wall Street Journal. That would be the third increase in as many months, up from 2.4% in November to the fastest annual pace since May.

Down the Rabbit Hole; The Age of Inflation On Demand

by Gary Tanashian

Kitco

[…] Let’s take a look at the 30yr Treasury yield Continuum from another angle by way of a chart I just found in my list that we used back in those critical days of early 2020 in gauging the coming inflationary recovery (and future inflation problem). I’ve marked it up further today in an effort to tell a story.

[…] Let’s take a look at the 30yr Treasury yield Continuum from another angle by way of a chart I just found in my list that we used back in those critical days of early 2020 in gauging the coming inflationary recovery (and future inflation problem). I’ve marked it up further today in an effort to tell a story.

My general view of this story is that what people call the “Everything bubble” is actually a long-term bubble in monetary policymaking (you can always count on government from either side of the aisle to auto-stimulate through fiscal policies) that has been periodically interrupted by bubble bursts, liquidity events and inflationary recoveries as our policy heroes swing into action. This continuum of invasive policy is ongoing, but in 2022, after the latest and most extreme policy kick-save ever, the bond market rebelled, and today the trend is gone. Poof!