from CNBC Television

GBP/USD Lower, Food Inflation Jumps

by Kenny Fisher

Market Pulse

The British pound has reversed directions on Tuesday and is considerably lower. In the North American session, GBP/USD is trading at 1.2436, down 0.48% on the day.

The British pound has reversed directions on Tuesday and is considerably lower. In the North American session, GBP/USD is trading at 1.2436, down 0.48% on the day.

UK food inflation hits 9-month high

The Bank of England has waged a tough war with inflation and managed to push inflation below its 2% target last September, when CPI eased to 1.7%. Since then, inflation has pushed higher and is currently running at 2.5%. The British Retail Consortium price index indicated that food prices jumped 0.5% m/m in January and 1.6% higher than a year earlier.

Democrats Finally Acknowledge Inflation, and Already Blame Trump

by John Carney

Breitbart.com

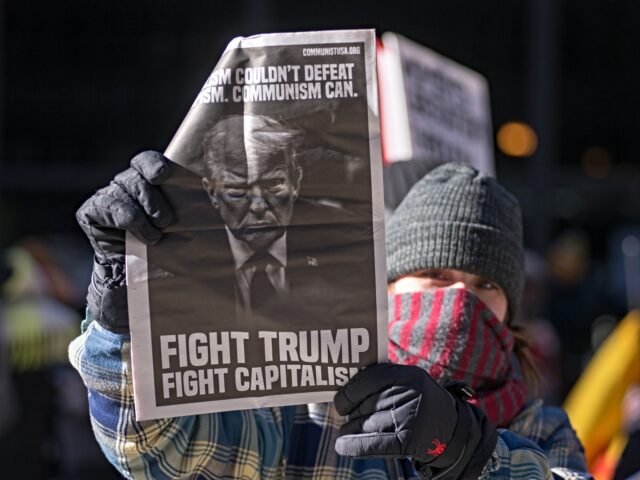

After four years of gaslighting the American people that inflation was transitory or non-existent, and just days after assuming office, the Democrat Party is blaming inflation on President Donald Trump.

After four years of gaslighting the American people that inflation was transitory or non-existent, and just days after assuming office, the Democrat Party is blaming inflation on President Donald Trump.

“Democrats slam Trump for not making good on promise to ‘immediately’ lower food prices,” reads the headline from far-left NBC News.

Some 20 Democrats, including Sen. Elizabeth Warren (D-Not Cherokee), sent Trump a letter on his sixth day in office attacking him over inflation:

Trump made inflation and the cost of food a hallmark of his run for a second presidential term, displaying everything from a teeny box of Tic Tacs at a rally in North Carolina to entire tables full of groceries outside his Bedminster, New Jersey, golf club to express his commitment to lowering voters’ grocery bills.

Trump Says Inflation Isn’t His No. 1 Issue. So What Will Happen to Consumer Prices?

Inflation was a driving force behind Donald Trump’s election victory, but he’s put the issue on the back burner during his first week in office

by Chris Megerian and Josh Boak

ABC News

WASHINGTON — Two months ago, in his first network television interview after the election, Donald Trump said he owed his victory to Americans’ anger over immigration and inflation, specifically the rising cost of groceries.

WASHINGTON — Two months ago, in his first network television interview after the election, Donald Trump said he owed his victory to Americans’ anger over immigration and inflation, specifically the rising cost of groceries.

“When you buy apples, when you buy bacon, when you buy eggs, they would double and triple the price over a short period of time,” he told NBC’s “Meet the Press. “And I won an election based on that. We’re going to bring those prices way down.”

But in Trump’s first week back in the White House, there was little in his initial blitz of executive orders that directly tackled those prices, besides directing federal agencies to start “pursuing appropriate actions.” He is taking steps to lower energy costs, something that Trump hopes will have ripple effects throughout the economy. Otherwise, his focus has been clamping down on immigration, which he described as his “No. 1 issue” shortly after taking the oath of office.

Here’s What To Expect From January’s CPI Inflation Figures

by Simon Moore

Forbes

![]() The Consumer Price Index report for January is expected to show broadly unchanged annual inflation compared to December according to nowcasts. The CPI release is scheduled for February 12. If nowcasts for relatively flat annual inflation hold, then that may reassure the Federal Open Market Committee that inflation is subdued. Nonetheless, further interest rate cuts are not viewed as imminent. Broadly flat inflation would be relatively welcome because headline CPI inflation has accelerated a little since September. Steady inflation would be a positive for policymakers in that context.

The Consumer Price Index report for January is expected to show broadly unchanged annual inflation compared to December according to nowcasts. The CPI release is scheduled for February 12. If nowcasts for relatively flat annual inflation hold, then that may reassure the Federal Open Market Committee that inflation is subdued. Nonetheless, further interest rate cuts are not viewed as imminent. Broadly flat inflation would be relatively welcome because headline CPI inflation has accelerated a little since September. Steady inflation would be a positive for policymakers in that context.

The Importance Of Housing

The most important series within CPI inflation is often shelter costs. Shelter carries a significant weight within the index and was increasing at a 4.4% annual rate as of the December CPI report. As such, shelter costs contributed 1.6% to the headline inflation rate of 2.9% on an annual basis to December 2024 given shelter’s 36% weight in the CPI series.

Ocasio-Cortez: ‘Trump is All About Making Inflation Worse’

by Tara Suter

The Hill

Rep. Alexandria Ocasio-Cortez (D-N.Y.) said amid fears of a trade war with Colombia on Sunday that President Trump is making inflation worse in the U.S.

Rep. Alexandria Ocasio-Cortez (D-N.Y.) said amid fears of a trade war with Colombia on Sunday that President Trump is making inflation worse in the U.S.

“To ‘punish’ Colombia, Trump is about to make every American pay even more for coffee,” the New York Democrat said on the social platform X.

“Remember: *WE* pay the tariffs, not Colombia,” she added. “Trump is all about making inflation WORSE for working class Americans, not better. He’s lining the pockets of himself and the billionaire class.”

Prior to Ocasio-Cortez’s remarks, Trump said in a post on Truth Social that “two repatriation flights from the United States, with a large number of Illegal Criminals, were not allowed to land in Colombia.”

Should Inflation Be Defined Only as Price Increases?

by Frank Shostak

Mises.org

If inflation is a general increase in prices, as most experts hold, then why is it regarded as bad news? What kind of damage does it do? Most experts are of the view that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of low-income earners and causes a misallocation of resources. Inflation weakens real economic growth.

If inflation is a general increase in prices, as most experts hold, then why is it regarded as bad news? What kind of damage does it do? Most experts are of the view that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of low-income earners and causes a misallocation of resources. Inflation weakens real economic growth.

Why should a general rise in prices hurt some groups of people and not others? Why should a general rise in prices weaken real economic growth? Or how does inflation lead to the misallocation of resources? The popular definition of inflation as a general increase in prices is questionable. In order to ascertain what inflation is all about, we must go back in time when this phenomenon emerged.

Historically, inflation occurred when a country’s ruler, such as a king, would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one.

To Whip Inflation, Trump Needs the Courage To Be Unpopular

When the President and Congress blow out the budget, the difference is borrowed from future (imagined) surpluses. That depreciates the dollar.

by Alexander W. Salter

The Daily Economy

How much longer will high inflation plague the US economy? Both the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCEPI) have grown faster than 2 percent (annualized) every month since March 2021. Inflation peaked during the summer of 2022 and has since fallen. Yet, it remains stubbornly elevated.

How much longer will high inflation plague the US economy? Both the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCEPI) have grown faster than 2 percent (annualized) every month since March 2021. Inflation peaked during the summer of 2022 and has since fallen. Yet, it remains stubbornly elevated.

Much depends on the economic priorities of the Trump administration. I think many economist’s fears about the inflationary effects of trade and immigration restrictions are exaggerated. This is disputable, of course, and we should have a good-faith public debate. But let’s not lose sight of the big picture: monetary and fiscal policy still matter most.

Consumer Sentiment Dragged Down by Democrat Panic and Inflation Fears

by John Carney

Breitbart.com

Consumer sentiment fell in January for the first time in six months, with inflation concerns and a sharp drop in perceptions of current conditions among Democratic voters driving the decline.

Consumer sentiment fell in January for the first time in six months, with inflation concerns and a sharp drop in perceptions of current conditions among Democratic voters driving the decline.

The University of Michigan’s sentiment index dropped to 71.1, its lowest in three months, from 74 in December. The decline was more pronounced than preliminary data suggested, underscoring growing unease about the economy’s trajectory.

Consumers reported feeling better about their personal finances and said incomes were stronger. But assessments of business conditions, the labor market, and economic growth slumped.

“While assessments of personal finances inched up for the fifth consecutive month, all other index components pulled back,” the director of the survey, Joanne Hsu, said in a statement.

JD Vance Gives Economics Lesson For CBS Host Trying Gotcha Question On Inflation

by Hailey Gomez

DailyCaller.com

Vice President J.D. Vance outlined how President Donald Trump is executing his economic plan Sunday on CBS after host Margaret Brennan repeatedly questioned when voters will feel inflation ease.

Vice President J.D. Vance outlined how President Donald Trump is executing his economic plan Sunday on CBS after host Margaret Brennan repeatedly questioned when voters will feel inflation ease.

During his campaign, Trump vowed to address voters’ concerns about the cost of living, as many Americans were worried about the U.S. economy and rising grocery prices before the 2024 November election. On CBS’ “Face the Nation,” Brennan asked Vance which executive order signed by Trump in his first week of office addresses the issue of lowering prices.

“We have done a lot and there have been a number of executive orders that have caused already jobs to start coming back into our country, which is a core part of lowering prices,” Vance responded. “More capital investment, more job creation in our economy is one of the things that’s going to drive down prices for all consumers, but also raise wages so that people can afford to buy the things that they need.”

Do Money Supply, Deficit and QE Create Inflation?

by Lance Roberts

Real Investment Advice

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was the recent inflationary surge due to a different set of drivers? In today’s post, we will examine the money supply represented by M2, the Federal budget deficit, the Fed’s previous adventures with QE, and the correlation to inflation.

Let’s begin with the money supply. One common mistake the “inflation is coming back” crowd makes is focusing on increases in the money supply. Their key argument is that the government is “printing money out of thin air, destroying the dollar’s value.” This argument has two fallacies.