from Schwab Network

Trump Has No Magic Wand That Will Lower Inflation

He’ll have a hard time keeping his promises on this front, as anyone would, because of the dynamics involved.

by Paul Anton

Star Tribune

“If everyone in town just pulls together, can we keep inflation out of our town?”

That is the question I was asked on a phone call to my office at the Federal Reserve Bank of Minneapolis one morning in 1979. I was a young economist in the bank’s research department. The caller was a representative of a special civic committee from a medium-sized city in the Ninth Federal Reserve District. The committee’s goal was to keep inflation out of their town, if possible.

The caller was so sincere that I felt he deserved more than a glib answer. So, I explained step by step. The committee would have to convince the Ford dealership not to raise its prices when the wholesale prices it paid Ford for cars rose and, eventually, to sell cars at a loss. The same held true for the local appliance store and other local merchants.

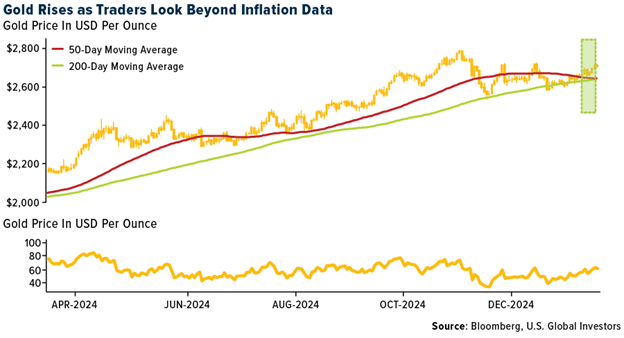

Gold SWOT: Gold Rises as Traders Look Beyond Inflation Data

by Frank E. Holmes

Kitco

Strengths

Strengths

– The best performing precious metal for the week was gold, up 0.86%. Bullion traded at over $2,700 an ounce, after the consumer price index — which excludes food and energy costs — rose 0.2% following four months of gains of 0.3%. Gold climbed to the highest in a month after a surprise slowdown in U.S. inflation revived expectations for Federal Reserve rate cuts this year, reports Bloomberg. […]

– According to BMO, Mandalay Resources reported fourth quarter 2024 gold equivalent production of 25,000 ounces. On an annual basis, the company produced 97,000 ounces of gold, which approached the high end of its annual production guidance of 90,000-100,000 ounces. Mandalay has coproduct grades of 5% antimony that significantly enhances its importance to Western interest with China cutting of antinomy exports.

How Trump’s Promise to Take On Inflation Could Hit Your Wallet

by Brad Smith

Yahoo! Finance

![]() In his inauguration speech, President Trump vowed his Cabinet will defeat inflation by using “the vast powers at their disposal.” How should Americans expect the administration’s economic policies to affect their personal finances as they work to bring down their own debt?

In his inauguration speech, President Trump vowed his Cabinet will defeat inflation by using “the vast powers at their disposal.” How should Americans expect the administration’s economic policies to affect their personal finances as they work to bring down their own debt?

“At the end of the day, there’s just these personal finance pillars that are important for everybody, no matter who’s in office, no matter what inflation rates are doing, no matter what wages are doing,” Ramsey Solutions master financial coach and debt elimination expert Jade Warshaw discusses with Brad Smith.

“It’s important to be a good steward of the money that you have and your… personal purview. And that really just looks like being a person who’s always on a budget. That’s part of how you handle money.”

Economists: Why a Trump Presidency Could Lead to “Hyperinflation”

by Billy Duberstein

NASDAQ

According to a recent ABC/Ipsos poll, voters currently see the economy and inflation as the most important issues. The economy is usually top-of-mind in most elections, but having been through the roller coaster of the COVID-19 pandemic and its aftermath, it’s especially prominent this election cycle.

According to a recent ABC/Ipsos poll, voters currently see the economy and inflation as the most important issues. The economy is usually top-of-mind in most elections, but having been through the roller coaster of the COVID-19 pandemic and its aftermath, it’s especially prominent this election cycle.

The United States’ recovery from the pandemic has actually been far better than all other G7 countries, with U.S. gross domestic product (GDP) growth the best of the bunch while having the third-lowest unemployment rate and a stock market that just hit an all-time high. And yet, despite this good growth and jobs picture, only 23% of Americans rate the economy as “excellent” or “good,” with 36% believing it’s “poor” and 41% saying it’s only “fair,” according to the Pew Research Center.

A Trump Address Thin On Inflation, Big On Promises

The 47th president skipped out on ‘carnage’ but still painted a dark image of the America he’s inheriting and swearing he’ll save.

by Olivier Knox

USNews.com

After an election in which anger over inflation helped sweep him back to the White House, President Donald Trump devoted relatively little time to the cost of living in his inaugural address on Monday, while promising a whole-of-government war on illegal immigration.

After an election in which anger over inflation helped sweep him back to the White House, President Donald Trump devoted relatively little time to the cost of living in his inaugural address on Monday, while promising a whole-of-government war on illegal immigration.

– “From this moment on, America’s decline is over,” Trump declared in the Capitol Rotunda, surrounded by a sea of VIPs, lawmakers and Cabinet picks. “We will begin the complete restoration of America and the revolution of common sense.”

He made no mention of the Jan. 6, 2021, rioters to whom he repeatedly promised clemency on the campaign trail. Or of his plans to repudiate birthright citizenship, setting up a legal battle that almost certainly will reach the Supreme Court. Ukraine? He did not utter the name.

Too Few Appreciate the Dangers of Our Fraudulent Money System

Chris discusses the fraudulent nature of the monetary system, focusing on inflation as a hidden tax, its impact on society, and the role of government and financial institutions.

by Dr. Chris Martenson

Chris Martenson’s Peak Prosperity

We have a money problem, because our system of money is fraudulent.

We have a money problem, because our system of money is fraudulent.

Fraud

The act of intentionally deceiving someone to obtain a benefit, such as money, property, or services.

In our elected system of government, the way it’s supposed to work is that if or when your elected officials deem it necessary and in the national interest to take some of your money so they can spend it on something, they have to tax it.

A law has to be written, debated and then passed. Over time, the US tax laws have morphed into a colossal pile of impossibly complex code, usually penned not by actual Congressmen, but by special interest lobbyists.

Demand Helped Cause Inflation, but Price Pressure From Stimulus Was Worth Growth

by Ian Hanchett

Breitbart.com

During an interview with Bloomberg aired on Thursday’s “Balance of Power,” White House Council of Economic Advisers Chair Jared Bernstein stated that “strong demand” did help cause inflation and he accepts that the upward pressure on prices from COVID stimulus was worth it, but inflation was about the same in every G7 country, “and they all had different fiscal and monetary policies. So, I think it’s a mistake to assign too much of that increase to fiscal policy. And I think the Republican argument is fundamentally undermined by that international comparison.”

During an interview with Bloomberg aired on Thursday’s “Balance of Power,” White House Council of Economic Advisers Chair Jared Bernstein stated that “strong demand” did help cause inflation and he accepts that the upward pressure on prices from COVID stimulus was worth it, but inflation was about the same in every G7 country, “and they all had different fiscal and monetary policies. So, I think it’s a mistake to assign too much of that increase to fiscal policy. And I think the Republican argument is fundamentally undermined by that international comparison.”

Bernstein said, “The president realized, quickly, that it was snarled supply chains that helped cause that inflationary spike, in part, along with strong demand. And unsnarling those chains was going to be really important. But the thing that the president recognized was that we also have to worry about costs, the price level, not just inflation. And that’s why, starting shortly after that peak, we started talking about what we were doing to lower costs.”

On the Road to Hyperinflation (Gold and Silver) – Daryl Montgomery

Montgomery’s concerns about hyperinflation and his recommends to invest in gold and silver.

by PR

Jerusalem Post

In a recent interview with Natural Resource Stocks, gold and silver expert Daryl Montgomery warned of a potential hyperinflationary event in the United States. Montgomery’s comments come as the U.S. economy continues to grapple with rising inflation and a growing national debt.

“We are on the road to hyperinflation,” Montgomery said. “The government is printing money at an alarming rate, and the national debt is out of control. This is a recipe for disaster.”

Montgomery also warned that the current economic situation is fragile and could easily lead to a recession. He pointed to the rising cost of living, the war in Ukraine, and the ongoing supply chain disruptions as factors that could trigger a downturn.

All the Data Confirms Stagflation

by SchiffGold.com

LewRockwell.com

On Wednesday, Peter marked his return to the Peter Schiff Show studio. He tackles the most recent batch of 2025 economic data, highlights inflation signals in commodity prices, and comments on President Biden’s legacy as his term comes to a close. Donald Trump is set to take the reins on Monday, and Peter also analyzes the latest from the president-elect.

On Wednesday, Peter marked his return to the Peter Schiff Show studio. He tackles the most recent batch of 2025 economic data, highlights inflation signals in commodity prices, and comments on President Biden’s legacy as his term comes to a close. Donald Trump is set to take the reins on Monday, and Peter also analyzes the latest from the president-elect.

To start the show, Peter praises Trump for what appears to be a behind-closed-doors negotiation of a ceasefire between Israel and Hamas. Despite his strengths, Trump is unlikely to solve America’s economic troubles:

CPI Triggers Bond Rally, Disclosure Season is Here

Bond markets rallied unexpectedly following the CPI release, while disclosure season heats up with pivotal insights into inflation, banking trends, and shifting global confidence in the dollar and gold.

by Dave Fairtex

Chris Martenson’s Peak Prosperity

Consumer Economy

Consumer Economy

Retail Sales (RSAFS); $729B +3.3B (+0.45% m/m)

Industrial Production (INDPRO); +0.91% m/m

Producer Prices (PPIACO); +0.16% m/m

CPI All Urban (CPIAUCSL); +0.39% m/m

Retail Sales made a new all-time high, and it may be keeping up with inflation. Industrial production jumped higher – but it is not at a new all-time high. Still, the move is a positive sign, and not recessionary.

Producer prices (the old index, not the new one) didn’t change much. PPI is linked closely to energy.

Lastly, CPI rose 0.39%; annualized, that’s 4.68%. Since all the bureaucrats do is lie, this is an incredibly inflationary signal. Perhaps instead we should focus on “core CPI” (which removes the “useless” food & energy components – who needs them?), which rose just 0.23% this month, or 2.7% annualized.

Wolf’s take here: