from Fox Business

Why Used-Vehicle Prices May Put Upward Pressure On CPI, After Having Been a Powerful Contributor to Cooling Inflation

by Wolf Richter

Wolf Street

The new-vehicle shortages of 2021-2022 now mean lower supply to the used-vehicle market, amid solid demand.

The new-vehicle shortages of 2021-2022 now mean lower supply to the used-vehicle market, amid solid demand.

Used-vehicle prices, which had spiked over the two-year span 2020-2021 by 65% on the wholesale side and by 55% on the retail side, provided rocket fuel to inflation. Then, as prices careened down in 2022 through 2023, giving up about half of the wholesale price spike and about a third of the retail price spike, they contributed to the sharp deflation in durable goods that helped decelerate overall inflation. But this drop in used-vehicle prices petered out in 2024, amid solid demand facing tight inventories due to reduced supply from rental fleets and lease terminations.

CNBC Daily Open: Markets Shrug Off Inflation Warnings

by Yeo Boon Ping

CNBC.com

What you need to know today

What you need to know today

Fed cautious about inflation and Trump’s policies

At their December meeting, U.S. Federal Reserve officials expressed concern that inflation would stubbornly remain above the central bank’s 2% target, and over the possible impact of U.S. President-elect Donald Trump’s policies. Consequently, officials would be moving more slowly on interest rate cuts, minutes released Wednesday showed.

Stocks shrugged off inflation concerns

U.S. stocks eked out a small gain on Wednesday even though the 10-year Treasury yield

touched to its highest since April following the release of the Fed’s minutes. The pan-European Stoxx 600 index lost 0.19%, relinquishing earlier gains after flash data by the European Commission showed that EU economic sentiment indicator had dropped 1.7 points in December.

Wall Street Ends Lower as Inflation Fears Mount

by Johann M Cherian, Sukriti Gupta and Carolina Mandl

Yahoo! Finance

Stocks gave up early gains after a Labor Department report showed job openings unexpectedly increased in November, while a separate report said services sector activity accelerated in December with a measure tracking input prices surging to a near two-year high.

“Markets are starting to recognize that they thought we were in the eighth inning of the inflation fight but now it’s going to be higher for longer,” said Joe Mazzola, head of trading and derivatives strategist at Charles Schwab.

Eurozone Inflation Bumps Up Again Causing Political Discomfort

Increasing prices for energy and services drive the raise.

by Carlo Martuscelli

Politico

Inflation in the eurozone quickened in December for the second month in a row, as rising prices for energy and services kept it uncomfortably above the European Central Bank’s target.

Inflation in the eurozone quickened in December for the second month in a row, as rising prices for energy and services kept it uncomfortably above the European Central Bank’s target.

Consumer prices rose by 2.4 percent on an annual basis across the currency area, up from 2.2 percent in November, Eurostat said in a release. In monthly terms, prices rose 0.4 percent.

Inflation in services remains the biggest contributor, up 4.0 percent annually, and up a chunky 0.8 percent just from November. Energy prices rose 0.6 percent on the month, bringing them back above year-earlier levels after four months of annual deflation. Price increases for unprocessed food, meanwhile, slowed to 1.7 percent annually from 2.3 percent the month before.

Labor Market Dynamics Retighten, Job Openings Jump Again. Fed Faces Scenario of Solid Job Market, Re-accelerating Inflation.

by Wolf Richter

Wolf Street

In light of this scenario, the Fed has been backpedaling on rate-cut expectations for two months.

In light of this scenario, the Fed has been backpedaling on rate-cut expectations for two months.

October’s majestic jump in job openings was revised even higher, and in November, job openings jumped by another 259,000, to 8.10 million (blue in the chart below), the highest since May and well above the prepandemic record in late 2018, and the three-month average (red) rose for the second month in a row, as the underlying dynamics of the labor market retightened, according to the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics today. This data is based on surveys of about 21,000 work locations, and not on online job listings.

The End of Economic Growth: Energy Shortages Drive Global Downturn

from Zero Hedge

Authored by Gail Tverberg via Our Finite World,

- The global economy is expected to enter a recession in 2025 due to a decline in the availability of crude oil, coal, and uranium relative to population.

- Government attempts to stimulate the economy through debt will lead to inflation rather than growth, as energy supplies are constrained.

- High interest rates, low energy prices, and a decline in industrial output will characterize the economic landscape in 2025.

As the world enters 2025, the critical issue we are facing is Peak Crude Oil, relative to population. Crude oil has fallen from as much as .46 gallons per person, which was quite common before the pandemic, to close to .42 gallons per person recently (Figure 1).

Europe’s Inflation Rate Rose 2.4% in December

by Baystreet Staff

Bay Street

Inflation across Europe rose for a third consecutive month in December to reach an annualized 2.4%, according to statistics agency Eurostat.

Inflation across Europe rose for a third consecutive month in December to reach an annualized 2.4%, according to statistics agency Eurostat.

The December reading was in line with the consensus forecasts of economists polled by the Reuters news agency and marked an increase from 2.2% in November.

Core inflation remained unchanged at 2.7% for a fourth month, also meeting economists’ expectations. However, services inflation increased to 4% from 3.9%.

The latest rise in consumer prices will be closely watched by the European Central Bank (ECB), which is expected to lower interest rates from 3% to 2% throughout this year.

Inflation in Germany, Europe’s largest economy, hit a higher-than-expected 2.9% in December. At the same time, inflation in France came in at 1.8%, below forecasts calling for a 1.9% rise.

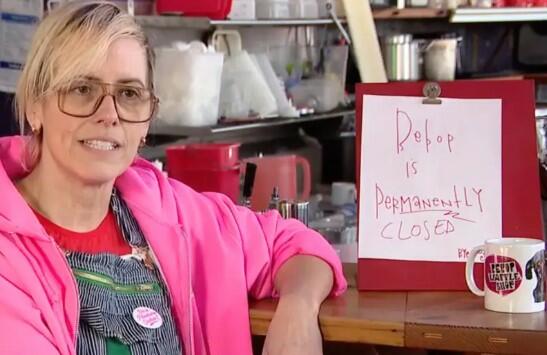

Popular Seattle “Safe Space” Waffle Shop Forced to Close Due to Inflation and New $20 Minimum Wage

from Zero Hedge

A waffle shop in Seattle is being forced to close down over the city’s new $20 per hour minimum wage law, according to a new report by the New York Post.

The owner of Bebop Waffle Shop said she was forced to close after the city’s new $20.76 minimum wage law took effect on New Year’s Day.

Owner Corina Luckenbach told the Post:

“I’ve cried every day.”

Luckenbach, who founded Bebop over a decade ago after moving from New York to Seattle, said inflation-driven food costs and reduced foot traffic due to remote work had already strained her business. The minimum wage hike was the final blow.

Egg Prices to Record-Breaking Heights

by Amy Furr

Breitbart.com

People across America are feeling the sting of the rising cost of eggs in part being driven by the bird flu outbreak.

People across America are feeling the sting of the rising cost of eggs in part being driven by the bird flu outbreak.

In October, Vice President-elect Sen. JD Vance (R-OH) pointed to the skyrocketing price of eggs as evidence of President Joe Biden (D) and Vice President Kamala Harris’s (D) economic policies, per Breitbart News.

“Eggs, when Kamala Harris took office, were short of $1.50 a dozen. Now, a dozen eggs will cost you around $4, thanks to Kamala Harris’ inflationary policies,” he said.

Thanks to Years of Inflation, the Price of Breakfast in America is Now Obscene

by Michael Snyder

The Economic Collapse Blog

They have officially ruined breakfast. Once upon a time, breakfast was the least expensive meal of the day, but now everything has changed. Eggs, butter and coffee have all become extremely expensive, and there is no relief in sight in 2025. When I went to the grocery store on Friday, I spent about 45 dollars for just nine tubs of butter. I could hardly believe my eyes, but after doing some digging I discovered that five dollars for a pound of butter is very close to the national average at this stage.

They have officially ruined breakfast. Once upon a time, breakfast was the least expensive meal of the day, but now everything has changed. Eggs, butter and coffee have all become extremely expensive, and there is no relief in sight in 2025. When I went to the grocery store on Friday, I spent about 45 dollars for just nine tubs of butter. I could hardly believe my eyes, but after doing some digging I discovered that five dollars for a pound of butter is very close to the national average at this stage.

Of course in some areas it is even more expensive. During an exchange on MSNBC’s Morning Joe program, Joe Scarborough was astounded to learn that the price of butter has reached 7 dollars in some stores in his area…