Experts Say High Food Prices Are Here to Stay. Here’s Why.

by Juhohn Lee

CNBC.com

Inflation has steadily cooled over the past two years, despite seeing a slight stall in October and November. Prices for items such as gasoline, used cars and energy have all declined accordingly. However, food prices continue to outpace inflation, increasing by 28% since 2019.

Inflation has steadily cooled over the past two years, despite seeing a slight stall in October and November. Prices for items such as gasoline, used cars and energy have all declined accordingly. However, food prices continue to outpace inflation, increasing by 28% since 2019.

More than 85% of consumers report feeling frustrated with rising grocery prices, and over a third say they have resorted to buying fewer items to save money, according to a 2024 survey by RR Donnelley.

However, experts say high food prices are here to stay.

“Once food price goes up, it tends to stay up,” said Claudia Sahm, a chief economist at New Century Advisors. “The inflation may come back down, so you don’t see the big price increases. But outside of widespread depression, we don’t tend to see prices falling across the board.”

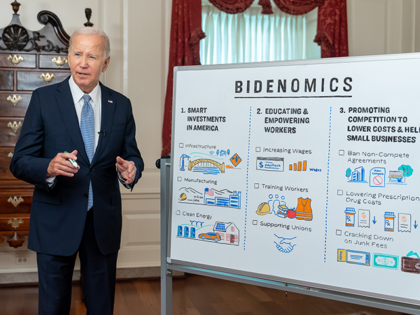

Dingell: People Are Still Worried About Grocery Bills, Have Rising Rent, Can’t Buy Home

by Ian Hanchett

Breitbart.com

During an interview with C-SPAN on Friday, Rep. Debbie Dingell (D-MI) stated that people are still worrying about the high prices of groceries, seeing rent increases, and “can’t afford to buy a home.”

During an interview with C-SPAN on Friday, Rep. Debbie Dingell (D-MI) stated that people are still worrying about the high prices of groceries, seeing rent increases, and “can’t afford to buy a home.”

Dingell stated, “I go to Kroger on Sunday mornings. I have a routine. And when I’m in that — in the store, people know I’m going to be there. They come and talk to me about what — the price of eggs is what’s really, I think has not still quieted down, how they’re worried about their grocery bills, about people that can’t afford to buy a home. The rent’s going up, everyday issues that matter to working men and women across the country.”

She further stated, “We’ve got to listen and show them how we’re addressing those issues.”

Here’s the Fed’s 2025 Meeting Schedule and What to Expect for Interest Rates

by Simon Moore

Forbes

![]() Fixed income markets anticipate that the Federal Reserve will cut interest rates in 2025, but not by much. Short-term interest rates are expected to end 2025 close to 4%, that’s down from the current 4.25% to 4.5% range as of January 2025. This is after the Fed cut rates in December 2024.

Fixed income markets anticipate that the Federal Reserve will cut interest rates in 2025, but not by much. Short-term interest rates are expected to end 2025 close to 4%, that’s down from the current 4.25% to 4.5% range as of January 2025. This is after the Fed cut rates in December 2024.

This forecast assumes that the U.S. economy continues to grow; unemployment remains slightly above 4%; and inflation ends the year close to 2.5%. These projections were the median forecasts of Federal Open Market Committee policymakers in December 2024. If the economy performs differently than these expectations, then the interest rate outlook will evolve too.

Seattle Public Schools Sees Alarming 20% Spike in Student Homelessness After 30% Rise Last Year

from Zero Hedge

Seattle Public Schools is seeing an alarming rise in the number of its students experiencing homelessness.

Seattle Public Schools is seeing an alarming rise in the number of its students experiencing homelessness.

As of October, the district reported 2,235 students experiencing homelessness since the school year began, a nearly 20% increase from last year’s 30% rise, KUOW/NPR reported.

Homelessness has reached record levels nationwide, according to a recent HUD report. In Washington state, over 41,000 students experienced homelessness during the 2023-24 school year, a nearly 15% increase.

Jenny Allen, a McKinney-Vento support worker in Seattle, said rising costs and limited affordable housing are straining families, while the district has seen a rise in immigrants and refugees, particularly from South America.

The Inflation Ruination to Come

All forecasts are useless amid a global financial structure of unstable criticality in which any snowflake can bring an avalanche

by Jeffrey Race

Asia Times

The coming years are going to be a bumpy ride for more reasons than appear in press chatter, talk shows and podcasts and bumpier than the chatterers and “experts” imagine.

The coming years are going to be a bumpy ride for more reasons than appear in press chatter, talk shows and podcasts and bumpier than the chatterers and “experts” imagine.

Global finances are at an epochal turn. The world has been living on capital (energy, water, land) and credit for many, many decades and that has stopped.

Economists blithely call it “The Great Moderation” and congratulate themselves. Highly skilled in their discipline, they are innocent of history and other kinds of insight essential to comprehending today’s situation.

With their narrow understanding, American economists just told their leaders to max the national credit card, possible once President Nixon had in 1971 cut the dollar’s link to gold, theretofore the sole restraint keeping American politicians and public modestly responsible.

21 Essential Skills for Thriving During Hyperinflation

by Scott Mackenzie

MSN

Hyperinflation is an economic nightmare that can devastate savings and upend entire societies in the blink of an eye. Just look at Venezuela, where inflation hit 65,000% in 2018, or Zimbabwe, where it reached a mind-boggling 79.6 billion percent in 2008. While it may seem far-fetched, history shows that no economy is completely immune. The skills outlined here aren’t just nice-to-haves; they’re potentially life-saving in a world where money loses its value by the hour. Ignore them at your peril.

Analysis: How Will Inflation, Interest Rates and the U.S. Consumer Fare in 2025?

by Brandy Hadley

PBS

Brian Blank is a finance scholar and Fed watcher who researches how companies navigate downturns and make financial decisions, as well as how markets process information. Brandy Hadley is a finance professor who leads a student-managed investment fund and studies corporate decision-making and incentives. Together, they’re also the resident economic oracles at The Conversation U.S., and their forecast for 2024 held up notably well. Here, they explain what to expect from 2025.

Brian Blank is a finance scholar and Fed watcher who researches how companies navigate downturns and make financial decisions, as well as how markets process information. Brandy Hadley is a finance professor who leads a student-managed investment fund and studies corporate decision-making and incentives. Together, they’re also the resident economic oracles at The Conversation U.S., and their forecast for 2024 held up notably well. Here, they explain what to expect from 2025.

New year, new questions

Heading into 2024, we said the U.S. economy would likely continue growing, in spite of pundits’ forecast that a recession would strike. The past year showcased strong economic growth, moderating inflation, and efficiency gains, leading most economists and the financial press to stop expecting a downturn.

High Rates and Continued Inflation Mean Housing Prices Stay High

by Roger Valdez

Forbes

![]() Like anyone in the housing discourse, I’ve done my share of prognosticating about mortgage rates and inflation and their impact on housing in general and housing policy specifically. It makes sense at the beginning of a new year to think about where rates may go in 2025, why, and what impact that will have on the housing economy.

Like anyone in the housing discourse, I’ve done my share of prognosticating about mortgage rates and inflation and their impact on housing in general and housing policy specifically. It makes sense at the beginning of a new year to think about where rates may go in 2025, why, and what impact that will have on the housing economy.

Housing continues to be a huge share of the American economy, making up as much as 18% of Gross Domestic Product (GDP). That figure includes single-family home construction and multifamily construction but the associated services and economic production created by the housing economy. When changes happen in one part of the housing economy it has profound effects on other sectors as well. Changes in interest rates means a change in the cost to borrow which means shifts in demand.

How Do Cryptocurrencies Combat Hyperinflation?

from Coin Gecko

Introduction

Introduction

Hyperinflation, an economic disaster characterized by astronomical hikes in price of goods and services, and the resultant overnight erosion of a currency’s value, has become synonymous with the economic devastation that countries such as Venezuela and Argentina have experienced.

While traditional approaches, like currency redenominations or price controls, do little to remedy the situation, cryptocurrencies such as Bitcoin or stablecoins are increasingly becoming attractive alternatives. With Bitcoin’s independent and decentralized nature, as well as stablecoin offerings that are tied to more reliable fiat currencies, such as the US dollar, these virtual assets have created a beacon of hope in protecting one from the worst forms of inflation. But will crypto be able to provide a truly sustainable solution for economies teetering on the edge of collapse?

Skyrocketing Prices Are an Age-Old Problem. Here’s How Roman Emperors Battled Runaway Inflation.

by Peter Edwell

The Conversation

Therefore, who would not know that effrontery hijacks the public interest? […] It ratchets up the prices of things for sale, not fourfold or eightfold but so much that the human tongue’s reckoning cannot untangle what to call the accounting and the deed!

The language is different but this edict on maximum prices, issued in 301 CE by Roman emperor Diocletian, reflects a feeling familiar to many: why is everything so expensive lately?

Diocletian’s edict highlights the deep outrage he and and his imperial colleagues felt at the rampant inflation that had engulfed the Roman empire for much of the third century.

Inflation eroded the pay of the soldiers whose loyalty was the basis of the emperors’ authority.

So, how did the Roman Empire get into this mess – and how did it get out of it?