from AaronClarey

‘Term Premium’ Sends a Message. Inflation Isn’t What Bond Investors Fear Most.

by Karishma Vanjani

Barron’s

The yield on U.S. government debt maturing in 10 years slipped by 0.038 percentage point to 4.322% on Tuesday, calming down after marking its biggest weekly gain since the end of the 2001 recession last week. Sales of U.S. debt are pushing down prices and raising yields; yields and bond prices are inversely related.

Last week, Wall Street mainly blamed the surge on foreign central banks selling bonds and the unwinding of a complex, highly leveraged hedge fund strategy called the basis trade. Both were difficult-to-measure variables, partly because transactions by both groups are opaque.

What Should the Federal Reserve Do in the Face of Stagflation?

Economists, including former PIMCO CEO Mohamed El-Erian, believes the central bank should prioritize tackling inflation.

by Shreyas Sinha

Observer

President Trump’s tariff announcements have simultaneously raised inflation expectations and dampened economic prospects—so much so that former New York Fed President Bill Dudley wrote that “stagflation is now America’s best-case scenario.” Stagflation, the combination of high inflation and slow growth, is among the most difficult for the Federal Reserve to manage: contractionary policy may tame inflation but slows growth further, while expansionary moves risk fueling inflation without the guarantee of boosting the economy. Every option, in effect, becomes a double-edged sword.

President Trump’s tariff announcements have simultaneously raised inflation expectations and dampened economic prospects—so much so that former New York Fed President Bill Dudley wrote that “stagflation is now America’s best-case scenario.” Stagflation, the combination of high inflation and slow growth, is among the most difficult for the Federal Reserve to manage: contractionary policy may tame inflation but slows growth further, while expansionary moves risk fueling inflation without the guarantee of boosting the economy. Every option, in effect, becomes a double-edged sword.

The central bank is meeting on May 7 to determine its next step on interest rates. Currently, markets expect rates to stay the same after the May meeting but a 60 percent chance of a 25 basis-point cut in June, according to the CME Group’s FedWatch. Such expectations reflect “how they have been trained repeatedly by the Fed to expect looser financial conditions the minute there are any signs of unusual market volatility,” the economist Mohamed El-Erian wrote in a Bloomberg op-ed last week.

U.S. Import Prices Ease, but Tariffs Casting Shadow Over Inflation

by Reuters

Kitco

WASHINGTON, April 15 (Reuters) – U.S. import prices unexpectedly fell in March, pulled down by decreasing costs for energy products, the latest indication that inflation was subsiding before President Donald Trump’s sweeping tariffs came into effect.

WASHINGTON, April 15 (Reuters) – U.S. import prices unexpectedly fell in March, pulled down by decreasing costs for energy products, the latest indication that inflation was subsiding before President Donald Trump’s sweeping tariffs came into effect.

Import prices dipped 0.1% last month, the first decline since September, after a downwardly revised 0.2% gain in February, the Labor Department’s Bureau of Labor Statistics said on Tuesday. Economists polled by Reuters had forecast import prices, which exclude tariffs, would be unchanged following a previously reported 0.4% increase in February.

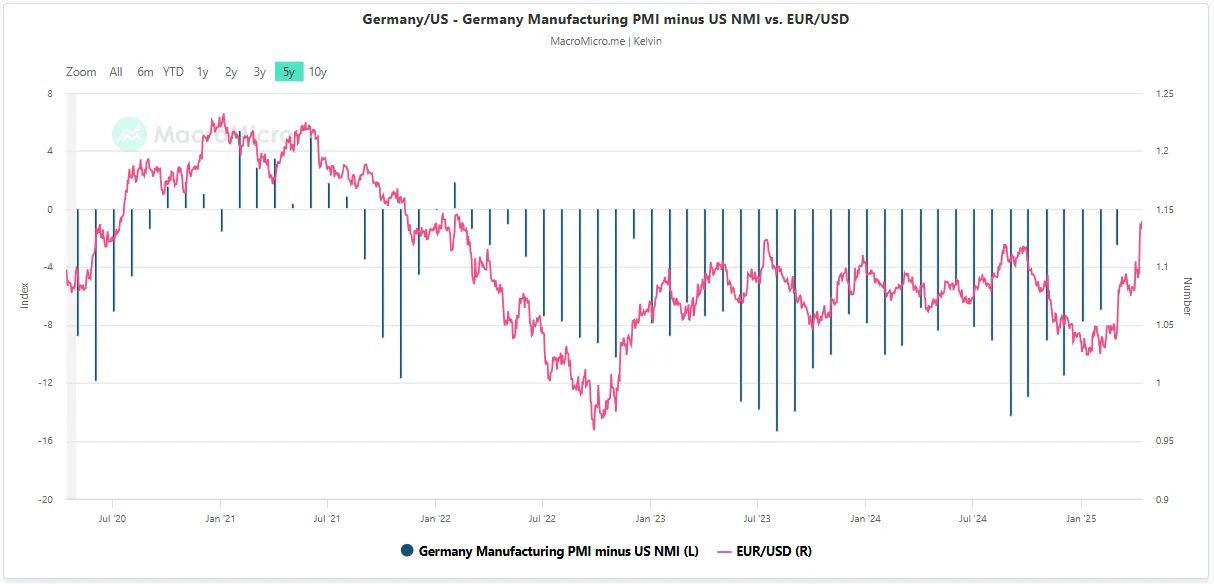

EUR/USD Outlook: Major Bullish Breakout Supported Stagflation Risk in the U.S.

The narrowing of the Germany Manufacturing PMI to U.S. ISM Services PMI spread suggests that Germany’s growth prospects have improved relative to those of the US.

by Kelvin Wong

Market Pulse

Since our last analysis, the price actions of the EUR/USD have rallied towards 1.0940 on 17 March before it staged the expected minor corrective pull-back to retest the key 200-day moving average acting as a support at 1.0730 (printed an intraday low of 1.0733 on 27 March) as highlighted.

Since our last analysis, the price actions of the EUR/USD have rallied towards 1.0940 on 17 March before it staged the expected minor corrective pull-back to retest the key 200-day moving average acting as a support at 1.0730 (printed an intraday low of 1.0733 on 27 March) as highlighted.

Thereafter, the EUR/USD resumed its bullish impulsive up move sequence with a rally of 6.9% to hit a 52-week high of 1.1474 on last Friday, 11 April, on the backdrop of the uncertainty surrounding the implementation of US reciprocal and sectoral-based trade tariffs.

Is “De-Dollerization” On the Table? BRICS Summit Approaches as Trade War Simmers.

by Brandon Smith

Alt Market

For many years now I have been talking about the growing global economic divide between East and West. This volatile opposition between the BRICS nations and the US is not a product of the Trump era. It has been decades in the making with a myriad of complex working parts and numerous US trading partners have been preparing for the fallout as far back as 2008.

At the same time behind the scenes there have been malicious influences at play: Special interests within the Davos community have been working diligently to undermine the US economy and the dollar. But what is the ultimate aim of this agenda?

In 2018 I published an article titled ‘World War III Will Be An Economic War’ – In it I outlined the basic mechanics of the East vs West paradigm and how banking institutions like the IMF and BIS were positioning to take advantage of the chaos.

Technical Scoop: Possible Reversal, Golden Roars, Pummeled Dollar

by David Chapman

GoldSeek

Another wild volatile week but stock markets ended up after hitting new 52-week lows. A reversal? A technical temporary bottom is most likely in and it should be helped further with the announcement that smartphones and computers are exempt from the punishing tariffs on China. It’s an ever-changing world of tariffs. What’s on one minute is off the next.

Another wild volatile week but stock markets ended up after hitting new 52-week lows. A reversal? A technical temporary bottom is most likely in and it should be helped further with the announcement that smartphones and computers are exempt from the punishing tariffs on China. It’s an ever-changing world of tariffs. What’s on one minute is off the next.

There was so much going on that we are not putting out our usual full report this past week. We highlight the past week. A number of charts are provided, any one of which could be considered the chart of the week.

With markets tanking It sparked margin calls for big funds and the instrument of choice to dump was bonds. Bond yields rose sharply. Not what the Trump administration wants. So another reversal in the tariff wars as they announced a 90-day pause for everyone but China. Stock markets roared. But bonds stayed up as rumors came foreign central banks could be dumping U.S. bonds as well. Bond yields were down because of fear of recession.

Some of This is Completely Delusional. Some of it May Actually Be Pretty Smart.

by James Hickman

Schiff Sovereign

It’s been nearly two weeks of whipsaw, roller coaster tariff moves and countermoves… all of which threatens to upend not only economic stability, but even the global financial system as we know it.

It’s been nearly two weeks of whipsaw, roller coaster tariff moves and countermoves… all of which threatens to upend not only economic stability, but even the global financial system as we know it.

I can’t stress this enough: what we’re witnessing right now will almost certainly go down as one of the most monumental events in US economic history. And the consequences will have far-reaching implications far beyond a trade war or potential recession.

It’s fair to say that the approach to tariffs so far has been erratic… almost bipolar. And the instability has already caused tremendous damage to consumer, business, and investor confidence.

But last week we saw a glimmer of something that might actually look like a real strategy.

Bonds Break, Bullion Breaks Out

by Adam Sharp

Daily Reckoning

Global markets have reached a day of reckoning. This has been decades in the making. Now, massive changes are sweeping the world.

No, what we’re seeing in the markets is not “normal.” Instead, this is the:

- Moment precious metal investors have been waiting for

- Birth of a multipolar world order (U.S. is no longer the sole superpower)

- Start of a very uncertain period for bonds and fiat currency

- Peak of globalization

In short, you no longer have the luxury of relying on the old rules, the old way of thinking. It’s time for a new playbook.

Feds Borrowed $1.3 Trillion in the First Six Months of This Fiscal Year

That’s the highest total outside of the COVID-19 pandemic, and now Congress wants to borrow even more.

by Eric Boehm

Reason.com

President Donald Trump stood before a joint session of Congress less than six weeks ago and vowed to do something that has not been done in nearly a quarter century: balance the federal budget.

President Donald Trump stood before a joint session of Congress less than six weeks ago and vowed to do something that has not been done in nearly a quarter century: balance the federal budget.

New numbers from the Treasury and recent developments in Congress suggest that’s not going to happen. Indeed, all indications are pointing in the opposite direction.

The federal government borrowed $1.3 trillion during the first six months of the current fiscal year, the Treasury Department reported last week. That’s the second-highest six-month total in history, bested only by the record set in the midst of the COVID-19 pandemic.

Spending is on the rise too. Over the first six months of the fiscal year, the federal government spent more than $3.5 trillion, up from the $3.25 trillion spent during the same six-month period in the previous fiscal year. Year-over-year spending is up by $139 billion during the three months since Trump was inaugurated, according to the Treasury data.

Consumer Prices Fall in March

Both headline and core inflation are heading in the right direction. But the Fed shouldn’t overcorrect after a single month of falling prices.

by Alexander W. Salter

The Daily Economy

After a quarter-long inflationary resurgence, it looks like prices are now falling. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) declined 0.1 percent in March. Prices rose 2.4 percent year-over-year, compared with 2.8 percent last month. The biggest decrease was for energy, which fell 2.4 percent. Gasoline prices were down 6.3 percent.

After a quarter-long inflationary resurgence, it looks like prices are now falling. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) declined 0.1 percent in March. Prices rose 2.4 percent year-over-year, compared with 2.8 percent last month. The biggest decrease was for energy, which fell 2.4 percent. Gasoline prices were down 6.3 percent.

Excluding volatile energy and food prices, inflation stayed in positive territory. Core CPI rose 0.1 percent in March (2.8 percent year-over-year). But this is lower than February’s 0.2 percent monthly increase.

This is good news. Both headline and core inflation are heading in the right direction. But the Federal Reserve’s job might not get easier. Fed Chair Jerome Powell recently noted that Trump’s tariffs may complicate the Fed’s task by pushing up prices. This would be a one-time price increase rather than sustained inflation. Yet it might compel monetary policymakers to respond anyway.