from Yahoo Finance

U.S. Homelessness Hits New Record in 2024

by AFP

Breitbart.com

The number of people in the United States experiencing homelessness reached a new record this year, with lingering inflation and high housing prices among likely drivers, a government report said Friday.

The number of people in the United States experiencing homelessness reached a new record this year, with lingering inflation and high housing prices among likely drivers, a government report said Friday.

An estimated 771,480 people were homeless on a single night in January 2024, rising 18 percent from 2023, said the Department of Housing and Urban Development (HUD) in an annual assessment.

This translates to about 23 in every 10,000 people in the country, home to the world’s biggest economy.

The uptick came as households felt the pressure from housing costs, with the median rent for January 2024 being 20 percent higher than that in January 2021, according to the National Low Income Housing Coalition.

Affordable Care Act & the Inflation of Healthcare

by Lance Roberts

Real Investment Advice

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. The chart below tells you almost everything you need to know, but in this blog, we will revisit why the Affordable Care Act failed to make healthcare affordable and some solutions to fix the problem.

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. The chart below tells you almost everything you need to know, but in this blog, we will revisit why the Affordable Care Act failed to make healthcare affordable and some solutions to fix the problem.

[…] When it was conceived, the Affordable Care Act (ACA) was hoped to improve healthcare access. At the time, roughly 20 million Americans were uninsured. The bill hoped to lower the rising cost of healthcare in the economy by providing a Government mandate.

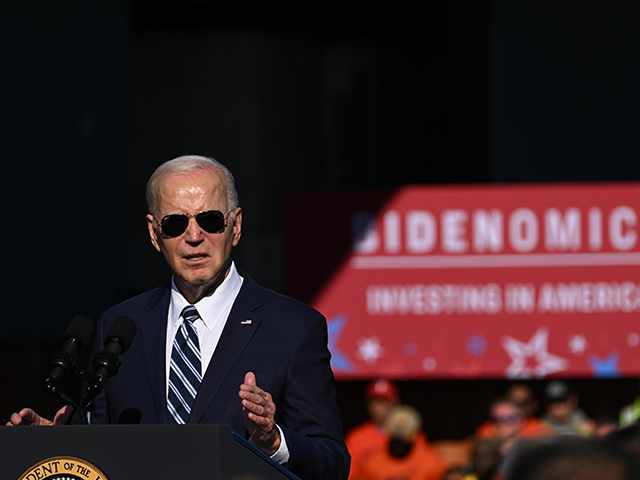

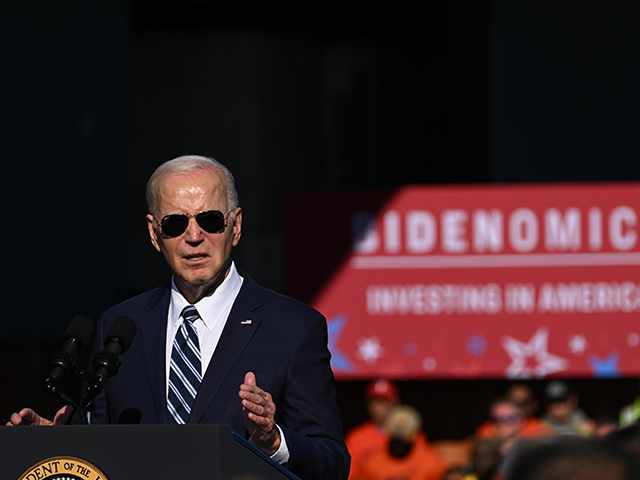

Biden’s Inflation Misstep Was a Warning Sign All Along

by John Carney

Breitbart.com

Biden’s Inflation Crisis Was a Competency Crisis

Biden’s Inflation Crisis Was a Competency Crisis

Joe Biden’s presidency has always had a whiff of improvisation, a tendency to sidestep reality for the sake of convenience. But rarely was this more evident than in July 2021, when he assured the nation that “no serious economist” was worried about inflation spiraling out of control. It was a statement as false as it was revealing, encapsulating the administration’s mix of arrogance, economic mismanagement, and wishful thinking.

In hindsight, this moment offers more than a clue to Biden’s broader failures—it serves as Exhibit A in the case that his presidency was, at its core, marked by incompetence and denial.

Biden’s dismissal of inflation concerns wasn’t just a verbal misstep. It was a bizarre signal that Biden wasn’t in touch with the policy discussion going on across the country.

Labor, Inflation Challenged Hotel Operators in 2024, and Some Worry They Will Persist in 2025

Rising costs of goods and wages tightened margins

by Trevor Simpson

CoStar

Hotel management companies overcome different sets of challenges each year, but the main ones from 2024 were a continuation of lingering issues from years past: labor and inflation.

Hotel management companies overcome different sets of challenges each year, but the main ones from 2024 were a continuation of lingering issues from years past: labor and inflation.

Those two challenges play hand in hand with each other — high inflation leads to higher wages, which has only accentuated existing staffing problems, hoteliers said.

Gregg Forde, president and chief operating officer at West Palm Beach, Florida-based Island Hospitality, said that on a macro level, inflation was the key driver of operational challenges for the hotel industry this year.

Investors Need ‘More Clarity’ On Trump Policy, Inflation: Portfolio Manafer

by Brad Smith and Josh Lipton

Yahoo! Finance

![]() Plaza Advisory Group at Steward Partners director of portfolio management and wealth manager Andrew Briggs joins Morning Brief to discuss his market outlook for 2025.

Plaza Advisory Group at Steward Partners director of portfolio management and wealth manager Andrew Briggs joins Morning Brief to discuss his market outlook for 2025.

Briggs acknowledges significant uncertainty surrounding inflation and upcoming policy changes with the new Trump administration. “Until there’s more clarity, it’s tough to broaden out that portfolio too quickly,” he explains.

He emphasizes the importance of understanding how the Trump administration’s policies, particularly on immigration, will affect the labor market, noting its “direct impact” on both consumers and market performance.

Fixed Household Costs Are Rising Much Faster Than Inflation, Research Shows

from NL Times

The average family’s fixed costs will rise much faster than inflation next year. An average family will pay almost 500 euros more in fixed costs in 2025, more than 120 euros higher than what would be expected based on the rate of inflation. The higher fixed costs are mainly due to soaring insurance rates, according to price comparison site Keuze.nl.

The average family’s fixed costs will rise much faster than inflation next year. An average family will pay almost 500 euros more in fixed costs in 2025, more than 120 euros higher than what would be expected based on the rate of inflation. The higher fixed costs are mainly due to soaring insurance rates, according to price comparison site Keuze.nl.

A family with two adults, two children, a home and a car will pay 474 euros more in fixed costs next year than in 2024 due to rising premiums and increased fees for various subscriptions. Their anticipated costs will therefore increase considerably faster than the expected inflation rate of 3.2 percent they will face next year.

This calculation does not include rent, and it does not include mortgage payments. The website’s analysts calculated household costs on the basis of the most common subscriptions and contracts within families and households, together with data about municipal taxes and fees.

Breitbart Business Digest: Biden’s Inflation Misstep Was a Warning Sign All Along

by John Carney

Breitbart.com

Biden’s Inflation Crisis Was a Competency Crisis

Biden’s Inflation Crisis Was a Competency Crisis

Joe Biden’s presidency has always had a whiff of improvisation, a tendency to sidestep reality for the sake of convenience. But rarely was this more evident than in July 2021, when he assured the nation that “no serious economist” was worried about inflation spiraling out of control. It was a statement as false as it was revealing, encapsulating the administration’s mix of arrogance, economic mismanagement, and wishful thinking.

In hindsight, this moment offers more than a clue to Biden’s broader failures—it serves as Exhibit A in the case that his presidency was, at its core, marked by incompetence and denial.

Biden’s dismissal of inflation concerns wasn’t just a verbal misstep. It was a bizarre signal that Biden wasn’t in touch with the policy discussion going on across the country.

Dollar Bounces From Inflation Data Drop, Euro Soft

by Reuters

Kitco

NEW YORK, Dec 23 (Reuters) – The dollar advanced after a drop in the prior session while the euro edged lower on Monday, as market moves were being dictated by recent global central bank meetings that set expectations for diverging rate cut paths next year.

NEW YORK, Dec 23 (Reuters) – The dollar advanced after a drop in the prior session while the euro edged lower on Monday, as market moves were being dictated by recent global central bank meetings that set expectations for diverging rate cut paths next year.

The dollar index , which measures the U.S. currency against six of its largest peers, resumed its upward trajectory, after suffering its biggest one-day drop in nearly a month on Friday following a softer than expected reading on inflation, but still above the Federal Reserve’s 2% target rate. The greenback is now on track for its fourth gain in five sessions.

The Fed last week projected a more measured pace of rate cuts than markets had been anticipating, pushing both the dollar and U.S. Treasury sharply higher.

Bitcoin: How I Learned to Stop Worrying About Hyperinflation and Love Cryptos

by Kerry Lutz

In recent years, the financial world has witnessed a fascinating tug-of-war between gold and cryptocurrencies, particularly Bitcoin. People who extol the virtues of being able to hold a tangible asset in your hands, mostly older, have been slow to accept the virtues of Bitcoin. While gold has long been the go-to store of value and hedge against economic uncertainty, Bitcoin and other cryptocurrencies have emerged as strong competitors, attracting a new generation of investors. This dynamic has had a significant impact on the price of gold, and many experts argue that cryptocurrencies are playing a role in keeping gold prices lower than they might otherwise be. While this thesis may not be provable, it has a certain intuitive appeal. And it’s important to realize holding gold and crypto are not mutually exclusive.

In recent years, the financial world has witnessed a fascinating tug-of-war between gold and cryptocurrencies, particularly Bitcoin. People who extol the virtues of being able to hold a tangible asset in your hands, mostly older, have been slow to accept the virtues of Bitcoin. While gold has long been the go-to store of value and hedge against economic uncertainty, Bitcoin and other cryptocurrencies have emerged as strong competitors, attracting a new generation of investors. This dynamic has had a significant impact on the price of gold, and many experts argue that cryptocurrencies are playing a role in keeping gold prices lower than they might otherwise be. While this thesis may not be provable, it has a certain intuitive appeal. And it’s important to realize holding gold and crypto are not mutually exclusive.

What Can Christmas Dinner Tell Us About Inflation?

by Finn McEvoy

Economics Observatory

Digital microdata reveal nuance in the price of the holiday season’s most important meal, while historical records highlight how the cost of key ingredients has changed over decades.

Digital microdata reveal nuance in the price of the holiday season’s most important meal, while historical records highlight how the cost of key ingredients has changed over decades.

The typical Christmas dinner is set to cost between £26 and £36 a head this year depending on where you buy your turkey, sprouts, spuds and so on. That’s according to the BBC, but the whole media is awash with such stories this week. Kantar’s estimate of precisely £32.57 features in The Guardian; the Financial Times says that costs have risen 20% since the pandemic; while The Sun is promoting offers for all the Christmas vegetables you need for just 15 pence.

Analysts and media outlets are coming to these varied conclusions by making different assumptions. No two Christmas dinners are alike. The choice of meat (or not), the range of vegetables, the type of stuffing and the volume of gravy to cover it all matter.