from ITM TRADING, INC.

The Economic World Order is Cracking Up and Taking the Dollar Down with It

by David Haggith

GoldSeek

This Deeper Dive will lay out the fault lines that have appeared throughout the US economy. They reveal major tectonic plates that are shifting global economics, which I’ll present with hard facts, not just conjecture to show what is erupting beneath the surface and how dangerous the crumbling world will be as we move through the next ninety days of sustained Trump tariffs (with threat of a return to worse tariffs after ninety days) as the global tariff war continues to rile all global markets. I’ll lay out where the deepest cracks are forming.

This Deeper Dive will lay out the fault lines that have appeared throughout the US economy. They reveal major tectonic plates that are shifting global economics, which I’ll present with hard facts, not just conjecture to show what is erupting beneath the surface and how dangerous the crumbling world will be as we move through the next ninety days of sustained Trump tariffs (with threat of a return to worse tariffs after ninety days) as the global tariff war continues to rile all global markets. I’ll lay out where the deepest cracks are forming.

I’m also going to demonstrate that what you can expect to see in the days ahead in terms of empty shelves and soaring prices is truly horrendous based on what is already happening due to the economic war China just declared on Friday. I warned this was likely coming from tariffs. It just began overnight, and the velocity will grow exponentially if Trump does not fully retreat in a hurry. I’ll lay out the current proofs that collapse is already happening in multiple domains.

She Predicted $3,000+ Gold, the U.S. Dollar Crash, and Global Markets Engulfed in Chaos

from King World News

Nomi Prins, who gives speeches to the World Bank, IMF, and Federal Reserve, correctly predicted $3,000+ gold, the quick crash in the US dollar, and that global markets would be engulfed in chaos. Here are her latest dire warnings and predictions.

Nomi Prins, who gives speeches to the World Bank, IMF, and Federal Reserve, correctly predicted $3,000+ gold, the quick crash in the US dollar, and that global markets would be engulfed in chaos. Here are her latest dire warnings and predictions.

April 12 (King World News) – Nomi Prins: “Yeah, Eric, it’s interesting you did mention the banks and how some of them had moved up their gold forecasts into the $3,000s after we discussed this way before they caught on to this. But yeah, some of them did and some of them are pushing their clients in, and I think it’s a combination of high-net worth individuals saying, ‘Look, we actually want some certainty in our portfolio.’ And again, it’s very obvious that not only has gold rallied but it has rallied in the face of uncertainty on both the upside and the downside of markets. And that, that is very critical. And what’s happening is…

The Money Supply Keeps Growing as the Fed Backs Off Monetary “Tightening”

by Ryan McMaken

Mises.org

Money-supply growth rose year over year in February for the seventh month in a row, the first time this has happened since mid-2022. The current trend in money-supply growth suggests a continued reversal of more than a year of historically large contractions in the money supply that occurred throughout much of 2023 and 2024. As of February, the money supply appears to be continuing in a period of moderate monetary growth coming out of a period of historically large swings in monetary trends from early 2020 to mid-2024.

Money-supply growth rose year over year in February for the seventh month in a row, the first time this has happened since mid-2022. The current trend in money-supply growth suggests a continued reversal of more than a year of historically large contractions in the money supply that occurred throughout much of 2023 and 2024. As of February, the money supply appears to be continuing in a period of moderate monetary growth coming out of a period of historically large swings in monetary trends from early 2020 to mid-2024.

In February, year-over-year growth in the money supply was at 2.75 percent. That’s slightly below December’s 28-month high of 2.79, February reported the second-largest year-over-year increase since September 2022. February’s growth rate was up from January’s rate of 2.34 percent. It’s also a big change from February 2024’s year-over-year decline of 5.62 percent. Last year, the US money supply was still in the midst of the largest drop in money supply we’ve seen since the Great Depression. Prior to 2023, at no other point for at least sixty years had the money supply fallen by so much.

Jasmine Crockett: You Can’t Afford Groceries Because of Trump’s ‘Failed Immigration Policies’

[Ed. Note: Someone ask her what made it unaffordable 4 months ago, before Trump took the Whitehouse?]

by Hannah Knudsen

Breitbart.com

Democrat darling Rep. Jasmine Crockett (D-TX) said the Trump administration’s “failed immigration policies” — which includes deportations — are the reason many Americans cannot afford groceries or a home.

Democrat darling Rep. Jasmine Crockett (D-TX) said the Trump administration’s “failed immigration policies” — which includes deportations — are the reason many Americans cannot afford groceries or a home.

“One thing I can tell you, is that if you sit down and you say, ‘Are you okay with your grocery prices? Are you ok with the fact that housing prices are going up?’ and you start to connect how important it is for us to have immigrants that are contributing to our country in this way, then, people may start to shift,” Crockett said during an appearance on CBS News.

New Highs for Gold, Interest Rates Rise, but Maybe Deflation Ahead?

The word of the day is “uncertainty.” Which may well lead to far more disruptions and dislocations in global markets. Gold is signaling that maybe something is really broken this time. Europe’s solution? Oh, the usual; go to war.

by Dave Fairtex

Chris Martenson’s Peak Prosperity

My (rough) estimate of the deflationary impact of a complete magic-money cutoff is around 8%. Of course, the Fed will eventually “print” (after a long enough wait to punish Trump – because the Fed is comprised of Blue Hats, and Trump = Hitler), but will it be enough? And if the magic money machine scope is disclosed, Fed printing might actually make the situation worse due to the confidence hit post-magic-money disclosure. “Oh, they’re using a FED magic money machine. Bail out of the buck faster!”

My (rough) estimate of the deflationary impact of a complete magic-money cutoff is around 8%. Of course, the Fed will eventually “print” (after a long enough wait to punish Trump – because the Fed is comprised of Blue Hats, and Trump = Hitler), but will it be enough? And if the magic money machine scope is disclosed, Fed printing might actually make the situation worse due to the confidence hit post-magic-money disclosure. “Oh, they’re using a FED magic money machine. Bail out of the buck faster!”

Doug Casey On Trump’s Tariffs and the Coming Economic Fallout

by Doug Casey

International Man

International Man: President Trump recently imposed sweeping tariffs on much of the world, dubbing it Liberation Day.

International Man: President Trump recently imposed sweeping tariffs on much of the world, dubbing it Liberation Day.

Trump declared: “It will forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed, and the day we began to make America wealthy again.”

What’s your take?

Doug Casey: The left constantly calls Trump a liar. And frankly, things like this are why. It’s not that he lies more than a typical politician, or even lies intentionally. It’s that his use of words is so hyperbolic, so estranged from reality, that it makes him seem like a liar. It’s intellectually dishonest—dishonest, period—to falsely label something. It’s bizarre that Trump thinks his potentially catastrophic tariffs should be called Liberation Day.

Wild Trading Continues as Gold Futures Surge Another $115 and U.S. Dollar Collapse Accelerates

from King World News

Wild trading continues in markets as gold futures surge another $115 and the US dollar collapse accelerates, but take a look at this…

Wild trading continues in markets as gold futures surge another $115 and the US dollar collapse accelerates, but take a look at this…

US Dollar Collapse

April 10 (King World News) – Peter Boockvar: … what stands out the most today is the continued weakness in the US dollar where the DXY is having its worst percentage day since November 2022 and nearing 100. The last time it broke 100 was in July 2023.

Donald’s $ Ducks

by Alasdair MacLeod

Gold Money

Measured in gold, the dollar’s decline is accelerating as foreigners bail out and gold is the go-to refuge. It is a panic on a global scale which looks like only just starting.

Measured in gold, the dollar’s decline is accelerating as foreigners bail out and gold is the go-to refuge. It is a panic on a global scale which looks like only just starting.

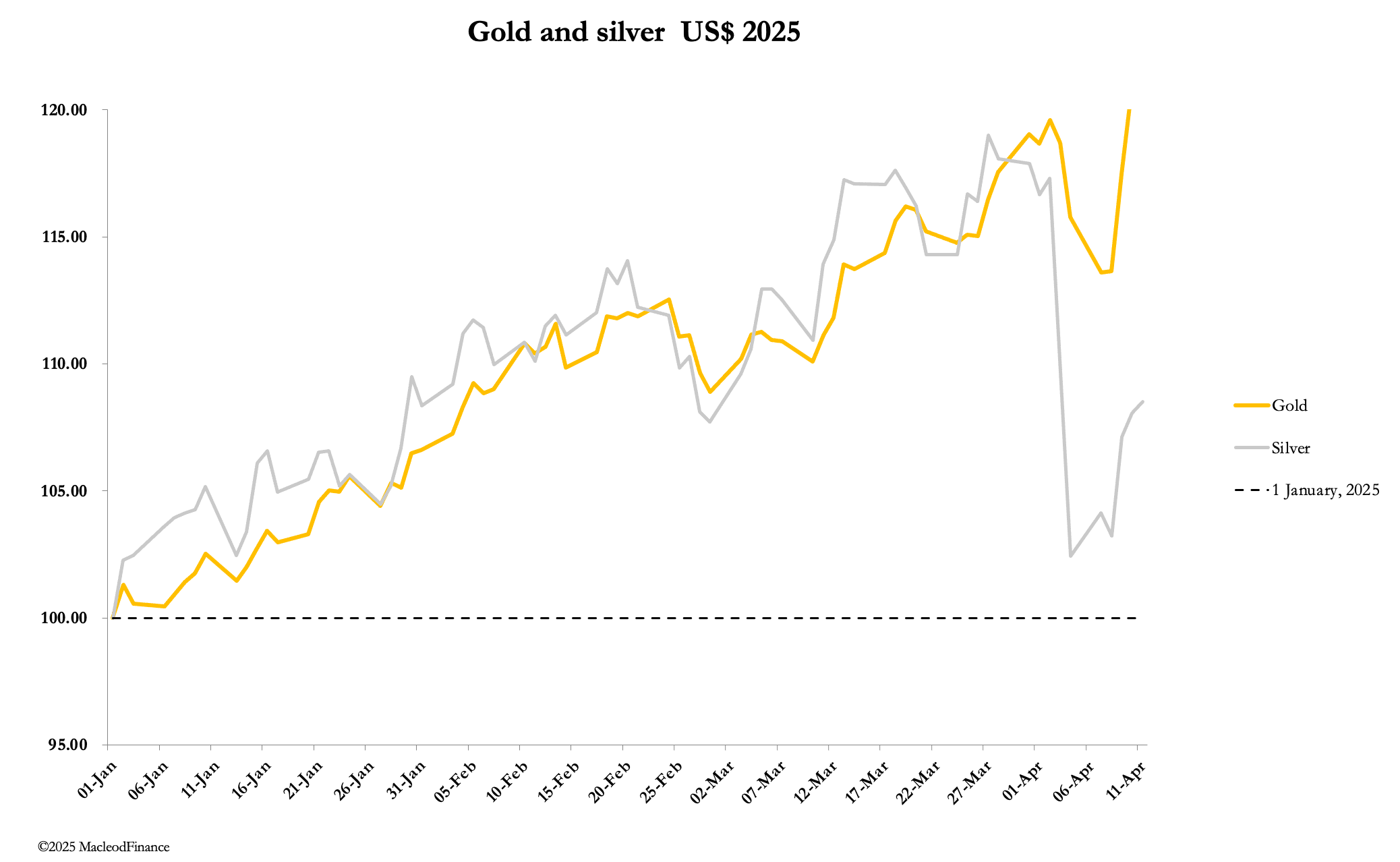

[…] After last week’s dramatic selloff, gold and silver rallied this week, spectacularly in the case of gold. In early morning European trade today, gold was $3221, up $190 from last Friday’s close — a new record level. Silver was $31.46, up $1.88. But since last week’s dramatic selloff, silver has been left way behind gold, reflected in our headline chart.

So what’s driving these two metals?

Part of the reason for this disparity is that Comex dealers have a better understanding of industrial demand factors than of money. This has led them into the wrong contract, which is illustrated in the chart below of price and open interests.

Beneath the Skin of CPI Inflation: Surging Prices of Food, Housing, Medical Care Meet Plunging Prices of Gasoline & Travel Services

by Wolf Richter

Wolf Street

Worst food inflation since 2022. Worst housing inflation in months. But plunging prices for lodging, rental cars, and airfares are interesting.

Worst food inflation since 2022. Worst housing inflation in months. But plunging prices for lodging, rental cars, and airfares are interesting.

In the Consumer Price Index today, month-to-month inflation accelerated further for housing, food, medical care services, and motor vehicle maintenance and repair, showing the worst increases in many months, and in the case of food, in years.

But these price increases were overpowered by plunging gasoline prices, and by plunging prices in the travel sector – month-to-month not annualized: lodging away from home (-3.5%), airline fares (-5.3%), and rental cars (-2.7%). These are huge month-to-month drops, annualized between -28% and -48%.

Jerome Powell Wants ‘Hard Data’ About Tariffs and Inflation Before He Lowers Interest Rates – So Here it is

by Jack Hellner

American Thinker

Jerome Powell says that he needs hard data on the tariffs, and the effect they have on inflation, before he lowers interest rates.

Jerome Powell says that he needs hard data on the tariffs, and the effect they have on inflation, before he lowers interest rates.

Here is some information that should help if he really cares:

China is massively manipulating its currency to keep its prices down and factories humming to offset the tariffs. Just like in Trump’s first term, China is eating a lot of the tariffs, meaning they would have little effect on inflation in the U.S.

Ford says it is discounting the price of its cars until June. If Ford lowers its prices, the other car companies won’t raise prices much.

Walmart says it will work extremely hard to keep its prices low which means other retailers like Amazon will have to follow.