Inflation May Not Be Tamed. How Commodities Can Protect Your Portfolio.

If prices start rising again, copper, corn, and oil could offer protection.

by Andrew Bary

Barron’s

The Bloomberg Commodity Index, a leading gauge, is down 2% this year against the 25% gain in the S&P 500 index. That comes after a 13% drop in 2023, when the equity benchmark returned 26%.

Most retail investors have little or no direct exposure to commodities, even as so-called alternatives like private equity, real estate, and private credit prove increasingly popular with wealthy individuals. A Goldman Sachs survey of family offices—ultrahigh-net-worth families that manage their own money—found that they had just a 1% allocation to commodities, against 26% for private equity.

A Tight Housing Market and Inflation Are Holding Back the Remodeling Business

Lowe’s said it’s seeing less demand for expensive DIY home projects.

by Sarina Trangle

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2166734504-cefd8cf1cffc4f4a90f303cee97f2bd9.jpg) The DIY crowd isn’t doing it for Lowe’s.

The DIY crowd isn’t doing it for Lowe’s.

In a tight housing market, Americans are remodeling less, and that’s challenging for a “DIY dominant business” like Lowe’s, CEO Marvin Ellison said during an earnings call Tuesday. Fewer people are looking to market a home or make it their own: Housing turnover is near a 30-year low, Ellison said, while Americans are still feeling squeezed by high interest rates and inflation.

“Continued underlying pressure in big-ticket discretionary—so, categories like kitchen and bath, flooring and décor—[we] really continue to just see that tied to the macro,” CFO Brandon Sink said, according to a transcript of the call made available by AlphaSense.

In response, executives said, Lowe’s Cos. (LOW) has been trying to focus its core customer on less expensive projects like painting, and generate excitement with a rewards program. The retailer is also trying to serve more home contractors, they said.

U.K. CPI Inflation Rebounds to 2.3% YoY in October vs 2.2% Expected

United Kingdom’s annual CPI jumped 2.3% in October vs. 2.2% estimate.

by FXStreet Team

FX Street

The United Kingdom (UK) Consumer Price Index (CPI) rose at an annual rate of 2.3% in October after increasing by 1.7% in September, the data released by the Office for National Statistics (ONS) showed on Wednesday.

The United Kingdom (UK) Consumer Price Index (CPI) rose at an annual rate of 2.3% in October after increasing by 1.7% in September, the data released by the Office for National Statistics (ONS) showed on Wednesday.

Data beat the expectations for a 2.2% acceleration, moving back above the Bank of England’s (BoE) 2.0% target.

Core CPI (excluding volatile food and energy items) edged higher by 3.3% YoY in October as against a 3.2% growth in September while outpacing the market forecast of 3.1%.

The UK October Services CPI inflation advanced to 5.0% YoY in October versus September’s 4.9%.

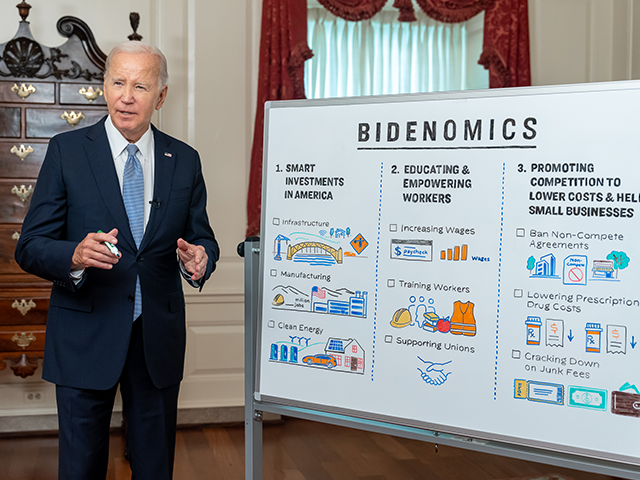

Breitbart Business Digest: How Bidenomics Triggered the Inflation Crisis and Cost Democrats Everything

by John Carney

Breitbart.com

How Biden’s Spending Explosion Caused the Inflation Crisis

How Biden’s Spending Explosion Caused the Inflation Crisis

Now that the election is safely in the past, we are finally getting some clarity about the economically damaging inflation that crippled Joe Biden’s presidency and swept the legs out from Kamala Harris’s attempt to become the 47th president.

The Wall Street Journal on Sunday night published a piece by Nick Timiraos, the paper’s chief economics correspondent and the nation’s leading Fed interpreter. Timiraos’s status as the Fed’s main conduit for indirectly communicating with investors and the public and as the Journal‘s top economic news guy is important to understanding the impact of this story.

U.S. Labor Market Still Boosting Inflation, San Francisco Fed Economists Say

by Reuters

Kitco

SAN FRANCISCO, Nov 18 (Reuters) – A tight U.S. labor market is still adding to inflationary pressures, though less so than it did in 2022 and 2023, according to research published on Monday by the San Francisco Federal Reserve.

SAN FRANCISCO, Nov 18 (Reuters) – A tight U.S. labor market is still adding to inflationary pressures, though less so than it did in 2022 and 2023, according to research published on Monday by the San Francisco Federal Reserve.

“Declines in excess demand pushed inflation down almost three-quarters of a percentage point over the past two years,” San Francisco Fed economists Regis Barnichon and Adam Hale Shapiro wrote in the regional Fed bank’s latest Economic Letter. “However, elevated demand continued to contribute 0.3 to 0.4 percentage point to inflation as of September 2024.”

The finding, based on an analysis of the relationship between inflation and labor market heat as measured by the ratio of job openings to job seekers, could help inform Fed policymakers as they weigh how much further and at what pace to reduce short-term borrowing costs.

How Much Has the Cooling Economy Reduced Inflation?

by Regis Barnichon and Adam Shapiro

Federal Reserve Bank of San Francisco

Inflation still lies somewhat above the Federal Reserve’s 2% goal after slowing significantly since its spring 2022 peak. Analysis shows that two labor market indicators—the ratios of job vacancies to unemployed workers and of vacancies to effective job seekers—are particularly informative in determining excess demand’s impact on recent inflation. The measures suggest that declines in excess demand pushed inflation down almost three-quarters of a percentage point over the past two years. However, elevated demand continued to contribute 0.3 to 0.4 percentage point to inflation as of September 2024.

Inflation still lies somewhat above the Federal Reserve’s 2% goal after slowing significantly since its spring 2022 peak. Analysis shows that two labor market indicators—the ratios of job vacancies to unemployed workers and of vacancies to effective job seekers—are particularly informative in determining excess demand’s impact on recent inflation. The measures suggest that declines in excess demand pushed inflation down almost three-quarters of a percentage point over the past two years. However, elevated demand continued to contribute 0.3 to 0.4 percentage point to inflation as of September 2024.

The well-known Phillips curve explains the relationship between inflation and unemployment—specifically that inflation is high when overall demand exceeds overall supply. With current inflation still somewhat above the Federal Reserve’s 2% goal, it is plausible that excess demand remains in the economy. Our prior research found that labor market tightness as measured by the ratio of job vacancies to unemployment (V–U ratio) outperformed other common measure of excess demand in forecasting inflation (Barnichon and Shapiro 2022).

Will Inflation Rise Under Trump? Economists Weigh In

by Shane Croucher

Newsweek

Voter dissatisfaction with the economy, particularly the high cost of living after post-COVID inflation, helped bring Donald Trump back to the White House.

Voter dissatisfaction with the economy, particularly the high cost of living after post-COVID inflation, helped bring Donald Trump back to the White House.

Inflation peaked at 9.1 percent in June 2022, driven by disrupted supply chains, stimulus spending, and global energy prices. Despite recovery efforts, many Americans still felt worse off by the 2024 election.

Trump’s campaign promised to “end inflation” and “make America affordable again,” but some policies could raise prices.

Additional tariffs and mass deportations might increase wages but also production costs. His plans to extend tax cuts could stimulate spending but, if they increase the deficit and federal debt, also drive up interest rates.

Russia is Locking Up Butter as Inflation Crisis Reaches New Heights

by Tim Lister

CTV News

Americans have spent the last few years complaining about inflation. But price rises in Russia are eye-watering by comparison – and just one symptom of an economy that is overheating.

Americans have spent the last few years complaining about inflation. But price rises in Russia are eye-watering by comparison – and just one symptom of an economy that is overheating.

Butter, some meats, and onions are about 25 per cent more expensive than a year ago, according to official data. Some supermarkets have taken to keeping butter in locked cabinets: Russian social media has shown stocks being stolen.

The overall inflation rate is just shy of 10 per cent, much higher than the central bank anticipated.

Inflation is being driven by the rapid rise in wages as the Kremlin pours billions into military industries and sends millions of men to fight in Ukraine. In the middle of a war, companies outside the defence sector can’t compete for workers without paying much higher wages. In turn, they charge higher prices. So the spiral continues.

The Trump Inflation Problem

by John Mauldin

GoldSeek

Two weeks ago, I opened this letter by noting the election uncertainty, once over, would give way to a different uncertainty about what comes next. That’s where we are now.

Two weeks ago, I opened this letter by noting the election uncertainty, once over, would give way to a different uncertainty about what comes next. That’s where we are now.

I fully expected a closer outcome that would take some time to resolve. Instead, we have an undisputed president-elect moving full speed ahead. And what we see publicly is a small part of what’s happening behind the scenes. I am reasonably well informed, and I have a lot of friends who are very well informed, but I don’t know anyone who hasn’t been surprised. And it’s not clear how everything will play out. It gives a whole new meaning to the lyrics: “A wheel in a wheel… Way up in the middle of the air.”

Our uncertainty stems from the simple fact that change is hard. Everything Trump wants to do will face powerful opposing forces, and not always Democrats. Many will be other Republicans, or people who supported his campaign. Some people helped Trump win precisely because they wanted to influence his actions. That’s how politics works. The technical term is “logrolling.”

Ron Baron Thinks Inflation is Higher Than You’ve Been Told

by Al Root

Barron’s

Growth investor Ron Baron believes inflation runs hotter than most people think. He has an idea about what investors should do with that information.

Growth investor Ron Baron believes inflation runs hotter than most people think. He has an idea about what investors should do with that information.

At Friday’s 31st annual Baron Investment Conference at New York City’s Lincoln Center, the firm included a handout “Inflation According to Ron Baron.”

It listed price changes the Octogenarian founder of Baron Capital has experienced over the past 75-plus years for homes, cars, gasoline, college tuition, steaks, and even golf caddy fees. Inflation has averaged roughly 4.5% to 6.5% a year.

Official government statistics peg the inflation rate at about 3.5% over the same span.