from Forbes Breaking News

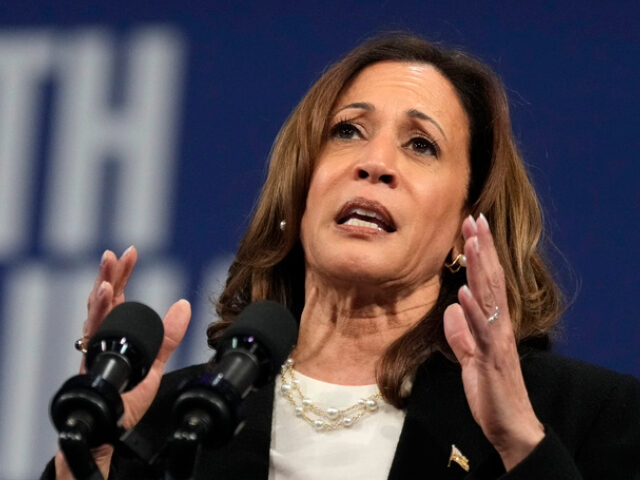

Kamala Harris Sidesteps Economic Reality, Bizarrely Says She Will Lower Costs By Lowering Cost of Necessities

by Hannah Knudsen

Breitbart.com

Vice President Kamala Harris appeared to be stumped when asked how she would lower the cost of living as president, telling a couple during a Q&A with Oprah Winfrey that she would do so by “bringing down the cost of everyday necessities” despite the fact that the cost of many necessities — including groceries, which she mentioned — have skyrocketed under her leadership.

Vice President Kamala Harris appeared to be stumped when asked how she would lower the cost of living as president, telling a couple during a Q&A with Oprah Winfrey that she would do so by “bringing down the cost of everyday necessities” despite the fact that the cost of many necessities — including groceries, which she mentioned — have skyrocketed under her leadership.

“We really would love to know what your plan is to help lower the cost of living,” the couple asked Harris, who immediately kicked off with a word salad, ignoring the actual question:

Gold Hits Another Record High, but Are We Looking at Deflation or Inflation in the Future?

from King World News

Today gold has hit another record high, but are we looking at deflation or inflation in the future?

Today gold has hit another record high, but are we looking at deflation or inflation in the future?

September 20 (King World News) – Matthew Piepenburg, partner at VON GREYERZ AG: As a polarized U.S. marches toward a political, financial, and perhaps even military crossroads in the closing months 2024, many feel what George Lucas might otherwise describe as a “disturbance in the force.”

From blow-off market tops, empty political platitudes and an openly broken bond market to debased currencies and large swaths of the planet at war or inching toward escalation, it seems we are juggling aspects of the stupid, the broken, the insane and perhaps even…the evil.

Let’s start with the stupid…

Tim Walz Stumped By Question On Inflation; Repeats Lie About Trump ‘Sales Tax’

by Joel B. Pollak

Breitbart.com

Minnesota Gov. Tim Walz, the Democratic nominee for vice president, was stumped Tuesday when asked by a reporter to explain what he and Vice President Kamala Harris would do for families struggling financially.

Minnesota Gov. Tim Walz, the Democratic nominee for vice president, was stumped Tuesday when asked by a reporter to explain what he and Vice President Kamala Harris would do for families struggling financially.

In an interview with local Macon, Georgia, CBS affiliate WMAZ, Walz first said that he and Harris understood the problem because they are “middle class.”

[…] He then offered a series of her proposals unrelated to inflation:

I tell them Kamala Harris and I know something about it being middle-class folks. Our family sit at the table trying to pay the bill. We know coming out of the COVID pandemic with prices where they were, that people need to see some relief.

And I think that’s why Kamala Harris has put out a plan — especially around home ownership — making sure we’re building 3 million more affordable homes, making sure we’re making the down payment assistance there.

The Denarius and the Dollar: Price Controls Then and Now

by J.D. Weigel

Mises.org

Since the response to Covid-19, the preeminent economic concern of the American public has been, simply put, price inflation. In an attempt to curry favor with the electorate, Vice President Kamala Harris recently declared support for price controls to combat high prices, which she attributes to supply chain issues and corporate greed.

Since the response to Covid-19, the preeminent economic concern of the American public has been, simply put, price inflation. In an attempt to curry favor with the electorate, Vice President Kamala Harris recently declared support for price controls to combat high prices, which she attributes to supply chain issues and corporate greed.

Today, it often seems that our country’s scope and knowledge of history is reduced to a few platitudes concerning markets that date back no further than the mid-1930’s, or perhaps the 1920’s. Inflation and currency debasement, however, go much further back. Furthermore, they are often accompanied by attempts to correct them with price controls. This has especially been the case with empires.

In the past year, there was a meme of sorts, where women would be perplexed to find out just how often their husbands, when asked, reflected on the Roman Empire during the course of a week.

Peter Schiff: Like Kamala, the Fed’s “Values Haven’t Changed”

by Peter Schiff

Schiff Sovereign

The Fed Chairman was flush with praise yesterday over the stupendous state of the US economy.

The Fed Chairman was flush with praise yesterday over the stupendous state of the US economy.

The economy is in a “good place”, he told reporters at a press conference after announcing a 50-basis point (0.5%) interest rate cut. The labor market is “strong”. Inflation is “coming down”. They’re “confident” about the future outlook. Basically, everything is awesome.

But at least a handful of reporters noticed the obvious paradox: if the economy is doing so great, then why are you slashing interest rates?

Typically, central bankers only cut interest rates when the economy is weakening… which certainly doesn’t conform to the Chairman’s effervescent outlook.

Brace for Impact: The Fed’s Panic Cut is a Sign the Worst is Yet to Come

by Sean Ring

Daily Reckoning

Yesterday, the Federal Open Market Committee (FOMC) shocked most market watchers, including yours truly, with an aggressive 50 basis point cut, a mostly unexpected move. The Fed’s decision, which saw Governor Michelle Bowman dissenting, raises serious questions about the stability of the U.S. economy. The stark contrast between the cut and the rhetoric leading up to the meeting signals more than just a recalibration of monetary policy. It signals fear.

Yesterday, the Federal Open Market Committee (FOMC) shocked most market watchers, including yours truly, with an aggressive 50 basis point cut, a mostly unexpected move. The Fed’s decision, which saw Governor Michelle Bowman dissenting, raises serious questions about the stability of the U.S. economy. The stark contrast between the cut and the rhetoric leading up to the meeting signals more than just a recalibration of monetary policy. It signals fear.

For months, Fed Chair Jerome Powell and his colleagues have emphasized that inflation remains stubborn, necessitating tighter policy for longer. But the sudden 50 bps cut suggests the Fed sees something behind the scenes that has them spooked—and it should have the rest of us spooked, too.

Let’s break down why this move reeks of panic, what Bowman’s dissent tells us, and why this could be the sell signal that stock market bulls desperately want to ignore.

Is There a Secret Ulterior Motive Behind the “Emergency Move” That the Federal Reserve Just Made?

by Michael Snyder

The Economic Collapse Blog

We aren’t supposed to question anything that the Federal Reserve does. We are just supposed to quietly accept their decisions and move on. Sadly, most Americans don’t even realize that the Federal Reserve has far more power over the economy than anyone else does. We often talk about the “Biden economy” or the “Trump economy”, but the truth is that the Fed is much more responsible for our economic performance than the White House is. So the fact that the Fed just made an “emergency move” that is normally only reserved for times of crisis should deeply alarm all of us. Has the Fed made this move for a secret reason that they aren’t telling us?

We aren’t supposed to question anything that the Federal Reserve does. We are just supposed to quietly accept their decisions and move on. Sadly, most Americans don’t even realize that the Federal Reserve has far more power over the economy than anyone else does. We often talk about the “Biden economy” or the “Trump economy”, but the truth is that the Fed is much more responsible for our economic performance than the White House is. So the fact that the Fed just made an “emergency move” that is normally only reserved for times of crisis should deeply alarm all of us. Has the Fed made this move for a secret reason that they aren’t telling us?

On Wednesday, the Federal Reserve reduced interest rates for the very first time in more than four years…

Why the Experts Are Wrong About Inflation

by Scott Sumner

Econlib

Almost every time I see an expert interviewed on the macroeconomy, they suggest that a substantial portion of the inflation over the past 5 years has been supply side. That’s wrong; none of it has been supply side. I’d go even further; essentially none of the inflation over the past 50 years has been supply side.

Almost every time I see an expert interviewed on the macroeconomy, they suggest that a substantial portion of the inflation over the past 5 years has been supply side. That’s wrong; none of it has been supply side. I’d go even further; essentially none of the inflation over the past 50 years has been supply side.

To be clear, I am speaking of the total cumulative increase in prices over 5 years, or over 50 years. It is true that some of the inflation in 1979 was supply side, as well as some of the inflation during 2008, or 2022. There have been individual years where negative supply shocks pushed up prices, but just as many years where positive supply shocks pushed down prices.

Many experts implicitly seem to think there’s some sort of “ratchet effect”, where negative supply shocks push up prices, and then inflation settles back to its average rate. That’s false. When negative supply shocks are not causing inflation to rise above average, positive supply shocks cause it to fall below average.

Fed Unveils Oversized Rate Cut as it Gains ‘Greater Confidence’ About Inflation

by Howard Schneider and Ann Saphir

Reuters.com

WASHINGTON, Sept 18 (Reuters) – The U.S. central bank on Wednesday kicked off an anticipated series of interest rate cuts with a larger-than-usual half-percentage-point reduction that Federal Reserve Chair Jerome Powell said was meant to show policymakers’ commitment to sustaining a low unemployment rate now that inflation has eased.

WASHINGTON, Sept 18 (Reuters) – The U.S. central bank on Wednesday kicked off an anticipated series of interest rate cuts with a larger-than-usual half-percentage-point reduction that Federal Reserve Chair Jerome Powell said was meant to show policymakers’ commitment to sustaining a low unemployment rate now that inflation has eased.

“We made a good strong start and I am very pleased that we did,” Powell said at a press conference after the Fed, noting its increased confidence that the country’s bout with high inflation was over, reduced its benchmark policy rate by 50 basis points to the 4.75%-5.00% range. “The logic of this both from an economic standpoint and from a risk management standpoint was clear.”

Trump and Harris’ Views On Inflation, According to Their Records and What They’ve Said

by Kathryn Watson

CBS News

Inflation is consistently a top issue ahead of the 2024 presidential election — in CBS News’ polling in mid-August, 76% of registered voters said it was a major factor in their choice for president — and they want to know how nominees Donald Trump and Kamala Harris would address it.

Inflation is consistently a top issue ahead of the 2024 presidential election — in CBS News’ polling in mid-August, 76% of registered voters said it was a major factor in their choice for president — and they want to know how nominees Donald Trump and Kamala Harris would address it.

Inflation — the rate of an increase in the price of goods and services over time — has hollowed out many voters’ wallets and made it tougher for Americans to save. According to the Federal Reserve, inflation averaged 1.9% a year from 2017 to 2021 when Trump was president.

Though inflation recently cooled to a three-year low of 2.5%, it’s on track to average 5% a year during the Biden administration.