Inflation wasn’t transitory, and neither is the blame for it. Powell’s attempt to rewrite history just doesn’t match the data.

by Bryan Cutsinger

The Daily Economy

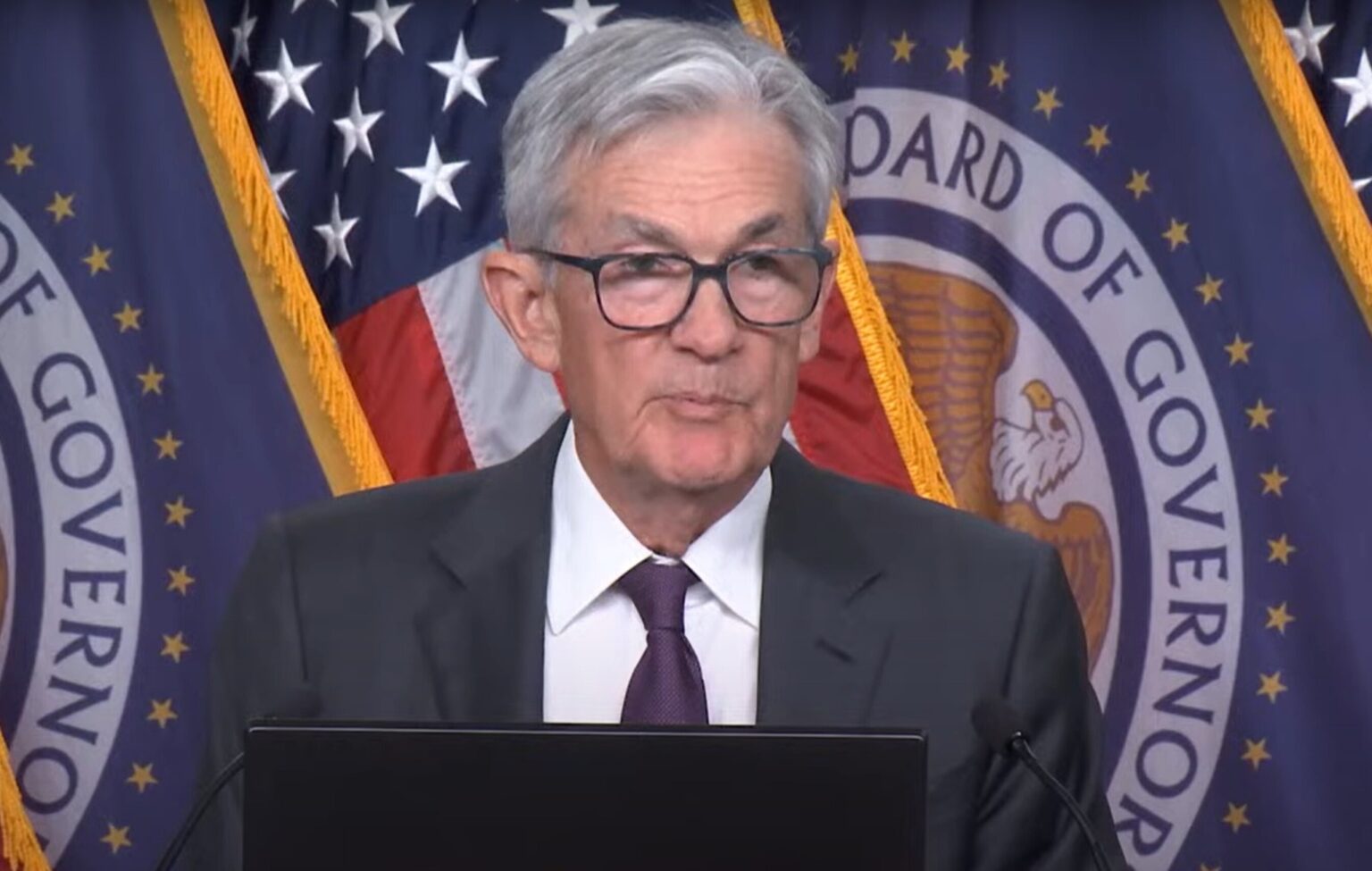

At a recent press conference, Federal Reserve Chair Jerome Powell claimed that the Fed’s flexible average inflation targeting (FAIT) framework did not contribute to the post-pandemic inflation surge.

At a recent press conference, Federal Reserve Chair Jerome Powell claimed that the Fed’s flexible average inflation targeting (FAIT) framework did not contribute to the post-pandemic inflation surge.

There was nothing moderate about the overshoot. It was — it was an exogenous event. It was the pandemic and it happened and, you know, our framework permitted us to act quite vigorously. And we did once we decided that that’s what we should do. The framework had really nothing to do with the decision to — we looked at the inflation as — as transitory and — right up to the point where the data turned against that. — and when the data turned against that in late ‘21, we changed our — our view and we raised rates a lot. And here we are at 4.1 percent unemployment and inflation way down. But the framework was — was more — was more irrelevant than anything else that — the that part of it — that part of it was irrelevant. The rest of the framework worked just fine as — as we used it — as it supported what we did to bring inflation down.

The temporary rise in inflation and permanent rise in the price level was, according to Powell, beyond the Fed’s control. The Fed’s framework did not inhibit the Fed’s response. To the contrary, Powell said, the framework supported the Fed’s efforts to rein in inflation.