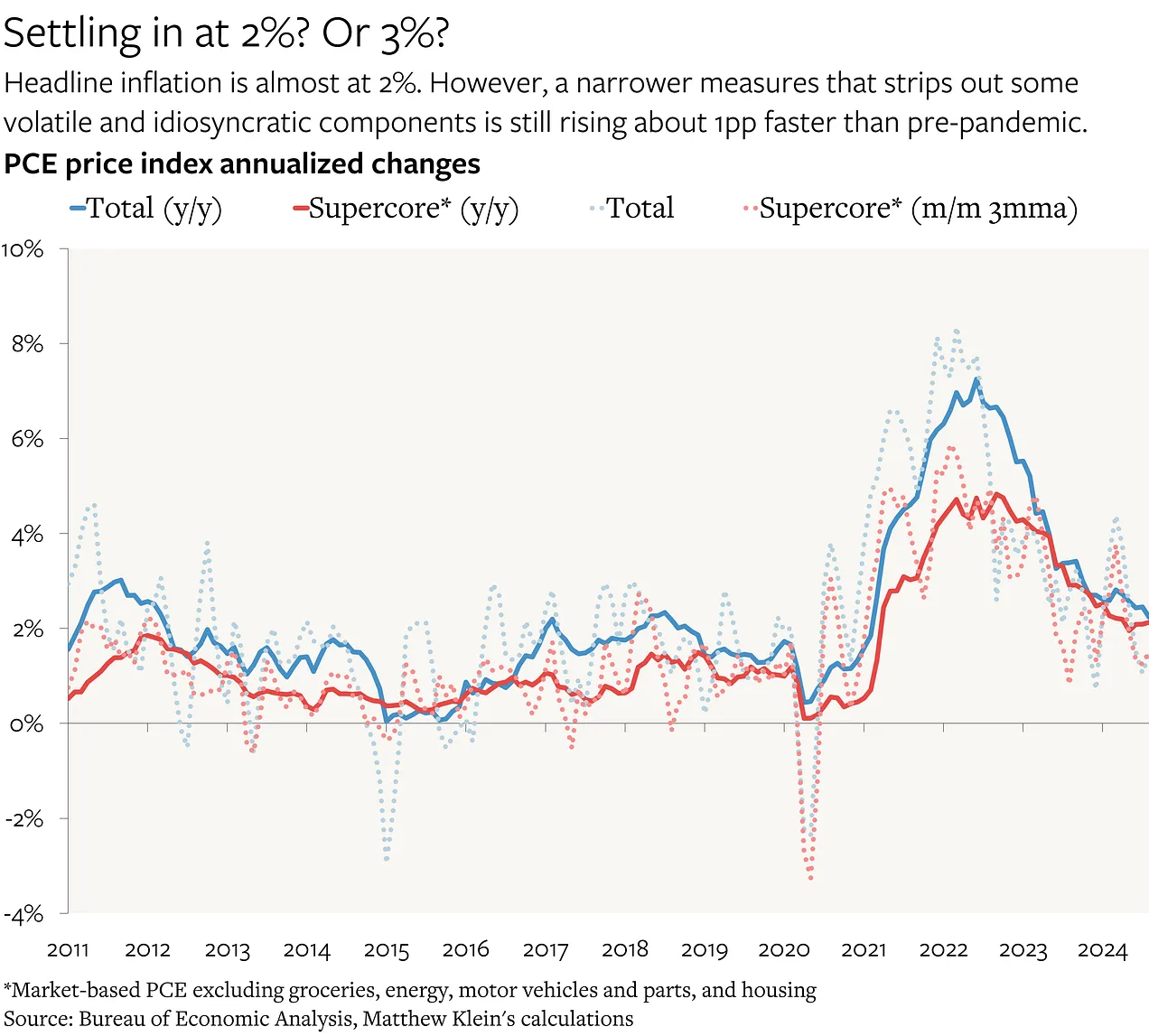

Underlying measures of prices are still rising about one percentage point or so faster than they were in 2017-2019. But there is nothing wrong with this new normal, even if may not be fully priced in.

by Matthew C. Klein

The Overshoot

Federal Reserve officials’ preferred measure of inflation—the Personal Consumption Expenditure (PCE) price index—rose just 2.2% over the past 12 months. Over the past six months, PCE inflation has come in at just 1.9% annualized, and by just 1.5% annualized over the past three months. Little wonder that Fed officials have shifted their focus from worrying about inflation to preempting any potential further weakness in the job market.

While that may be the correct decision, many of the underlying inflation measures that are supposed to strip out the noise from volatile and idiosyncratic components imply that prices are still rising about 1 percentage point faster than they were in the years immediately preceding the pandemic. That is broadly consistent with the latest data on nominal wages and incomes, which suggests that it is more representative of the underlying trends than a few good months of headline inflation prints.