Different Household – Different Inflation Rate

by Regina Kiss and Georg Strasser

European Central Bank

Households differ considerably in terms of the inflation they experience at any point in time. The main reasons for this are that prices (and thus price changes) differ from place to place and that households do not all buy the same products. Households adjust their purchases over time, but not enough to offset these differences.

Households differ considerably in terms of the inflation they experience at any point in time. The main reasons for this are that prices (and thus price changes) differ from place to place and that households do not all buy the same products. Households adjust their purchases over time, but not enough to offset these differences.

Sources of inflation rate dispersion across households

The differences between households in terms of their exposure to inflation have gained a lot of attention, especially since the recent jump in the cost of living. Their different inflation experiences feed into different inflation perceptions and expectations (D’Acunto et al. 2021; Weber et al. 2022). In turn, this can mean that households seemingly react differently to aggregate inflation. Moreover, systematic inflation differences among households can have distributional effects. For example, because poorer households spend a larger share of their income on food, an increase in food prices reduces their purchasing power relatively more.

Erdogan’s Economy: Turkish Inflation Hits 91%, Tanking Tourism Industry

by John Hayward

Breitbart.com

Persistently high inflation under the policies of President Recep Tayyip Erdogan is decimating the Turkish tourism industry, as both foreign visitors and locals decide to save money by nipping over to Greece for holiday getaways.

Persistently high inflation under the policies of President Recep Tayyip Erdogan is decimating the Turkish tourism industry, as both foreign visitors and locals decide to save money by nipping over to Greece for holiday getaways.

“Angry citizens have taken to social media to share their bills, including the equivalent of $640 for food and drinks for five people in Bodrum and $30 for five scoops of ice cream in Cesme,” Fortune reported Monday.

Grumpy Turks said the quality of service at hotels and restaurants is declining even as the prices skyrocket. Some accused Turkish businesses of using notoriously high inflation as an excuse to push their prices even higher.

Biden’s Big Government Solutions Dismiss Customer Welfare

Sen. Rand Paul writes that repealing the Robinson-Patman Act would help bust inflation.

by Rand Paul

Reason.com

The ostensible purpose of antitrust policy is to promote healthy competition in the marketplace, but antitrust enforcement has largely protected inefficient firms from the threat of competition and deprived consumers of the lower prices they would otherwise enjoy. Thanks to legal scholars like Robert Bork, antitrust enforcement over the past four decades has primarily focused on the most logical place—maximizing benefits for consumers. But Democrats are taking a radical turn from Bork’s philosophy by reviving a nearly 90-year-old price discrimination law known as the Robinson-Patman Act, making discounts to lower prices illegal. To strengthen your family’s purchasing power, the Robinson-Patman Act should be repealed.

The ostensible purpose of antitrust policy is to promote healthy competition in the marketplace, but antitrust enforcement has largely protected inefficient firms from the threat of competition and deprived consumers of the lower prices they would otherwise enjoy. Thanks to legal scholars like Robert Bork, antitrust enforcement over the past four decades has primarily focused on the most logical place—maximizing benefits for consumers. But Democrats are taking a radical turn from Bork’s philosophy by reviving a nearly 90-year-old price discrimination law known as the Robinson-Patman Act, making discounts to lower prices illegal. To strengthen your family’s purchasing power, the Robinson-Patman Act should be repealed.

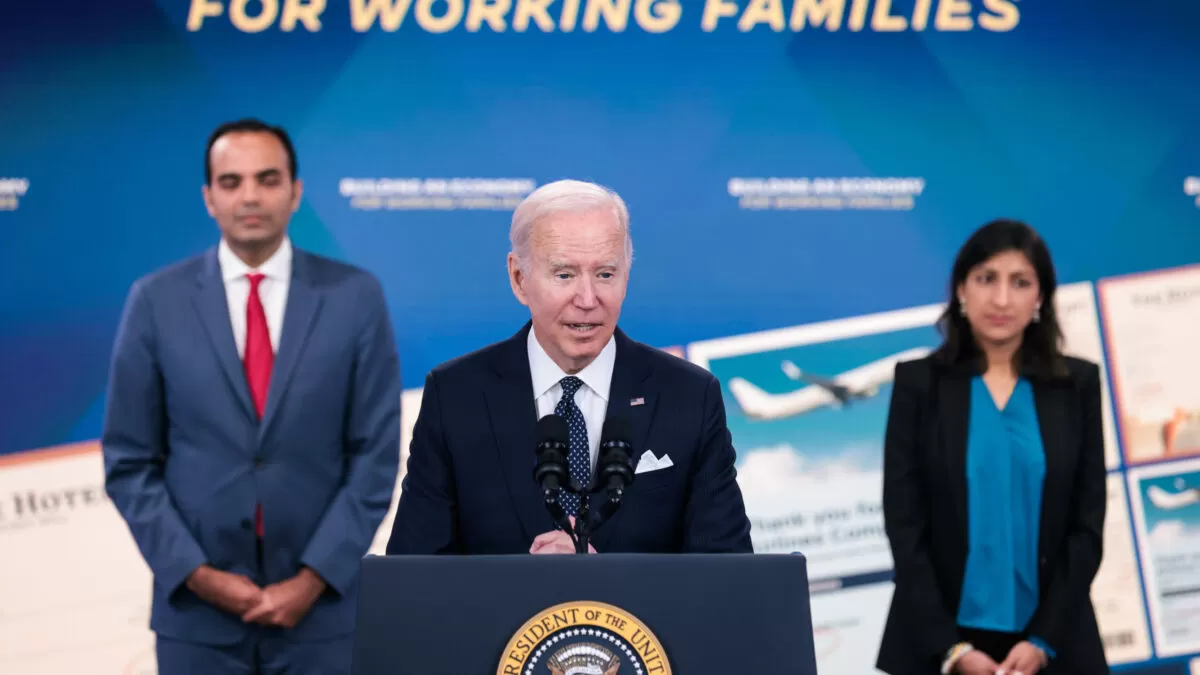

At a press conference in 2021, President Joe Biden called for “full and aggressive enforcement” of archaic antitrust laws against private industry. “Forty years ago, we chose the wrong path, in my view,” said Biden, “following the misguided philosophy of people like Robert Bork.” Now, instead of protecting consumers, the Federal Trade Commission (FTC) is determined to scapegoat well-run businesses to divert blame away from Biden for his own inflationary policies.

Venezuela Inflation Has Cooled, but Voters Say They Still Can’t Make Ends Meet

With the Venezuelan presidential election looming, workers say their salaries have not caught up with prices, despite lowest inflation rates in years.

by Reuters

NBC News

The government of Venezuelan President Nicolás Maduro, who is seeking reelection on Sunday, has had some success in curbing formerly sky-high inflation, but workers say their salaries have not caught up with high prices for food and other goods.

The government of Venezuelan President Nicolás Maduro, who is seeking reelection on Sunday, has had some success in curbing formerly sky-high inflation, but workers say their salaries have not caught up with high prices for food and other goods.

That, combined with general frustration after years of economic malaise, could chill support for Maduro and help bring out the vote for opposition coalition candidate Edmundo González, said voters and analysts.

Venezuela had suffered six-digit hyperinflation for about four years, with the indicator reaching a heady 130,000%, eroding savings and making basic supplies scarce.

Republican Platform Ignores Real Causes of Inflation

by Dr. Ron Paul

Ron Paul Institute

The 2024 Republican platform promises that, if Donald Trump returns to the White House and Republicans gain complete control of Congress, they will reduce inflation. The platform contains some proposals, such as reducing regulations and extending the 2017 tax reductions, that may help lower prices in some sectors and spur economic growth. However, the GOP platform does not address how the Federal Reserve’s enabling of spendaholic politicians contributes to price inflation.

The 2024 Republican platform promises that, if Donald Trump returns to the White House and Republicans gain complete control of Congress, they will reduce inflation. The platform contains some proposals, such as reducing regulations and extending the 2017 tax reductions, that may help lower prices in some sectors and spur economic growth. However, the GOP platform does not address how the Federal Reserve’s enabling of spendaholic politicians contributes to price inflation.

Other than an obligatory promise to cut “wasteful” spending, and a pledge to eliminate the Department of Education, the Republican platform is largely silent on proposals to reduce federal spending.

Cell Phones, Clothes … Rent? Inflation Pushes Teens Into the Workforce

by Bailey Schulz and Jessica Guynn

USA Today

At 18, Michelle Chen covers her cellphone bills as well as school expenses. She squirrels away money for college. And, with her earnings from a summer job with the Boston’s SuccessLink Youth Employment Program, she helps her parents by stocking the fridge with groceries when the shelves are bare and makes sure her two younger brothers have pocket money.

At 18, Michelle Chen covers her cellphone bills as well as school expenses. She squirrels away money for college. And, with her earnings from a summer job with the Boston’s SuccessLink Youth Employment Program, she helps her parents by stocking the fridge with groceries when the shelves are bare and makes sure her two younger brothers have pocket money.

Chen, a nursing major at Simmons University in Boston this fall, said she began working in fourth grade when her family ran a Chinese takeout restaurant. Since then, she has worked in social media marketing for a hair care company and as a coding instructor, learning soft skills that aren’t typically taught in school such as teamwork and time management.

Those skills, she said, helped her thrive in her classes. And the extra pocket money means she can pitch in with family expenses.

Trump Would Send Inflation Higher. That’s Not Good for Crypto, Says Analyst

Tax cuts, tariffs, and a weaker dollar lead to inflation, said Noelle Acheson.

by Ben Weiss

DL News

Former President Donald Trump is pro-crypto.

Former President Donald Trump is pro-crypto.

He’s met with prominent Bitcoin miners and will speak at an industry conference, while crypto boosterism is even part of the Republican party’s election platform.

Many in the industry swoon over Trump and think he’ll “pump their bags.”

But could Trump’s economic policies end up hurting, not helping, the crypto markets?

If we assume that the former president’s economic platform leads to higher inflation, then yes, said Noelle Acheson, a crypto and macroeconomic analyst, in a recent newsletter.

Inflation: How to Win Back Consumers When Discounts Are Not Enough

by Michelle Smith

Supermarket Perimeter

CHICAGO — Consumers have long memories, which means sales and promotions at grocery stores don’t seem like bargains right now because prices are 30% higher than they were five years ago.

CHICAGO — Consumers have long memories, which means sales and promotions at grocery stores don’t seem like bargains right now because prices are 30% higher than they were five years ago.

“It’s almost like the elephant memory where no one’s forgetting what the prices used to be. Therefore, when they go into the stores expecting to find the prices they used to pay, they’re not there,” said Sally Lyons Wyatt, global executive vice president and chief advisor, consumer goods and foodservice insights, Circana.

She was part of a panel discussion “How Rising Food Prices Create Challenges and Opportunities” at IFT First, the annual food science and innovation expo held July 14-17 in Chicago.

Turkish Tourists Flock to Greece as Inflation Drives Hotel Prices Through the Roof

by Emre Basaran

EuroNews

Hotel prices and ticket costs are soaring in Türkiye as inflation hits tourism.

Hotel prices and ticket costs are soaring in Türkiye as inflation hits tourism.

Turkish tourists are flocking to Greece as inflation makes it too expensive to travel within Turkey.

Inflation has surged in Türkiye in recent months, rocketing to 75.4 per cent in May, driven mainly by increases in hotel, cafe and restaurant prices.

“Actually, this problem started last year when the Turkish government took steps to suppress foreign currency,” Kivanç Meriç, Chairman of the Izmir Regional Representative Board of the Association of Turkish Travel Agencies (TÜRSAB), tells Euronews Travel.

Analyst Says the “Forces Underway for Inflation to Fall Like a Rock Are in Place”

Says its urgent that the Fed cut rates

by Eamonn Sheridan

Forex Live

Tom Lee is Fundstrat Global Advisors co-founder and head of research. Spoke with CNBC on Monday.

He is expecting inflation data from the US due on Friday (PCE) to be cooler.

- “One print can be uncertain, but I think the forces underway for inflation to fall like a rock are in place”

- there do not seem to be any new drivers of inflation

- so it can surprise to the downside

- expects inflation to fall sharply due to a recession in durable goods

- said there is “urgency” for the Federal Reserve to begin cutting interest rates

The data is due on Friday 25 July at 0830 US Eastern time / 1230 GMT

Fed’s Fake Victory Over Inflation

by David Stockman

LewRockwell.com

If you don’t think the Fed has become an abject handmaid of the Wall Street gamblers, take a gander at the chart below. Owing to the slight down-tick in this week’s monthly CPI report, the outcry for rate cuts is reaching a deafening roar down in the trading pits. And judging by Powell’s presser on Wednesday, the Fed is fixing to bend over soon, bar of soap in outstretched hand.

If you don’t think the Fed has become an abject handmaid of the Wall Street gamblers, take a gander at the chart below. Owing to the slight down-tick in this week’s monthly CPI report, the outcry for rate cuts is reaching a deafening roar down in the trading pits. And judging by Powell’s presser on Wednesday, the Fed is fixing to bend over soon, bar of soap in outstretched hand.

And yet and yet. On everything that makes a difference to the main street cost of living, prices are up by 32% to 36% during the period of UniParty rule since January 2017.

That’s right. Among the five biggies—services, food, energy, transportation and shelter—that comprise an overwhelming share of main street family budgets, the rate of price increase during the last seven-and-one-half years is close to 4.0% per annum! And for want of doubt, that rate of gain means that prices would double every 18 years.