from Fox Business

Why Consumers and Economists Don’t See Eye-to-Eye On Inflation

Official data shows that inflation has declined over the past year, but nearly two out of every three respondents to a recent survey believe it has risen.

by Terry Lane

Investopedia

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1961227840-62b23241ef6742b6a51dc56ede70089f.jpg) While the Federal Reserve is starting to feel pretty good about inflation, consumers remain frustrated about price pressures.

While the Federal Reserve is starting to feel pretty good about inflation, consumers remain frustrated about price pressures.

A recent survey by Morning Consult showed that nearly two out of every three respondents believed that annual inflation was either much or somewhat higher than a year ago, even though inflation has slowed from last year no matter how you measure it.1

“I think that consumers think about it differently than economists do,” said Sofia Baig, economist at Morning Consult.

So, why are consumers’ views of inflation different from the members of the Federal Reserve? One answer is consumers perceive price changes over time differently, Baig said.

Three Ways Inflation Could Be Impacted Now That Biden Has Dropped Out of the 2024 Election

by Nicole Spector

NASDAQ

In a post on X, formerly known as Twitter, President Joe Biden announced on July 21, that he has dropped out of the 2024 Presidential race.

In a post on X, formerly known as Twitter, President Joe Biden announced on July 21, that he has dropped out of the 2024 Presidential race.

“While it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term,” Biden wrote. “I will speak to the Nation later this week in more detail about my decision.”

[…] Democrats have been rallying for Biden to drop out since his disastrous performance in his first 2024 debate with former President and 2024 Republican nominee Donald Trump. Now that it’s actually happened, you may be wondering how the change could impact your wallet.

Waiting For the Coast to Clear On Inflation

by Ben Carlson

A Wealth of Common Sense

The Fed will likely begin cutting interest rates in the months ahead, for good reason.

The Fed will likely begin cutting interest rates in the months ahead, for good reason.

Last week felt like a victory against high inflation:

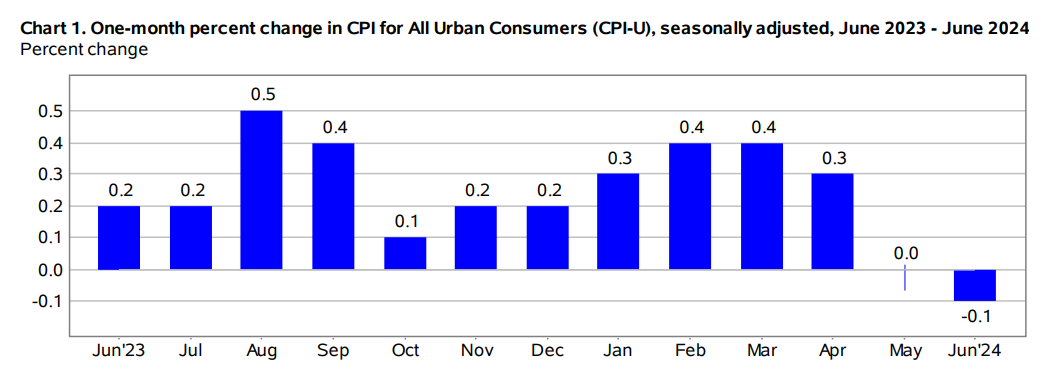

[…] We’ve now had no price increases on the overall inflation rate for two months.

Some pundits still aren’t so sure it’s time to take a victory lap just yet.

What about the 1970s?

There was a spike in inflation at the outset of the decade, it fell, then re-accelerated:

Business Cost Inflation: Labor Expenses Will Drive 2024-2025 Budgets

by Bill Conerly

Forbes

![]() Consumer inflation is declining, but business costs are a different story, challenging many companies. A little relief is in the cards, but not enough to compensate for smaller increases in product prices. Most businesses will need productivity growth to protect their profit.

Consumer inflation is declining, but business costs are a different story, challenging many companies. A little relief is in the cards, but not enough to compensate for smaller increases in product prices. Most businesses will need productivity growth to protect their profit.

Labor Costs

Labor is the largest cost for many organizations. Average hourly earnings over the last 12 months rose four percent, down from a peak of seven percent recorded early in 2022. That four percent inflation rate has been stable in recent months. Benefits cost data are only available through the first quarter and show 3.5 percent rate of increase. That was down from a year earlier.

Joe Biden Dropout Fallout, Inflation Data, and the Start of Tech Earnings: What to Know This Week

by Josh Schafer

Yahoo! Finance

Stocks pulled back from record highs amid pressure across the technology sector after a global tech outage sent shockwaves throughout the market on Friday.

The S&P 500 (^GSPC) ended the week down nearly 2% while the Nasdaq Composite (^IXIC) dropped more than 3.5% on the week. Both indexes had their worst weekly performance since April. Meanwhile, the Dow Jones Industrial Average (^DJI) rose about 0.7%.

This week, critical readings on economic growth and inflation, as well as the start of Big Tech earnings, will determine if the malaise continues.

Inflation and the Fed’s Monetary Policy

by Alasdair MacLeod

Gold Money

Jay Powell has signalled that inflation is moving sustainably towards the Fed’s 2% target and that the jobs market has cooled down. Hopes for an interest rate cut are rising, but the Fed is being misled badly…

Jay Powell has signalled that inflation is moving sustainably towards the Fed’s 2% target and that the jobs market has cooled down. Hopes for an interest rate cut are rising, but the Fed is being misled badly…

The dynamics behind rate policy

Undoubtedly, market values everywhere are predicated on the Fed cutting rates. To a limited extent, this could become a self-fulfilling prophecy. So far, the effect on the 10-year US Treasury Note, which sets the valuation tone for all financial assets, has been to reduce its yield in recent months from 4.7% to under 4.2% currently. I have pencilled in a potential support line at 4.08% (the pecked line).

Prepare For Liftoff, Bulls vs Bears, Plus Get Ready For More Inflation

from King World News

Prepare for liftoff, plus a look at bulls vs bears and more inflation.

Prepare for liftoff, plus a look at bulls vs bears and more inflation.

The Great Rotation

July 18 (King World News) – Graddhy out of Sweden: This very big picture ratio chart now shows silver breaking out plus backtesting vs SPX.

Silver Coiling To Blastoff vs S&P 500

Closing the Chapter On Inflation? ETFs to Watch

by Yashwardhan Jain

Yahoo! Finance

However, with inflation still remaining above the Fed’s benchmark target of 2%, this marks the first negative monthly headline CPI since May 2020, along with the slowest annual price increase since March 2021. The favorable inflation data makes rate cuts in 2024 more likely.

According to the CME FedWatch Tool, the Fed may begin reducing interest rates from September, this year, with a 91.6% probability that they will decrease to 5-5.25%.

Inflation’s Way Down, but Consumers Still Flinch at High Prices, Fed Observes

by Elizabeth Trovall

Market Place

In the latest Beige Book out this week, most Federal Reserve bank districts noted that retailers are offering discounts and price-sensitive consumers are buying fewer or lower-quality items.

In the latest Beige Book out this week, most Federal Reserve bank districts noted that retailers are offering discounts and price-sensitive consumers are buying fewer or lower-quality items.

This is the case even as inflation continues to cool. Prices actually came down in June from May, according to the latest consumer price index. So, why is price sensitivity lingering?

Pretty much anyone who eats can be price-sensitive. Even economists who track inflation, like Kayla Bruun with Morning Consult, who used to grab a bite at a nearby cafe.

Republicans at RNC Blame Biden for Inflation. Economists Say It’s Misleading.

A pandemic-era supply bottleneck is the main culprit, some economists said.

by Max Zahn

ABC News

Speakers at the Republican National Convention this week have faulted the Biden administration for putting the nation at risk from threats that include criminals, illicit drugs — and high prices.

Speakers at the Republican National Convention this week have faulted the Biden administration for putting the nation at risk from threats that include criminals, illicit drugs — and high prices.

“American families have been crushed by inflation,” Michigan Senate candidate Mike Rogers told the audience in Milwaukee, Wisconsin, on Tuesday. Virginia Gov. Glenn Youngkin, a Republican, described the “silent creep of inflation unleashed by Joe Biden and Kamala Harris.”

Some economists who spoke to ABC News took issue with the blame placed on President Joe Biden as an overstatement of his role in the price spike. Instead, they said, the bout of rapidly rising prices emerged from a supply shortage imposed by the COVID-19 pandemic and exacerbated by the Russia-Ukraine war.