from CNBC Television

Real Assets Are Historically Cheap Right Now. Here’s One Example.

by James Hickman

Schiff Sovereign

The “green energy” revolution is one of the biggest fantasies of today.

For example, they tell us that fossil fuels are going away, that the gasoline powered internal combustion engine is a thing of the past, and that everyone wants to drive an electric vehicle (EV).

Clearly, that’s why over 90% of consumers still choose gas powered vehicles…

So the government instead has to step in to mandate electric vehicle use, attempting to force manufactures to sell 50% electric vehicles by 2030.

They conveniently ignore the fact that the American electric grid cannot handle that kind of power demand.

And if the $1 billion per EV charging station Secretary of Transportation Pete Buttigieg is spending from the trillion-dollar infrastructure bill is any indication, we’re not going to get there in six years.

Warren Buffett, Dave Ramsey, and John Maynard Keynes Are Wrong!

by Mark Thornton

Mises.org

Hello and welcome to another episode of the Minor Issues podcast. I’m Mark Thornton at the Mises Institute.

Hello and welcome to another episode of the Minor Issues podcast. I’m Mark Thornton at the Mises Institute.

We have kicked off the Fall Campaign at the Mises Institute. I humbly request that you make a small donation in the name of this podcast using the link in the show notes. It would mean a great deal to me. For every $100 or more donation, or recurring donation of $5 or more, using this link, I will send you a signed copy of my Skyscraper Curse book: mises.org/mi5

This week’s episode explains how Warren Buffett, Dave Ramsey, and John Maynard Keynes are wrong about gold.

John Maynard Keynes, the Godfather of Keynesian economics, famously called gold the “barbarous relic,” a term he used to denigrate the gold standard and to disparage the use of gold as money.

Cheap Fast Food is Not Cheap Anymore

by Philip Chrysopoulos

Greek Reporter

Fast food has been the most convenient solution in the fast-paced world in which we live mainly because it used to be quite affordable and easy to get. Yet, fast food has now become expensive due to the high cost of beef.

Fast food has been the most convenient solution in the fast-paced world in which we live mainly because it used to be quite affordable and easy to get. Yet, fast food has now become expensive due to the high cost of beef.

The late 20th and early 21st century was the age of cheap food. Aside from the convenience and affordability, in the past decades, fast food restaurants were a part of social life for young people. In urban areas, fast food restaurants were places where youngsters could meet and socialize without spending all of their allowance.

For Americans, a visit to a fast food joint was a frequent occurrence. However, this is no longer the case worldwide since a number of such restaurants, including McDonald’s, belong to multinational chains. In other words, fast food has become unaffordable. A meal in a fast food restaurant has become a “luxury” even for mid-income families it seems.

Big Companies Are Not the Inflation Villain

Blaming corporate greed for rising prices is not a winning argument, write Yale SOM’s Jeffrey Sonnenfeld, economist and former presidential advisor Laura Tyson, and co-author Stephen Henriques.

by Jeffrey A. Sonnenfeld

Yale Insights

Following her latest economic policy speech, Vice President Kamala Harris and Stephanie Ruhle discussed Harris’s economic plan, including her controversial pledge to pass a new federal law against price gouging. When pressed on how this matches her belief in the capitalist system, the vice president responded, “I am never going to apologize for going after companies and corporations that take advantage of the desperation of the American people.”

Following her latest economic policy speech, Vice President Kamala Harris and Stephanie Ruhle discussed Harris’s economic plan, including her controversial pledge to pass a new federal law against price gouging. When pressed on how this matches her belief in the capitalist system, the vice president responded, “I am never going to apologize for going after companies and corporations that take advantage of the desperation of the American people.”

Most states, including California, have price-gouging rules that go after unjustifiable price increases on essential goods and services during emergencies such as pandemics and disruptive weather events. As California attorney general, Harris saw unscrupulous attempts to take advantage of crises and she responded. As president, she would propose comparable federal legislation. In the Ruhle interview, she went on to say that only a few companies, not the majority, engage in price gouging.

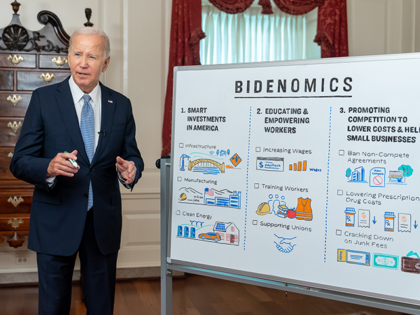

Harris Surrogate, Commerce Sec’y: Biden Inherited ‘Sky-High Inflation’ of 1.4%

by Ian Hanchett

Breitbart.com

On Monday’s broadcast of CNBC’s “Squawk Box,” Commerce Secretary Gina Raimondo — who was appearing in her personal capacity as a surrogate for the Harris campaign – claimed that when President Joe Biden took office, we had “sky-high inflation.”

On Monday’s broadcast of CNBC’s “Squawk Box,” Commerce Secretary Gina Raimondo — who was appearing in her personal capacity as a surrogate for the Harris campaign – claimed that when President Joe Biden took office, we had “sky-high inflation.”

After Raimondo said we know what the Trump presidency led to, and cited “massive deficits” under Trump, co-host Joe Kernen cut in to say that tariffs Trump put in were kept by President Joe Biden, there wasn’t a recession, real wages rose, the stock market performed well, unemployment hit record lows until the pandemic and we’ve also seen the results of Harris as Vice President.

Raimondo responded, “Right. What have you seen? You’ve seen more manufacturing in this country since any time since World War II.”

Kernen cut in to say, “You’ve seen an open border, I’ve seen real wages go down, I’ve seen crime –.”

Could Dock Worker Strike Spike Inflation? Experts Are Split.

The massive dock worker strike beginning Tuesday comes at an inopportune time for the U.S. economy, as the potential uptick in shipping prices comes ahead of the holiday season and as policy makers look to turn the page on inflation, though experts are split on whether the strike will have a major impact on inflation and the economy more broadly.

by Derek Saul

Forbes

![]() Key Facts

Key Facts

– The strike by 45,000 members of the International Longshoremen’s Association along the East Coast could cost the U.S. economy $3 billion to $4.5 billion daily, according to estimates from Jefferies and JPMorgan.

– Though that headline number is certainly a concern, experts largely think significant fallout would only come if the strike lasts more than the “base case” of a “few days,” noted Bank of America analysts led by Nathan Gee, who simultaneously warned a “prolonged strike lasting a few weeks could drive global congestion levels to all-time highs.”

– Austan Goolsbee, the president of the Federal Reserve’s Chicago branch, told Fox Business he’s concerned if the strike “drags on” it could “raise the cost of doing business” and the impacts of such events “are never good.”

Port Strike, If Short, Won’t Spur Inflation, Economists Say

by Megan Leonhardt

Barron’s

U.S. dock workers began a strike Tuesday at ports on the East and Gulf coasts. But a short strike would be unlikely to stoke inflation in consumer goods.

U.S. dock workers began a strike Tuesday at ports on the East and Gulf coasts. But a short strike would be unlikely to stoke inflation in consumer goods.

The United States Maritime Alliance, the alliance of port associations, container carriers, and employers, has failed so far to negotiate a new master contract with the International Longshoremen’s Association (ILA) that represents 85,000 longshore workers.

The current contract expired at midnight on Sept. 30. Thereafter, the ILA plans to strike at the 36 locations at 14 port authorities along the East Coast and Gulf Coast that employ the union’s workers.

Zimbabwe Already Devaluing New Gold-Backed Currency

by Mike Maharrey

GoldSeek

Well, that didn’t take long.

Well, that didn’t take long.

In April, Zimbabwe introduced a gold-backed currency in an effort to stabilize the country’s financial system. Less than six months later, the Reserve Bank of Zimbabwe has already devalued the new money.

I hate to say, “I told you so,” but, well, I told you so.

When Zimbabwe launched the ZiG, I warned that a gold-backed currency would be a great step but would not solve the country’s problems unless the government changed its ways.

It appears that hasn’t happened.

Fed Chair Jerome Powell: ‘Growing Confidence’ Inflation Cooling, More Rate Cuts Possible

by James Powel

USA Today

Federal Reserve Chair Jerome Powell on Monday said there’s “growing confidence” that inflation is moving toward the central bank’s 2% goal during a speech at the National Association for Business Economics conference in Nashville.

Powell said that two further rate cuts are possible if the economy continues to perform as expected, though they are likely to not be as aggressive as the half-percent cut the Fed made two weeks ago.

“The measures we’re taking now are really due to the fact that our stance is due to be recalibrated but at a time when the economy is in solid condition,” Powell said. “We’re recalibrating policy to maintain strength in the economy, not because of weakness in the economy.

Why Housing Inflation Looks Sticky

by Kristin Schwab

Market Place

Inflation cooled even more than expected in August. The personal consumption expenditures index — released Friday — clocked in at 2.2%, which is down from 2.5% in July. Still, one part of inflation that’s proven to be super sticky is housing.

Inflation cooled even more than expected in August. The personal consumption expenditures index — released Friday — clocked in at 2.2%, which is down from 2.5% in July. Still, one part of inflation that’s proven to be super sticky is housing.

Housing inflation is stubborn because there’s not enough housing, per Susan Wachter, a professor of real estate at Wharton.

“Demand continues and the supply is constrained,” she said.

That has to do with housing stock and interest rates. Rates have come down, but not enough for homeowners to sell. Wachter said the average existing rate is around 4%.