from Meet Kevin

U.S. Inflation is Still Hotter Than Pre-Pandemic, and That’s Okay

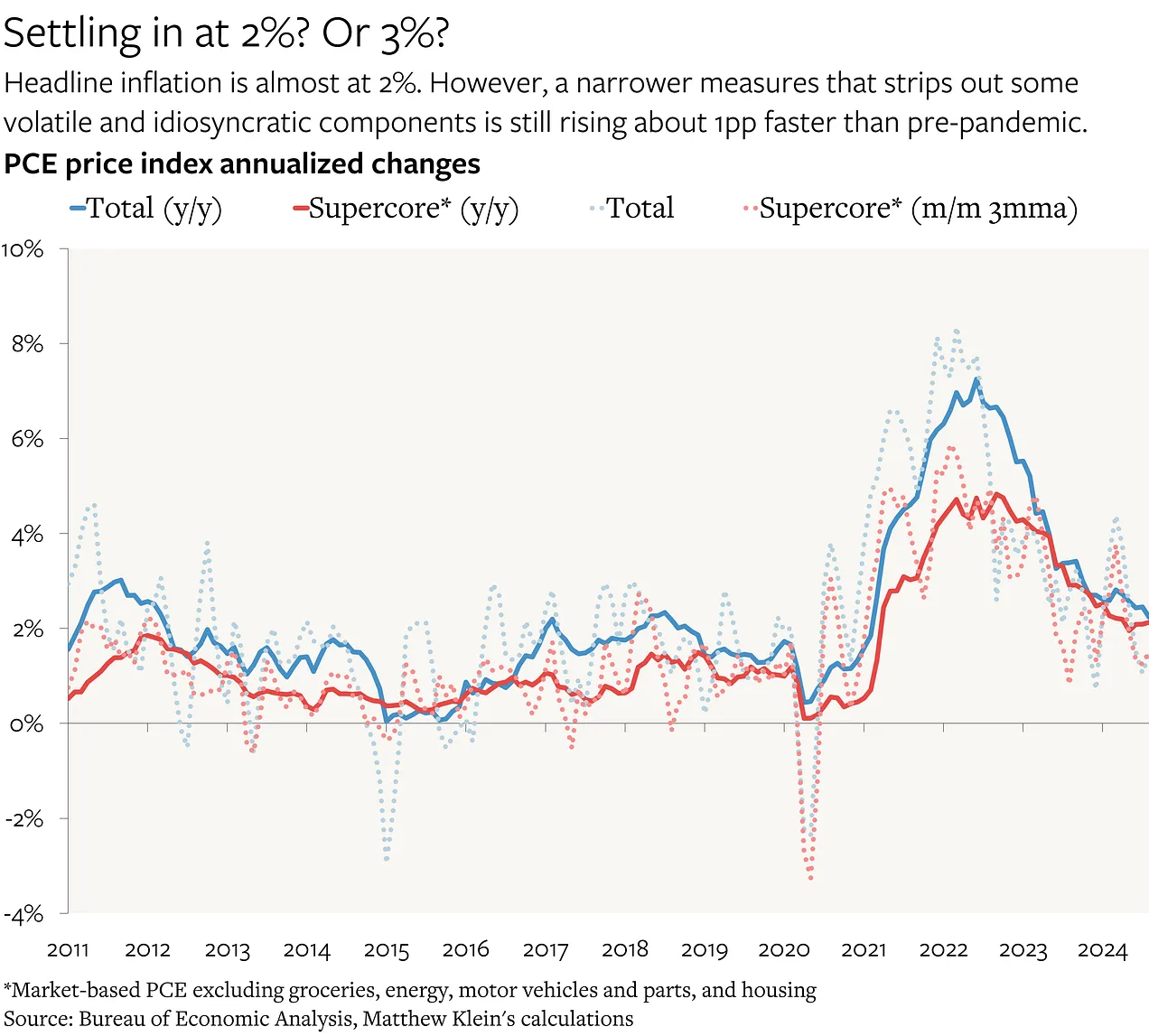

Underlying measures of prices are still rising about one percentage point or so faster than they were in 2017-2019. But there is nothing wrong with this new normal, even if may not be fully priced in.

by Matthew C. Klein

The Overshoot

Federal Reserve officials’ preferred measure of inflation—the Personal Consumption Expenditure (PCE) price index—rose just 2.2% over the past 12 months. Over the past six months, PCE inflation has come in at just 1.9% annualized, and by just 1.5% annualized over the past three months. Little wonder that Fed officials have shifted their focus from worrying about inflation to preempting any potential further weakness in the job market.

While that may be the correct decision, many of the underlying inflation measures that are supposed to strip out the noise from volatile and idiosyncratic components imply that prices are still rising about 1 percentage point faster than they were in the years immediately preceding the pandemic. That is broadly consistent with the latest data on nominal wages and incomes, which suggests that it is more representative of the underlying trends than a few good months of headline inflation prints.

Saving the U.S. Dollar Will Require More Carrot. Less Stick.

by James Hickman

Schiff Sovereign

At a campaign rally earlier this month, President Trump promised that if he is elected, “We will keep the US dollar as the world’s reserve currency. It is currently under major siege. Many countries are leaving the dollar.”

At a campaign rally earlier this month, President Trump promised that if he is elected, “We will keep the US dollar as the world’s reserve currency. It is currently under major siege. Many countries are leaving the dollar.”

What he’s referring to is the extreme privilege that the US has, i.e. that central banks around the world hold the US dollar in reserve as form of savings.

The entire world also conducts trade in US dollars. Since World War II, the vast majority of cross-border transactions among international businesses have been settled using US dollars.

Today, US dollars account for 54.8% of central bank holdings around the world. That’s still a lot, but it’s down from around 70% in the late 1990s, according to the latest IMF data.

And the US dollar is currently used for 42% of international trade, down from 52% in 2014, according to SWIFT, the Society for Worldwide Interbank Financial Telecommunication.

Half of a Percent Rate Cut? It’s Worse Than We Thought.

by Dave Kranzler

Investment Research Dynamics

“The US economy is in a good place and our decision today is designed to keep it there.” – Jay Powell at his post-FOMC press conference

Here’s the opening sentence to the latest FOMC policy statement: “Recent indicators suggest that economic activity has continued to expand at a solid pace.” Think about it for a moment: why does the Fed need to cut rates at all given that the alleged unemployment rate is low relative to history, the stock market is at a record high and housing prices are at all-time highs? As the global head of Deutsche Bank’s economic research (Jim Reid) wrote: “the interest rate cut of a half-percentage-point to kick off its easing cycle looks harder to justify than those in 2001 and 2007.” I qualify that by saying “at least on the surface.”

The Fed only cuts 50 basis points at the start of a rate cut cycle as it did in 2001 and 2007 after there’s been a severe deterioration in the markets or the economy. We know the economy is not expanding at a “solid pace,” unless the Fed’s definition of “solid” is the opposite of the dictionary definition.

Darn Facts On the Economy

by Jack Hellner

American Thinker

One of the biggest lies of all from the Democrats and the media is that Biden-Harris inherited an economic disaster—but in reality, they inherited a soaring economy.

One of the biggest lies of all from the Democrats and the media is that Biden-Harris inherited an economic disaster—but in reality, they inherited a soaring economy.

Another lie we are told is how much better Biden-Harris policies have been for minorities and manufacturing, but facts are stubborn things.

The following are a set of facts from the Bureau of Labor Statistics from February of 2020, three years into Trump’s term and before COVID, and for August 2024, three years and seven months into the Biden-Harris term.

Teenage unemployment

Trump’s Big Ideas Would Stunt U.S. Growth and Spur Inflation

The damage he would do is much worse than anything an “anti-business” liberal might offer.

[Ed. Note: And you know that you can trust Fareed Zakaria, because he’s not just another World Economic Forum stooge… Oh… Oops. Nevermind.]

by Fareed Zakaria

Washington Post

Take his most important proposals, ones that he repeats constantly: sweeping tariffs on all imported goods and mass deportations of undocumented workers. It is rare to find topics on which economists agree as strongly as they do that both would be bad for growth and cause inflation to spike.

Core Inflation Ticks Up to 2.7%, Stuck at High Level Since May

by John Carney

Breitbart.com

A key measure of inflation appears to be stuck significantly higher than levels consistent with the Federal Reserve’s price stability goal.

A key measure of inflation appears to be stuck significantly higher than levels consistent with the Federal Reserve’s price stability goal.

The so-called core personal consumption expenditures (PCE) price index, which excludes food and energy prices, rose 0.1 percent from July, the Bureau of Economic Analysis said Friday. That was in-line with expectations and below the 0.2 percent increase in the prior month.

Compared with a year ago, core prices are up 2.7 percent, a bit higher than the 2.6 percent recorded last month. Before rounding, the change was even smaller: from 2.64941 percent to 2.67847 percent.

Trump and Harris On Food Prices: Promises vs. Reality

Both candidates have shared plans to lower food prices

by Rich Johnson

News Nation

(NewsNation) — A long-held political truism has been that when the U.S. economy is going well, the president generally gets too much credit, and when things aren’t going well, the president gets too much blame.

(NewsNation) — A long-held political truism has been that when the U.S. economy is going well, the president generally gets too much credit, and when things aren’t going well, the president gets too much blame.

But that hasn’t stopped presidents and presidential candidates from claiming that their policies will quickly and effectively turn around bad times. And the 2024 presidential election is no exception.

Both former President Donald Trump and Vice President Kamala Harris have made promises and released proposals to improve the U.S. economy, especially when it comes to food prices. Here’s a look at some of their most prominent positions, and how experts view the chances of those stands becoming reality.

Fed Favored Annual Core PCE Price Index Accelerates to 2.7%, Highest Since April, On Higher Core Services Inflation (+3.8%). Durable Goods -2.2%, Energy -10%

by Wolf Richter

Wolf Street

Housing costs jumped. Stubbornly high housing inflation has frustrated Powell for a long time.

Housing costs jumped. Stubbornly high housing inflation has frustrated Powell for a long time.

The “Core” PCE price index, the Fed’s primary yardstick for its 2% inflation target, rose by 2.7% from a year ago in August, the second slight acceleration in a row, and the biggest increase since April (red in the chart below). This “core” index attempts to show underlying inflation by excluding the components of food and energy as they can jump and drop with commodity prices.

The overall PCE price index, which includes the food and energy components, rose by 2.2% year-over-year in August, a deceleration, on plunging energy prices (-10.1%) and slower rising food prices (+1.1%).

Inflation Remained Below Target in August

by William J. Luther

The American Institute for Economic Research

When the Federal Reserve’s Federal Open Market Committee (FOMC) voted to lower its federal funds rate target last week and thereby begin the process of un-tightening monetary policy, it said FOMC members had “gained greater confidence that inflation is moving sustainably toward 2 percent.” In fact, inflation appears to have already moved to 2 percent. If anything, inflation appears to be somewhat below target today.

When the Federal Reserve’s Federal Open Market Committee (FOMC) voted to lower its federal funds rate target last week and thereby begin the process of un-tightening monetary policy, it said FOMC members had “gained greater confidence that inflation is moving sustainably toward 2 percent.” In fact, inflation appears to have already moved to 2 percent. If anything, inflation appears to be somewhat below target today.

The Bureau of Economic Analysis (BEA) reports that the Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 2.2 percent over the last year. However, it has slowed considerably in recent months. PCEPI inflation has averaged 1.9 percent over the last six months and 1.4 percent over the last three months. In August 2024, it was just 1.1 percent.

The Real Inflation Rate? It’s a Mystery

by Martin Holzbauer

Terrace Standard

To the editor:

To the editor:

How does the actual cost of living actually work in relation to the Consumer Price Index (CPI)?

Several things are part of that index such as food from almond butter to yogurt. Why are zucchinis missing?

For shelter costs, 25 items, including mortgage and insurance costs. There are about 100 items for household operations from accounting to wine glass sets. Clothing and footwear are included from baby stuff to youth snow pants and then there is transportation from air travel to used vehicle purchases, including, of course, gas costs.

Then we come to health and personal care products, recreation, education and

reading from ‘A’ as in admission to hockey games to ‘V’ as in video on demand. That section also includes alcohol, tobacco, cannabis and vaping products.